Each year, central bankers, finance ministers and academics gather in Jackson Hole, Wyoming, for an economic policy symposium (or boondoggle, whichever you prefer).

From AI to CPI

The word unprecedented has appeared often in headlines this year — and for good reason. Breaking news has been in no short supply, and this week brought another wave of significant government and business activity.

Changes

Over the last week, the Bureau of Labor Statistic (BLS) released several data points highlighting some weakness in the jobs market.

Inflation Data Defies Predictions

For four consecutive months, economists have predicted that U.S. inflation would surge, largely due to President Trump's trade policies and the anticipated economic impact of his tariffs.

Is 3% the New 2%?

The Consumer Price Index (CPI) is a measure of goods and services prices across the economy, and a popular gauge of inflation. The headline CPI rose 3.5% in March from a year earlier, which was higher than economists had forecast and an increase from February’s 3.2% reading. The Core CPI, which excludes the volatile food and energy components, also rose more than expected, with medical care and auto insurance boosting the non-housing service prices.

Wealth Management Insights Second Quarter 2024: Planning for Our Children's Future

We present our second quarter 2024 issue of Wealth Management Insights titled “Planning for our Children’s Future.” In it, Samantha Pahlow, CTFA, AWMA®, discusses the crucial aspects to consider when planning for the distribution of assets for minor children. Scott Christianson, CFP®, writes about planning ahead for unanticipated outcomes in our estate plans and what we can do with estate planning to avoid major pitfalls and Charissa Anderson, CFP®, CDFA®, provides a considerations when saving for education and utilizing a 529 account.

Debt Drama Update

Many people believe the world’s largest and most important economy is on the brink of default. Indeed, politicians generally do a disservice by pushing their agenda until the last minute and then lose the trust of their constituents and investors. However, negotiations on the debt ceiling have improved over the last few days and the risk of default has decreased.

Chappell Authors Spokane Journal of Business Article

Our colleague, Casia Chappell, CFP®, CPWA®, recently wrote a piece for the Spokane Journal of Business. In it, she discusses how donor-advised funds can help streamline strategic giving.

Data > Headlines

To both economists and investors, one of the biggest surprises to begin 2023 has been the resilience of the economy, and in particular the labor market. Coming off the back of the most rapid Federal Reserve tightening cycle in decades, many assumed that economic data would prove recessionary as soon as the calendar flipped. While leading indicators still point to a slowing in the economy ahead, recession still seems a ways away.

The Fed Holds Fast

This week, all eyes were on the inflation report and the subsequent Federal Reserve announcement a day later. Since these were the last announcements of their kind for 2022, market participants were paying close attention, with the hope of gaining some insight into what the rest of the year might look like for markets.

A December to Remember

As investors handicap the most anticipated recession in history, fourth quarter equity returns are playing out as expected. Historically, the fourth quarter, specifically the month of December, delivers the best results for equity investors. While this quarter has continued the positive trend, December is not acting as planned.

JOLT to the Job Market

Jerome Powell has the most difficult job in America. The Fed Chairman and the Federal Reserve Open Market Committee are tasked with lowering inflation and they primarily have only one blunt tool to accomplish this goal, adjusting interest rates.

Lago Authors Spokane Journal of Business Article

Our colleague, Mary Lago, CFP®, CTFA, recently wrote a piece for the Spokane Journal of Business. In it, she discusses how financial strategies can optimize charitable giving.

Anderson on KOIN Wallet Wednesday

Charissa Anderson, CFP®, CDFA®, appeared on KOIN News Wallet Wednesday on October 12, 2022, and discussed the pluses and minuses of receiving financial advice from TikTok.

