U.S. unemployment claims at a 43-year low, manufacturing PMI’s back in positive territory, and a five percent unemployment rate are key reasons why recent recession fears have receded. Against this backdrop, stocks are above water for the year. While retail sales, including this week’s print, have been lackluster, four

Why the "F-Word" Is Important

f you Google the word, “fiduciary,” you will find that the definition states, “involving trust.” As a fiduciary of your investments, you should expect your investment adviser to put your interests before theirs when it comes to advice and selection of investment strategies. For many institutions, this

Takin' Care of Business and Working Overtime

Today, the Bureau of Labor Statistics published its monthly employment statistics. Especially with the presidential election in full swing, the state of the jobs market is on people’s minds. Let’s step back from today’s numbers and look at the employment over this economic cycle.

Market Resilience: Don't Stop Believin'

The resilience of the equity markets has been quite impressive. At the time of the February lows, pessimism was rampant. Faith in the Chinese economy was shaken, gold was on the rise and there were faint whispers of imminent recession. Fast forward six weeks and the S&P 500 has rallied

Back Where We Started

The S&P 500 rallied again this week and is back to even for the year. Our original outlook came under pressure from the first day of trading in 2016. We expected rates to be slightly higher for the year and within six weeks the U.S. 10-year Treasury yield had fallen from 2.30 percent to 1.66 percent. We expected stocks to have a modest return of between 5 to 8 percent this year

A New Bull Rides

With change at the economic margin beginning to improve (e.g. recent U.S. payrolls, durable goods orders and manufacturing PMI), investors are beginning to see cyclical elements of the equity market improve. Oil prices are now up year-to-date, energy and industrials are all of a sudden outperforming the broader market, and financials, which so far this year have pulled up the rear, are starting to get a bid.

Postmortem

There are only a handful of retailers left to report their earnings this quarter and thus far, it appears that companies’ results reflect a tough year in 2015. Profit growth declined just over 1 percent from 2014 as weak commodity prices and a strong dollar were major headwinds. This resulted in earnings per share (EPS) for the S&P 500 of $116. There were pockets of strength

Out of the Shadows

State and local governments have finally emerged from the shadows of the Great Recession. This debilitating time period had drastic effects on regional economies – high unemployment and low corporate profits shrunk government coffers. Cash flow that would usually flow to infrastructure and pension plans was diverted to aid unemployed voters and plans to spur economic recovery. Government spending was

A Negative Space in a Positive Outlook

Currently, nearly 30 percent of the world's sovereign debt has a negative yield. Said differently, owners of $7 trillion worth of government bonds issued by countries all over the world will get less money than they invested if they hold the bond to maturity.

A New Day Yesterday

With U.S. large cap stocks down over 10 percent, it hasn’t been a happy new year for investors. The Fed tried to alleviate fears this week on Capitol Hill by stating that they realize the current volatility may lead to slower economic growth and thus there will be no March rate hike. While the talking heads weren’t impressed with the statement, we believe that it was a positive and highlighted the fact

Staying the Course

At first glance, what some investors thought might by a perfect U.S. labor report for January met with a resounding thud in financial markets Friday. It seemed to be one without so many jobs created that the Fed would be forced into raising rates at an uncomfortably fast pace, yet a report that was still strong enough to

Earnings Season Underway

As of Thursday this week, roughly one-third of the S&P 500 companies have reported earnings for the fourth quarter of 2016. Of the 171 companies that have reported earnings 8 percent were in-line with expectations, 19 percent had a negative surprise and 72.6 percent reported a positive

Rescue Me

That’s the message we heard loud and clear from the markets this week. As economies and markets around the world wobble to start the new year, they were looking to central banks to bail them out. Mario Draghi gave markets around the world some solace with his dovish news conference yesterday.

Under Pressure

Earlier this week we lost a music icon. While I was not a big fan of David Bowie, there are a few songs of his that I enjoy. My favorite is “Under Pressure” which he co-wrote with the band Queen in 1981. The title is very appropriate for what we

Happy New Year (?)

