by Mary Lago, CFP®, CTFA

Chief Wealth Strategist

Principal

Selling a business is one of the most significant decisions an entrepreneur can make. Aside from being a meaningful financial transaction, it is also a life transition that impacts your legacy, family, employees and future. Approaching the process in the right way can lessen your anxiety, maximize value, reduce employee strain and ultimately help the transaction close more quickly.

Is a Third-Party Sale the Right Strategy?

Owners should consider a variety of exit strategies before pursuing a sale. In addition to a third-party sale, common strategies include family transfer, transition to key employees and sales to an employee stock ownership plan (ESOP). Each path has unique advantages and challenges, and understanding which structure aligns most with your goals will help you approach the process with confidence and avoid costly missteps. Family transfers can be deeply rewarding but require careful consideration of value, cashflow and the next generation’s readiness. Sales to key employees may offer continuity but often involve extended payment periods and increased risk for the seller. ESOPs can provide liquidity and tax benefits, but typically require long-term planning and may not deliver immediate proceeds.

Personal Motivation and Commitment

Business sales are generally more akin to a marathon than a sprint. Understanding motivations is crucial

for the endurance required to get over the finish line. For many entrepreneurs, their business is more

than an asset. It represents their life’s work and is their identity. Sellers must honestly consider and embrace their reasons for selling, whether it’s to optimize value, pursue new opportunities or achieve financial peace of mind. This self-reflection should be supported by a professional assessment of the financial impact of the decision.

