by Samantha Pahlow, CTFA, AWMA

Wealth Management Chair

Two joyful milestones—marriage and the arrival of a child—bring celebration, change and financial complexity. These transitions also create important opportunities to strengthen your financial foundation and ensure that the plans you have in place evolve to support the people you love. With thoughtful preparation, you can protect your family and approach the next chapter with confidence.

Marriage

The decision to marry reflects the blending of two lives—and two financial philosophies. Open and transparent conversations about how they each prefer to save, spend, manage debt and invest, help form

the basis of a joint financial plan that aligns priorities and can improve both financial well-being and relationship satisfaction.

Differences in investment risk tolerance are common, and they don’t need to be a source of tension.

A joint plan can balance each partner’s comfort level while still staying aligned with long-term goals. We often help couples find the right mix by blending risk perspectives—ensuring both partners feel confident and heard.

Once married, couples should revisit the key documents and structures that support their long-term financial life. Review beneficiary designations, update account titles, and revise estate and healthcare documents to reflect shared goals. Coordinating benefits, such as health insurance and retirement plan contributions, can uncover cost savings and improve overall coverage. Marriage also introduces tax considerations. Your filing status changes, which may shift tax brackets, deductions and credits. Reviewing your updated tax profile with your portfolio manager and tax advisor can help you anticipate meaningful changes and identify new planning opportunities.

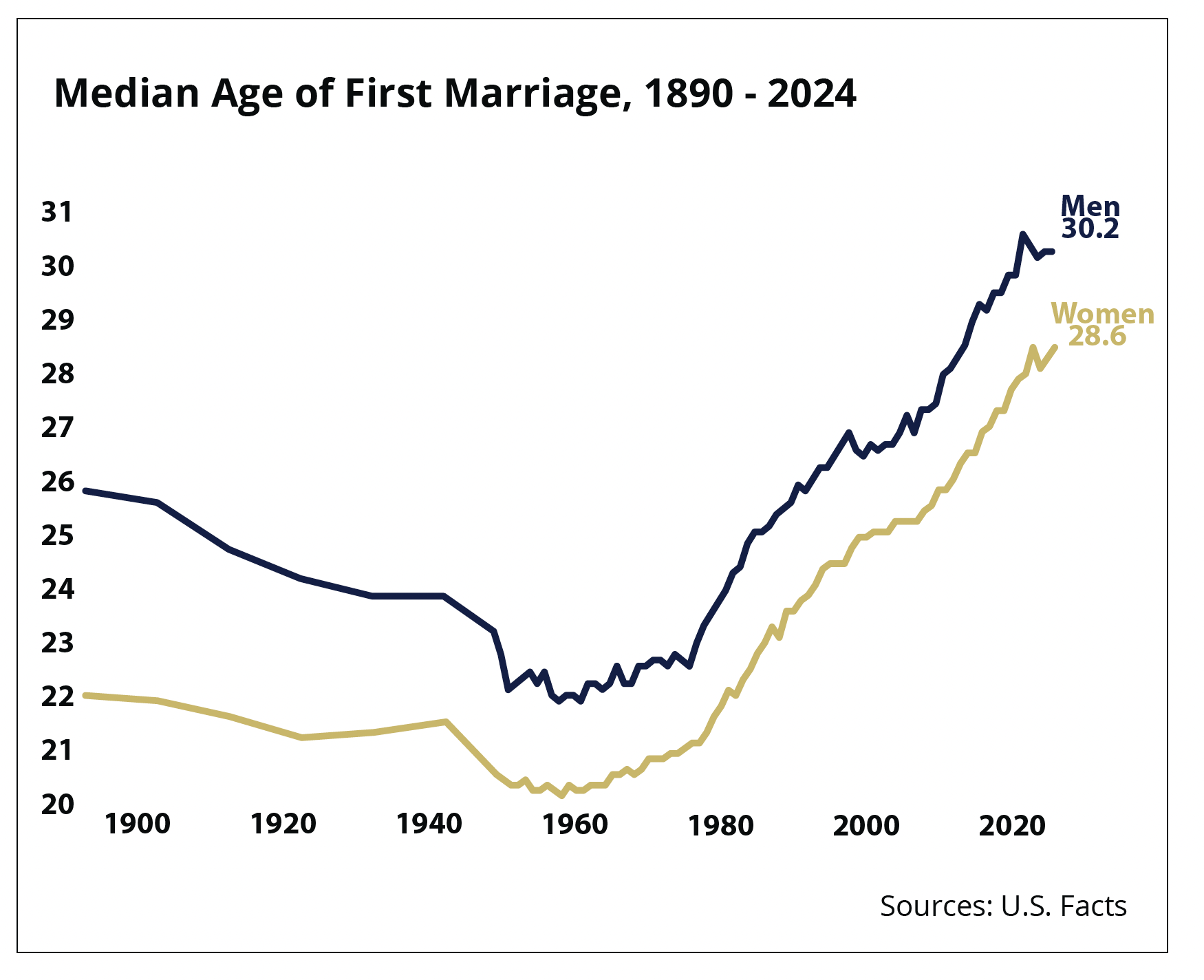

The age at which individuals marry today is the latest it has ever been. On average, women marry at age 28 and men at age 30. This means many couples come together with disproportionate wealth, significant premarital assets, or blended families and may benefit from using prenuptial agreements. A prenup is a practical planning tool that clarifies expectations around assets, debts, income, and long-term goals. The process promotes transparency, protects both partners, and often strengthens trust and communication.

Parenthood

Few events shift your perspective—or sleep schedule—as quickly as the birth of a child.

Suddenly, long-term planning becomes critical. New parents should review and update their estate documents, including naming guardians, establishing wills or trusts, and ensuring beneficiary designations reflect their wishes. These decisions help safeguard your child’s future. Parents should also revisit their budget and cashflow plan to account for childcare, healthcare, and new household expenses. Expanding emergency reserves can offer stability as responsibilities grow.

Risk management becomes increasingly important. Families may need to add or increase life and disability insurance to ensure income needs, care and education costs can be met if the unexpected occurs. Reviewing healthcare coverage and dependent benefits is also a valuable step.

Education is one of the largest long-term expenses families face. Saving early—through tax-advantaged savings vehicles such as 529 plans—can meaningfully expand future options.

Welcoming a child may also open access to tax benefits such as child-related credits or dependent-care flexible spending accounts, which allow families to cover eligible childcare costs using pre-tax dollars.

As families evolve, so do their goals. Marriage and parenthood are only the beginning of a lifetime of transitions that shape your financial life. A thoughtful review of your planning after major life events can help ensure your strategy stays aligned with your values, protects the people you care about, and supports the future you envision.