by Brad Houle, CFA

Principal

Head of Fixed Income

Portfolio Management

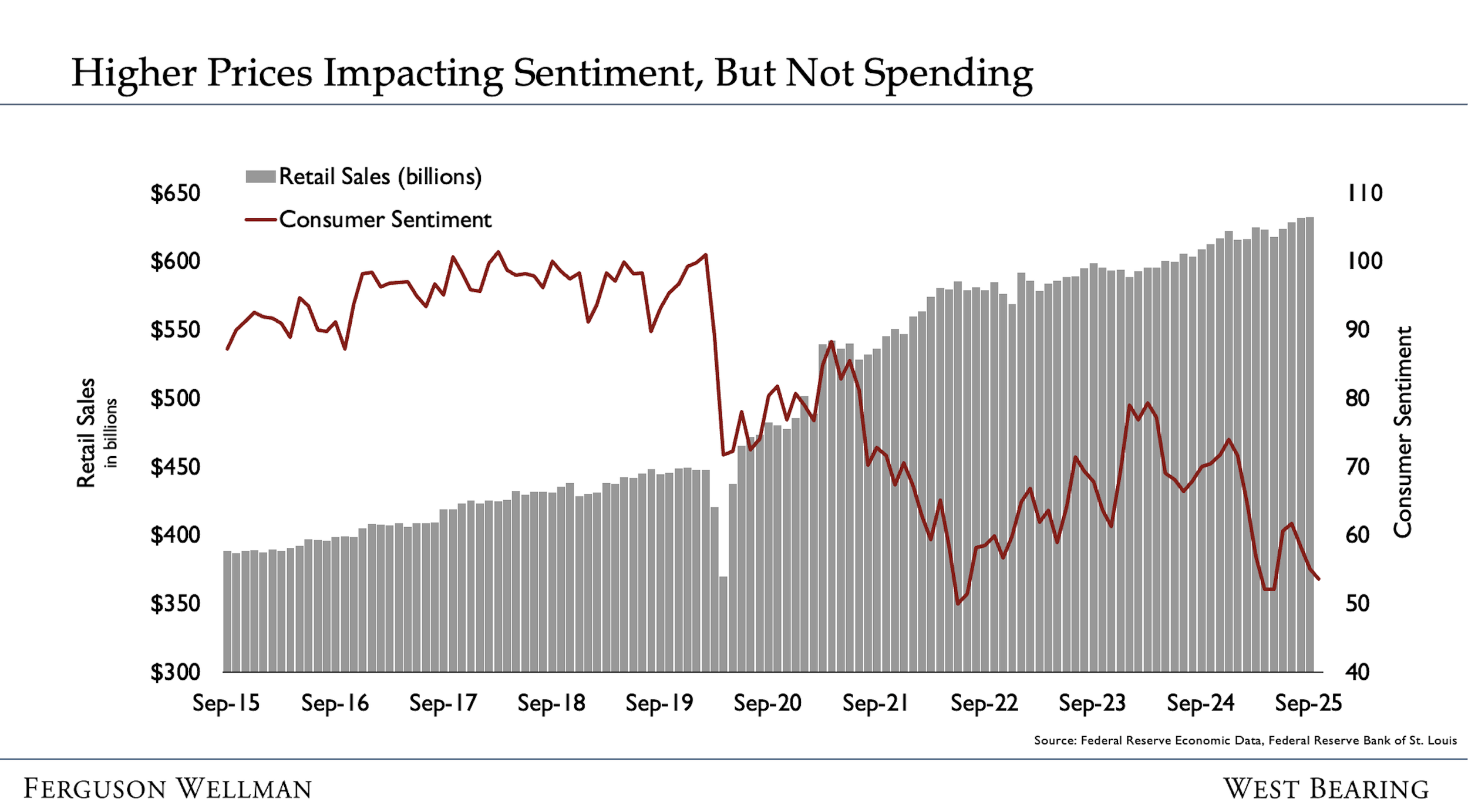

As New Year’s celebrations wrap up and 2026 begins, the U.S. economy is sending signals that are difficult to reconcile: consumer sentiment is deeply negative, yet spending remains resilient. Americans say they feel worse about the economy, even as they continue to open their wallets.

On the sentiment side, deterioration has been steady. The Conference Board’s consumer confidence index fell for a fifth consecutive month in December, reaching a historic low since 1995, and consumer confidence is well below where it was during the Great Financial Crisis and the COVID-19 pandemic.