As we observe U.S. stocks down roughly 5 percent in the first week of 2016, we are reminded of what occurred last fall when Chinese growth concerns and a strong dollar reverberated around the globe. While China accounts for only

Time Is On My Side

Santa Claus left investors with a lump of coal this December. Historically, the S&P 500 is positive in the month of December with a return of roughly 2 percent. 2015 resulted in a flat return, summing up the entire year for investors. There

Junk Bonds on the Naughty List

by Brad Houle, CFAExecutive Vice President

by Brad Houle, CFAExecutive Vice President

Last week, Third Avenue Management announced that they were freezing withdrawals from a leveraged credit fund. This announcement sent a wave of fear of broader contagion through the high-yield bond market. This fund bought bonds that were both illiquid and very risky from a credit quality perspective. Also, the fund employed leverage (borrowed money) in an attempt to enhance returns. This fund was swinging for the fences and not for risk adverse investors. This turbulence has bled over into the broader category of below investment grade bonds also referred to as high-yield.

Bonds that are below investment grade are often referred to as junk bonds due to the lower credit quality of the issuing companies. Junk bond is a somewhat of a pejorative description of an important part of the bond market. Small companies that are growing, a large engine for the U.S. economy, often fit into the category of below investment grade credit. It is important that there are public market debt financing options available for these entities. Because of the lower credit quality, investors demand more compensation in the form of interest in order to loan these companies money. Due to the lower credit quality there is a higher potential default risk for these bonds.

The genesis of this recent sell-off in the high-yield bond market has been the decline in the price of oil. Many smaller oil and gas companies use the high-yield debt market to finance their operations. When the price of oil declines these small oil and gas companies make less money and have more difficulty paying back the money they have borrowed. As a result, the prices on high-yield bonds in that segment of the market declined. Retail investors in mutual funds became nervous, withdrawing money from high-yield mutual funds and, to meet redemptions, the fund managers had to sell what they could to meet the investor demand for money. This dynamic has caused other parts of the high-yield bond market to decline as well.

Another wrinkle to this negative situation has been the decline in liquidity in the bond market. The Dodd-Frank Wall Street Reform and Consumer Protection Act that came from the financial crisis with the intention of reforming Wall Street has helped to create this predicament. Dodd-Frank severely limits the ability of large bank bond trading departments to inventory bonds, making building an effective market difficult due to capital requirements.

The higher quality investment grade market is where we invest our clients’ fixed income assets. Thus far, the investment grade bond market has only been modestly impacted by the sell-off. By comparison, the Barclays High Yield Index has declined 4.7 percent this year versus the Barclays Investment Grade Intermediate Credit Index which has returned 1 percent.

Our Takeaways from the Week

- We don’t believe that the current disruption in the high-yield bond market will cause a broader contagion in the financial markets

- We are particularly keeping a close eye on investment grade bonds where we have seen only a minor impact

- This week the Federal Reserve hiked rates for the first time in nine years and we continue to expect a slow and gradual rise in the Fed funds rate and interest rates in general

- We believe that this interest rate increase cycle will not end the bull market or push the economy into recession

The Time Has Come

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Awaiting Lift-Off

Following last week’s solid jobs report, a clear plurality of investors now expect the Federal Reserve to raise short-term interest rates next week. But once the Fed has achieved lift-off, what then? Amid ongoing dollar strength and falling energy prices, corporate profits have stagnated this year and economic growth remains pedestrian, causing concern about more of the same in 2016, but with less monetary accommodation along the way. We expect the path of Fed rate tightening to be gradual because inflation remains nearly non-existent. Even excluding food and fuel prices, so called “core inflation” also remains notably below the Fed’s 2 percent objective.

Mission Partly Accomplished

What we do have, and what is leading to the end of zero interest rate policy, is a state of relatively full employment. Although the labor force participation rate remains near decade low levels, the Fed rightfully sees its full employment mandate as having been achieved. In turn, we have seen stirrings of labor cost inflation, both statistically and anecdotally. The employment cost index is finally nearing 3 percent after having spent a prolonged stretch below that mark. Real life examples include fast food restaurants like McDonald’s and retailers Wal-Mart and TJ Maxx having to boost wage rates to keep employees; the degree to which labor inflation takes hold more broadly will be important to gauge, as this combined with the productivity of labor determine what we believe to be the single most enduring predictor of consumer price inflation – unit labor costs. Perhaps because of muted levels of capital spending later in the economic cycle, workers’ productivity has proven to be disappointing in recent quarters, increasing upward risk to this key measure. As the Yellen Fed achieves lift-off from zero percent interest rates, it will be closely tracking its labor force dashboard in helping to determine how fast and how high rates ultimately go.