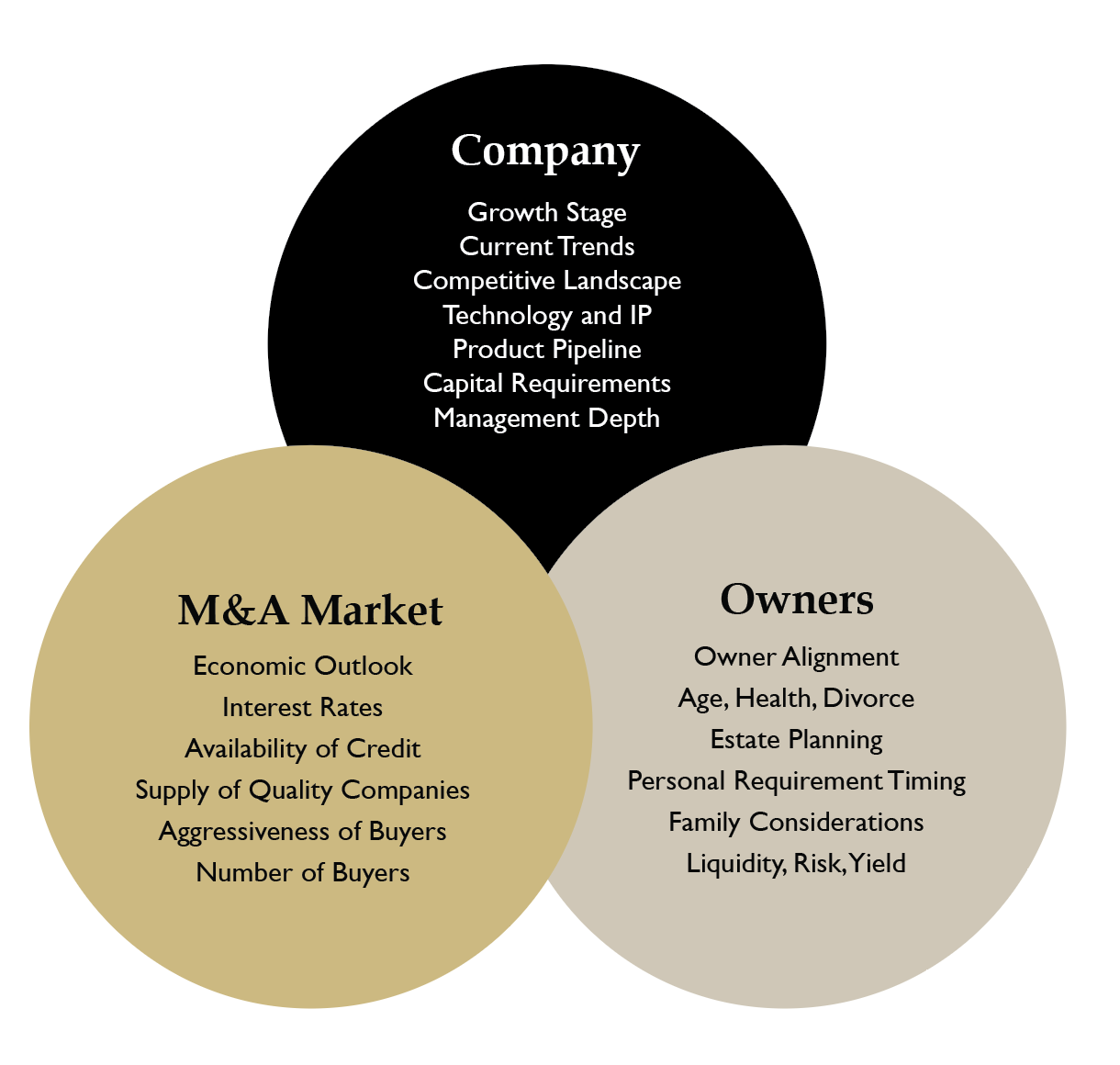

Timing - The Three Realms

Timing is often driven by a combination of personal factors, company performance and market conditions. Successful exits require balancing these three realms. In evaluating the company factors, buyers will look for upside potential, while sellers aim to maximize value. Owner-specific issues, such as the desire to retire, financial security, family needs and estate planning, also play a pivotal role. Selling during a strong market can significantly increase transaction value, sometimes doubling or tripling earnings before interest, taxes, depreciation and amortization (EBITDA) multiples compared to average or poor markets. It can be tempting for owners to try to slightly improve financial performance when the greater value may come from leaning into the proper point in the merger and acquisition cycle.

Maximizing Value: Process and Preparation

A well-orchestrated sale process is key to maximizing value. This includes assembling a collaborative advisory team including an investment banker, transaction attorney, estate planning attorney, tax professional and wealth advisor. Normalizing financial statements by separating personal and company finances, paying competitive salaries and addressing real estate can simplify the due diligence process. Stabilizing the management team and establishing a realistic valuation range are also critical steps. Bringing all potential buyers into the process at the same time and avoiding the “bear hug”, being seduced by a single buyer, helps maintain negotiating leverage and increases the likelihood of a successful outcome.

Preserving Versus Creating Value

It’s often easier to preserve value than to create it. Effective income tax planning, charitable planning and transfer tax strategies can help owners retain more of their proceeds. Properly structuring the sale as a stock sale or asset sale, leveraging qualified small business stock, and using charitable trusts can all provide significant tax advantages. Owners should also consider their legacy plans and potential opportunities to gift shares at pre-liquidity valuations or using trusts to benefit heirs and philanthropic causes.

Personal Opportunities and Goals

Diversifying wealth is critical, especially as owners approach retirement age, since concentration risk or an unexpected health event can threaten long-term family financial security. Beyond financial considerations, owners should reflect on their identity and future relationships. Transitioning from CEO to consultant or retiree can be challenging. Understanding the benefits of liquidity and the impact on family and community can ease the transition.

Run a Process, Not Just a Sale

Running a comprehensive and competitive process maintains sellers’ leverage to negotiate terms and optimize transaction value. Leveraging the expertise of an experienced professional team will help you more thoroughly prepare, consider broader impacts, negotiate and navigate a successful sale. After all, selling a business is about more than the numbers. It’s about securing your legacy, supporting your family and setting the stage for your next chapter.