Peter Jones, CFA

Executive Vice President

Equity Research and Portfolio Manager

Each year, central bankers, finance ministers and academics gather in Jackson Hole, Wyoming, for an economic policy symposium (or boondoggle, whichever you prefer). This week in Jackson Hole, Fed Chair Jerome Powell's tone was far less hawkish than many had feared, and his comments have now made a September interest rate cut seem all but guaranteed. This prospect of cheaper borrowing costs sent markets rallying sharply on Friday, with the most rate-sensitive sectors such as small caps and housing stocks leading the charge.

Despite this news, it's crucial for investors to look beyond the immediate headlines. It’s important to remember that the Fed funds rate is not your mortgage rate. Notably, the benchmark 10-year Treasury yield, a key driver for long-term loan rates, was largely unchanged in the wake of the speech.

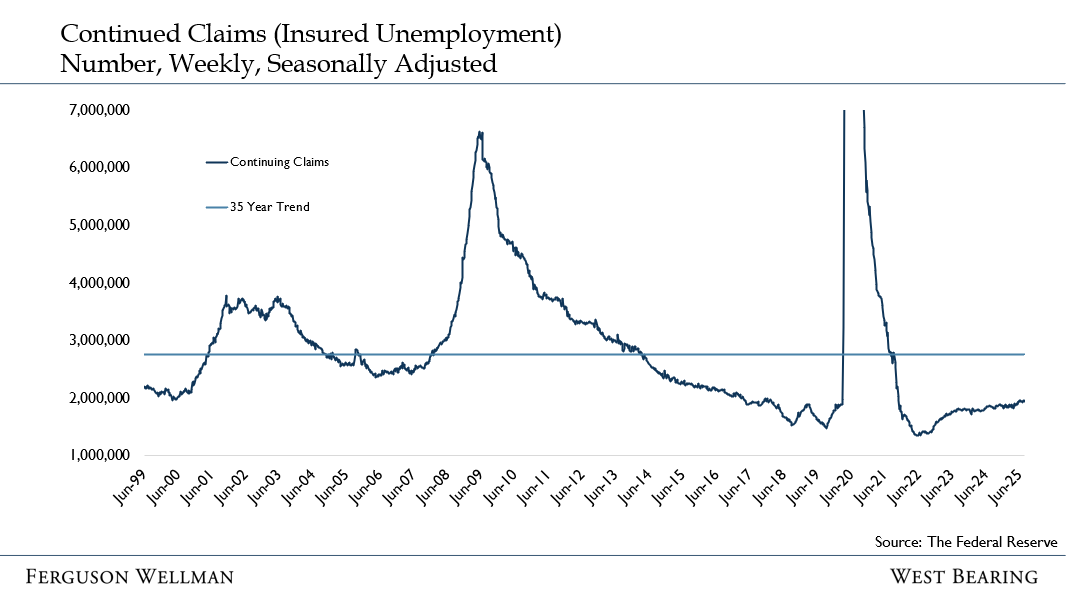

While the Fed's dovish pivot is fueling optimism, a notable shift is occurring in the engine room of the U.S. economy: the labor market. While widespread layoffs remain contained, the data suggests a sharp slowdown in hiring. Perhaps most telling is the steady rise in continuing unemployment claims—the number of people receiving unemployment benefits after their initial filing—which reached a four-year high this week. This suggests that it is taking longer for those out of work to find new positions. While the trend is clearly going in the wrong direction, it is important to evaluate this metric in a historical context before hitting the panic button. As seen below, continuing unemployment claims are still well below the average since the turn of the century.

With softness in the labor market, AI investment is a major factor in continued economic growth. We’re in the midst of an unprecedented wave of capital expenditure in artificial intelligence and related sectors. Capital spending from Alphabet, Amazon, Microsoft and Meta now account for more than 1% of economic output in the U.S., with this boom showing no signs of abating. The sheer size, balance sheet capacity and investment intentions of the hyperscale cloud computing companies are truly staggering. The appetite for investment is so strong that rivals are now paying each other for it: Meta just signed a massive $10 billion deal to use Google's cloud services. This dynamic suggests the outsized contribution from the tech sector could continue well into next year, providing a powerful counterbalance to any labor or tariff related headwinds.

Source: threads.com

Takeaways for the Week:

Markets rallied sharply as Fed Chair Powell’s Jackson Hole speech was more dovish than expected

While the trend in the labor market is softening, the level remains firm in a historical context

AI investment continues to propel the economy forward