OPEC Laissez-Faire

OPEC finished its latest and much anticipated meeting in Austria last Friday much like we expected, acceding to the current level of the 12-member cartel’s production, but apparently not making any plans to accommodate additional liftings from Iran once UN sanctions are lifted, as expected sometime early next year. While some thought OPEC would cut production, this outcome never seemed likely. Lead producer Saudi Arabia’s strategy has come into focus – keep oil prices low enough, long enough, to accommodate its recapture of market share and stimulate enough additional demand to tighten oil markets naturally. In essence, the cartel has ceased to act as one. By all accounts, the meeting was highly contentious and unusually long, the result of discord that saw members Venezuela, Nigeria and Ecuador argue unsuccessfully for reduced liftings.

Black Gold?

Oil prices fell on the news last Friday and have proceeded to breach late August support levels of $40/barrel. Not helping oil bulls’ cause is news this week that Iraqi production gains have boosted OPEC production to fresh three-year highs in November at the same time the El Nino weather phenomenon has warmed the Northern Hemisphere and squelched early season demand for heating oil, an important seasonal product of crude oil. These headwinds notwithstanding, we maintain our belief that oil markets will tighten as U.S. production continues to roll over, non-OPEC, ex-U.S. production stagnates, and oil demand again grows at a faster than anticipated clip. Barring a market share war within OPEC (one that would be fought with limited means given how little excess production capacity the cartel has), Saudi’s de facto strategy appears destined to succeed. We see modest levels of oversupply morphing into undersupply as 2016 progresses. After all, the following adage holds – the best cure for low oil prices is low oil prices.

Our Takeaways from the Week

- The long awaited Fed lift-off from zero interest rate policy is at hand

- Oil prices have fallen anew in the aftermath of OPEC’s highly anticipated meeting last week

Inflation Is Like Wine

by Brad Houle, CFAExecutive Vice President

by Brad Houle, CFAExecutive Vice President

This week, a few of us at Ferguson Wellman had the opportunity to attend a lunch presentation where Dr. John Williams, president of the Federal Reserve Bank of San Francisco, was speaking.

He started his remarks with a disclaimer that everything he was about to say was his own opinion and not the opinion of the Federal Reserve. That said, one can imagine that there are detailed guidelines around what Fed Governors can say in a public setting.

“Jawboning” is an expression for the Fed communicating its intentions to the market. Dr. Williams’ comments were being reported in real time on Bloomberg as well as other financial media outlets. These days, what the Fed says it is going to do is as important or more important that what it actually does. This week, Dr. Williams conveyed the message that the Fed was going to raise rates at the next Fed meeting without actually saying so.

One of the takeaways from the presentation was the how the Fed thinks about inflation and the lag between monetary policy changes and the actual impact. Dr. Williams said this about inflation: "The inflation side of the equation is where the winds are blowing colder than I’d like.” For those of us who lived through the ’70s and ’80s, the need for higher inflation seems anathema to a healthy economy, but that’s where we are right now. He also said, “Inflation is like wine … a little bit is actually good for you.”

With respect to the lag between monetary policy changes and the impact, Dr. Williams said, "Milton Friedman famously taught us that monetary policy has long and variable lags. Research shows it takes at least a year or two for it to have its full effect." Looking at the current inflation data in the context of this logic supports why the Fed will most likely raise interest rates even if inflation is below the 2 percent target.

There was a question from the audience regarding the notion that economic data is backward looking, yet Fed Governors are tasked with being forward looking. How would they reconcile the two? Dr. Williams shared how the Federal Reserve Governors are regionally based with volunteer boards within their districts. He said that they spend a lot of time speaking with business owners, bankers and other community leaders who live in the district. These efforts are a critical source of forward-looking information for the Fed.