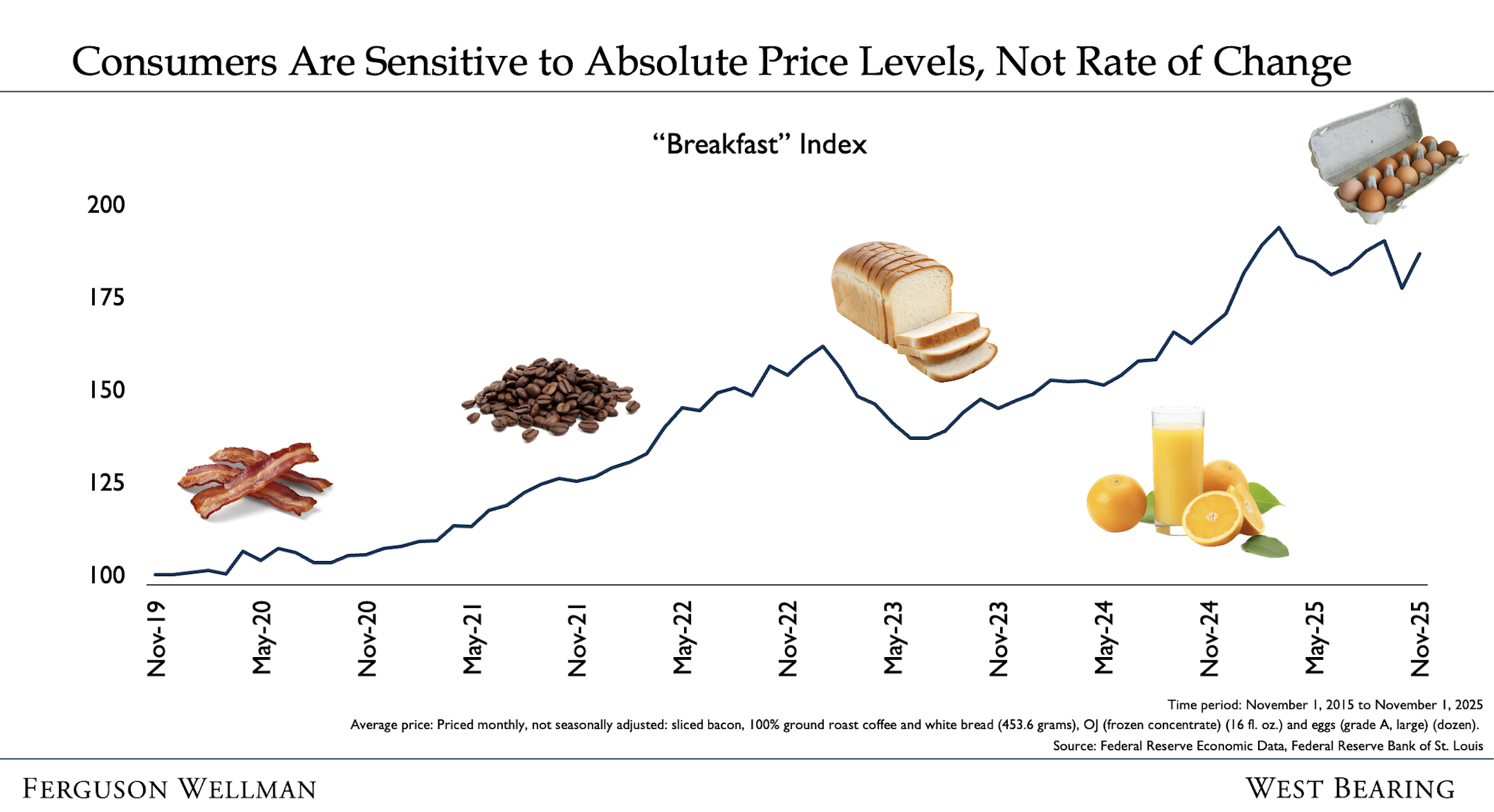

The underlying issue appears to be exhaustion rather than crisis. Inflation has slowed considerably from its 2022 peak, but prices remain materially higher than before the pandemic. While the rate of change in inflation has come down, the cumulative impact of inflation has left consumers fatigued, as illustrated below . Our "Breakfast Index” shows the growth in the cost of popular breakfast items before and after the elevated inflation following COVID.

Additional factors, namely labor market concerns, are reinforcing consumer sentiment. Fewer respondents are describing jobs as plentiful, and more are saying they are hard to get. However, even as consumers are less confident about the labor market, they continue to spend at normal rates. Unemployment is still low by historical standards of 4.6% and layoffs are not accelerating. That said, new job creation has slowed as well showing a softening in the labor market.

As discussed in a recent Ferguson Wellman blog by our colleague Jade Thomason, consumer behavior during the 2025 shopping season highlighted a similar dynamic—strong spending activity paired with cautious, price-sensitive decision-making. That holiday-focused view complements the broader picture emerging in the data today.

Demographically, higher-income households, supported by rising asset values and strong equity markets, now account for a disproportionate share of total spending. Lower-income households face tighter constraints, driven by higher rents, utilities and food prices.

Looking ahead, there are fiscal tailwinds including tax refunds and the potential for lower short-term interest rates that can supplement consumer spending. Ultimately, even though consumers are unhappy, they continue to spend, and consumption makes up 70% of our economy.

Takeaways for the Week

Consumer sentiment is near historic lows, but spending remains resilient as long as employment and income growth hold up.

The drag from inflation is cumulative, not incremental; prices feel high even as inflation slows, reinforcing consumer fatigue.