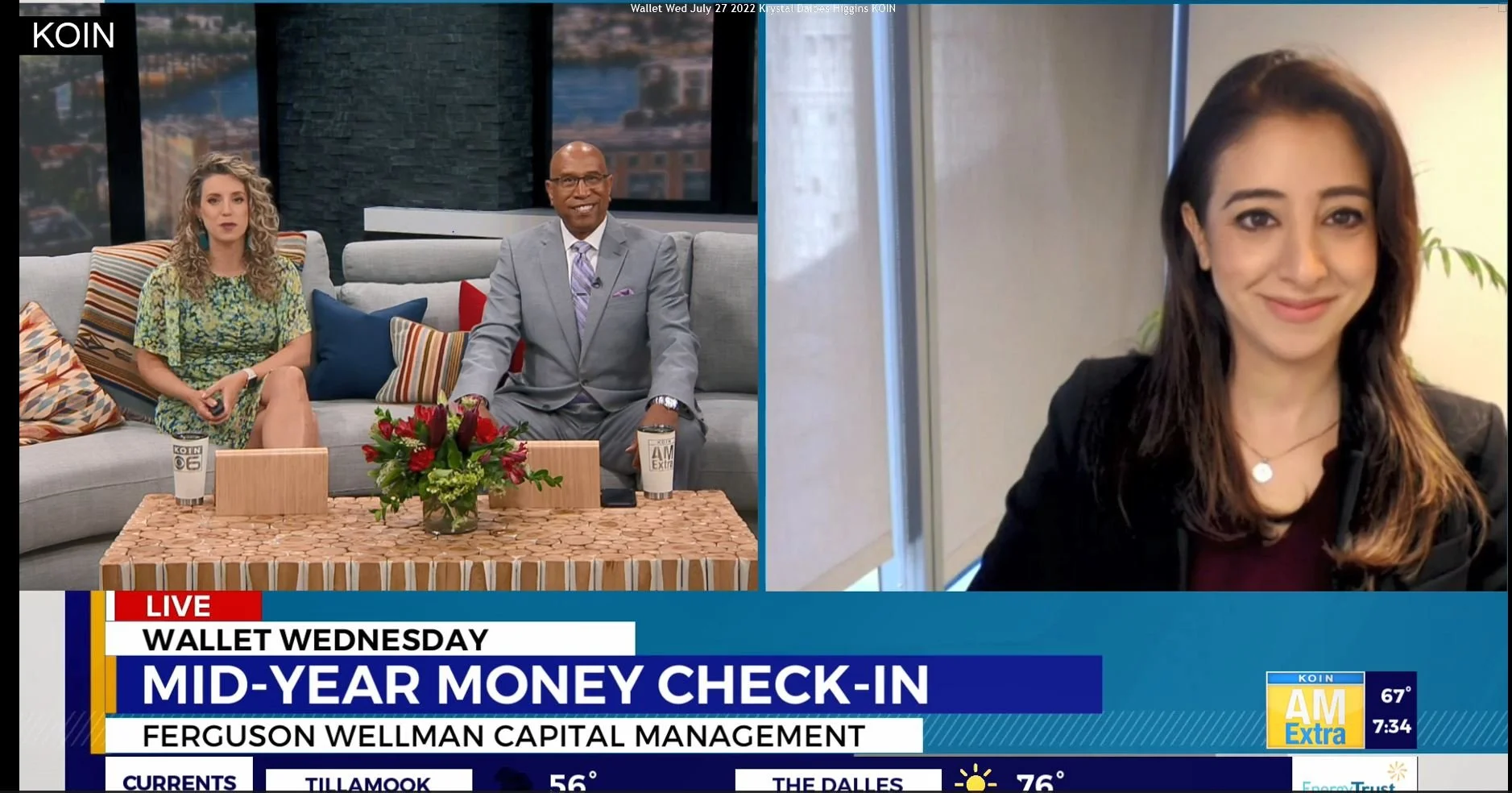

Daibes Higgins on KOIN Wallet Wednesday

Krystal Daibes Higgins, CFA, appeared on KOIN News Wallet Wednesday on July 27, 2022, and discussed the recent Fed Hike, inflation and gas prices.

Back to School for Ferguson Wellman and West Bearing Kids

As the new school year starts, we are reminded of the day when many of our children learned about the different work responsibilities at our firm and we, in turn, learned more about them.