We present Market Letter publication for the second quarter 2024 titled “So Far, So Good” in which Chief Investment Officer George Hosfield, CFA, outlines our belief the Fed remains on course to deliver an ever-so-rare soft landing to this inflationary cycle. Dean Dordevic writes about the Japanese economy and Warren Buffett’s investment there in recent years since the introduction of the “Corporate Governance Code” and Jason Norris, CFA, provides an update on equity market valuations and how investors expect the market to grow for the remainder of the year.

2024 Outlook Publication: Sticking the Landing

Fourth Quarter 2023 Market Letter: Inflation's Flame Flickers

Presenting our fourth quarter 2023 publication of Market Letter titled, “Inflation’s Flame Flickers.”

Third Quarter 2023 Market Letter: Standing Eight Count

Market Letter: Stalemate

Fourth Quarter 2022 Market Letter: Bad News Is Good News

Read our Market Letter publication for the fourth quarter 2022 titled, Bad News Is Good News, in which George Hosfield, CFA, Peter Jones, CFA, and Joe Herrle, CFA, share our thoughts on inflation, interest rates, the energy sector and housing supply in the United States.

Third Quarter 2022 Market Letter: Balancing Act

Read our Market Letter publication for the third quarter 2022 titled, Balancing Act, in which George Hosfield, CFA, Dean Dordevic and Brad Houle, CFA, share our thoughts on inflation, interest rates, recession risk and how to position portfolios in this environment.

Second Quarter 2022 Market Letter Publication: Kryptonite

The second quarter 2022 issue of Market Letter, our quarterly investment publication, titled, Kryptonite.

Outlook 2022: Extraordinary to Ordinary

Fourth Quarter 2021 Market Letter: Speed Bumps

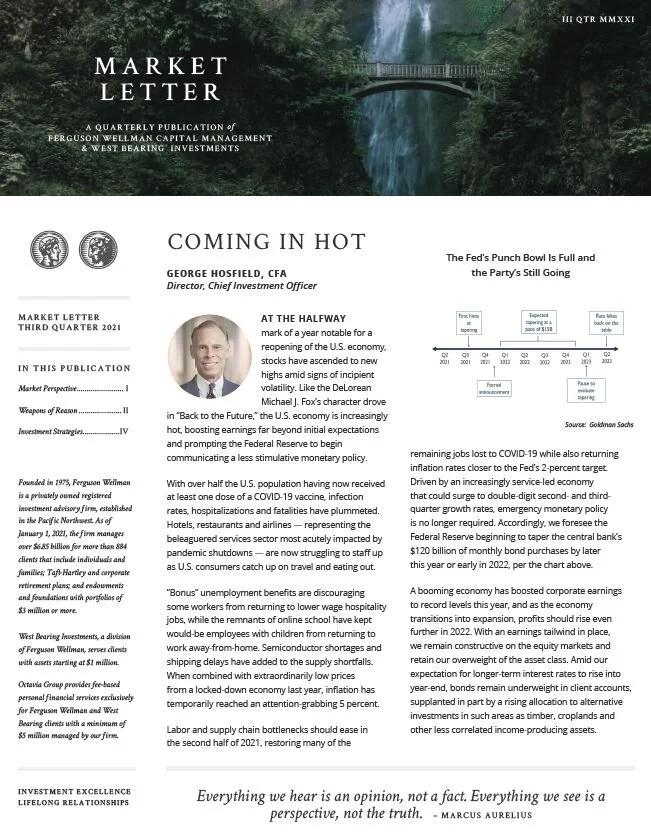

Third Quarter 2021 Market Letter: Coming in Hot

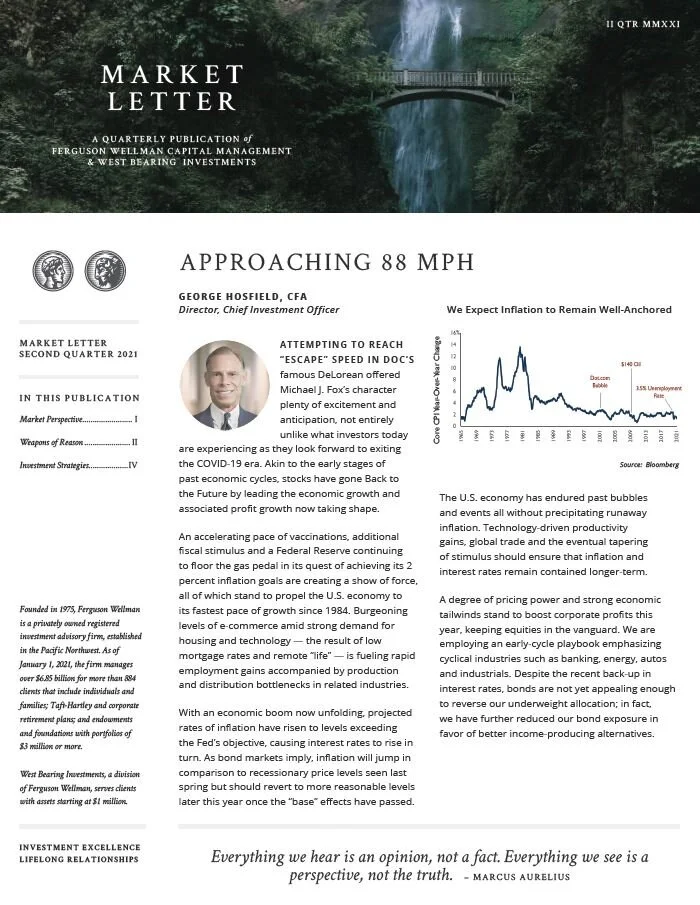

Market Letter Second Quarter 2021: Approaching 88 MPH

Quarterly publication discussing our investment strategies and the capital markets for the second quarter of 2021 titled, “Approaching 88 MPH.”

Outlook 2021: Back to the Future

Market Letter Fourth Quarter 2020

Despite the technology-led gains of U.S. equities so far this year, uneasiness abounds as the world adjusts to life with COVID-19. While roughly half the jobs lost to this year’s steep and short recession have already been recouped, many investors fear the day when the bill for massive stimulus comes due.

Market Letter Third Quarter 2020: Start Me Up

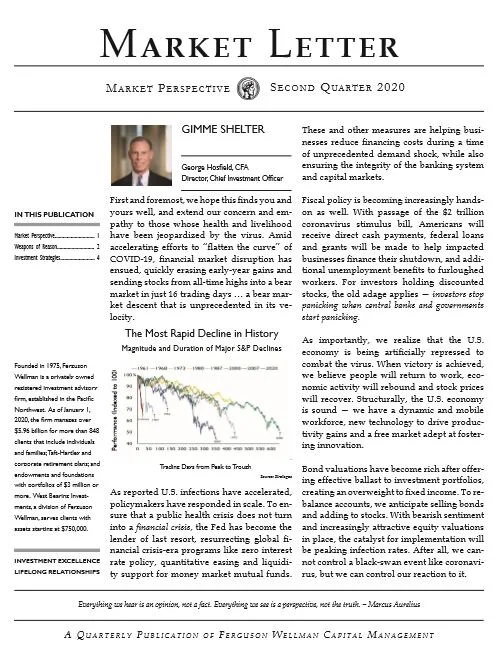

2020 Q2 Market Letter: Gimme Shelter

Outlook 2020

Having climbed the proverbial “wall of worry,” all the major domestic equity indices are poised to end the year at, or near all-time highs. In fact, it was a great year for virtually every asset class as bonds enjoyed their best return in a decade, international equities returned roughly 20 percent and real estate and commodities have also prospered.