Communication from the Federal Reserve increased greatly under Chairman Bernanke and has continued under the Yellen Fed. It was fascinating to glimpse a small step in the Fed's painstaking and deliberate communication with the financial markets.

With that, today’s U.S. jobs market report of 211,000 new jobs in November seems to seal the deal that interest rates are going to rise this month. The market responded favorably today with a 2 percent rally in the S&P 500 and the U.S. dollar strengthening as well. This confirms that, in addition to comments from the Fed, when economic data speaks – the markets listen.

Our Takeaways from the Week

- We anticipate an interest rate hike from the Fed in two weeks, albeit gradual

- The economy continues to grow at a steady, healthy pace

Who Says You Can’t Go Home?

by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Homeward Bound

Thanksgiving is the busiest travel time of the year. Families are crisscrossing the country returning to their childhood homes to celebrate the holiday. And one thing we should all be thankful for is a healthy housing market.

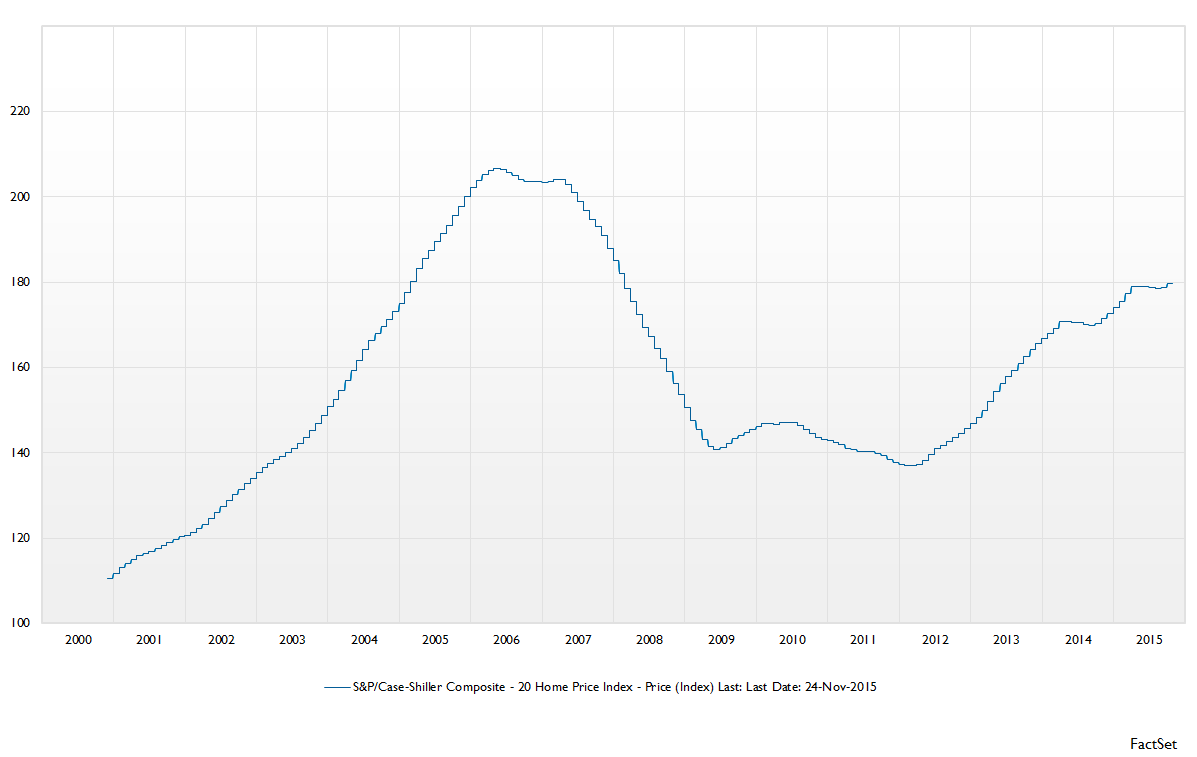

Earlier this week it was reported that the S&P 500/Case-Shiller Home Price index rose 5.5 percent from the prior year. Home prices remain 20 percent below levels reached in 2006 on average, but what is more important than the home price level is the change from one cycle to the next. From 2000 through 2006, home prices doubled at an unsustainable pace and we all paid the price. The current cycle is much more measured and thus, much more durable in our mind.

Home Is What You Make It

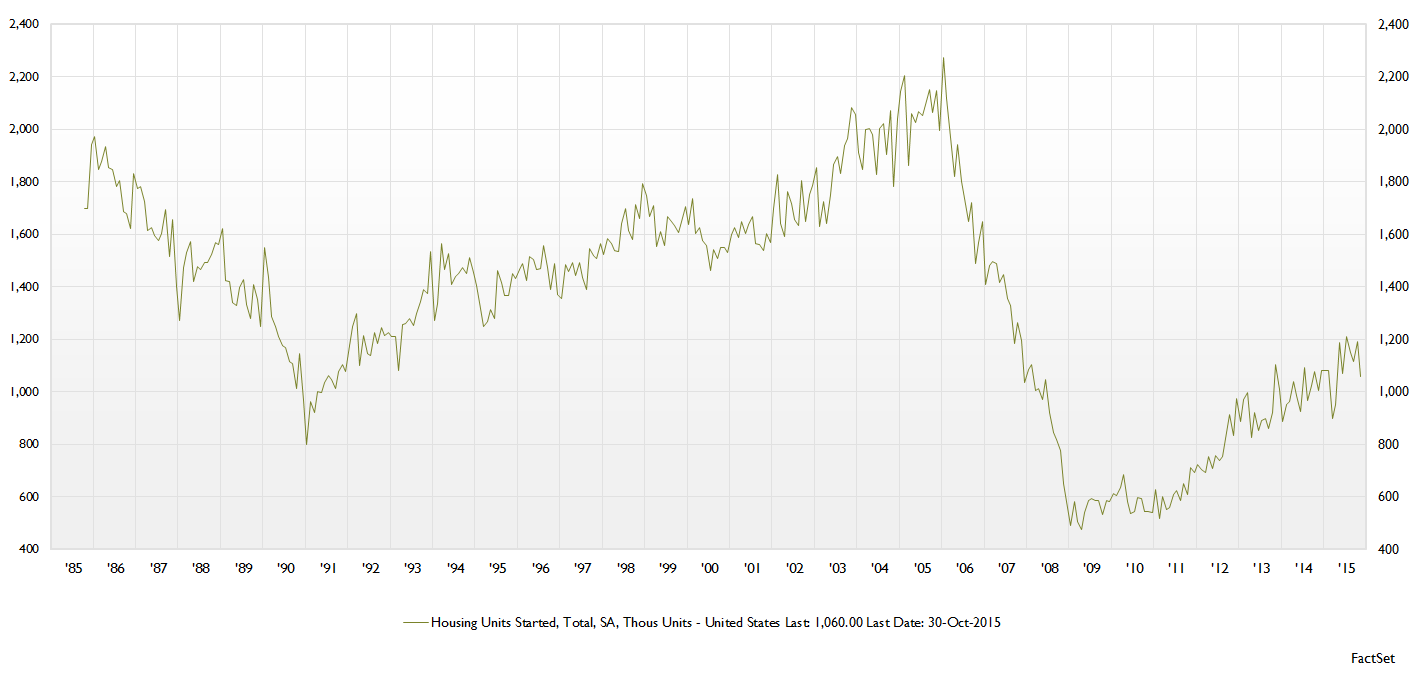

Prices are just one part of the overall housing equation. Below you can see housing starts for the past 30 years. Housing starts in the U.S. are just now barely above levels reached at the bottom of the last housing cycle in 1990. The first few years after the housing crash we experienced low rates of construction before it finally started to accelerate in late 2011.

The Incredible Journey

A continued rise in housing starts is needed to offset continued strong demand for new homes. If supply were too low, we would expect home prices to accelerate at a faster pace, making them less affordable. To this point, the market seems to be in balance.

Takeaways for the week

- The housing market is on much sounder footing this time around

- Have a safe and healthy Thanksgiving Holiday