by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Homeward Bound

Thanksgiving is the busiest travel time of the year. Families are crisscrossing the country returning to their childhood homes to celebrate the holiday. And one thing we should all be thankful for is a healthy housing market.

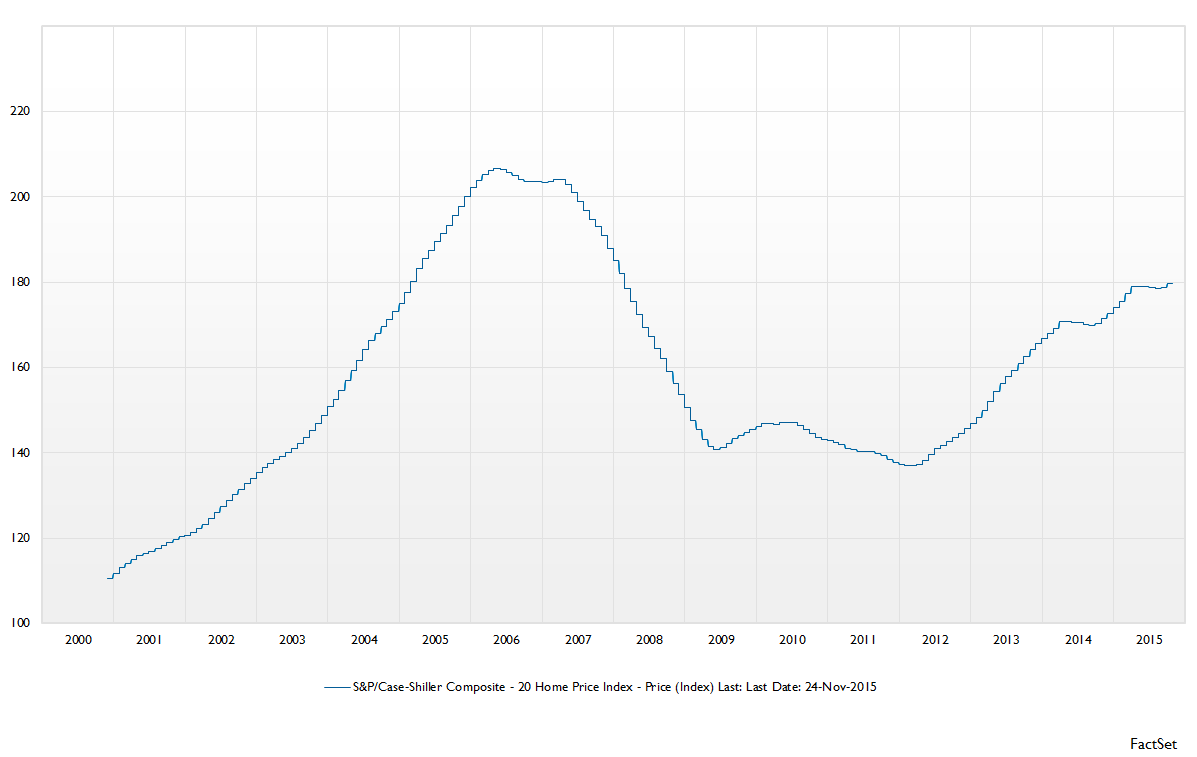

Earlier this week it was reported that the S&P 500/Case-Shiller Home Price index rose 5.5 percent from the prior year. Home prices remain 20 percent below levels reached in 2006 on average, but what is more important than the home price level is the change from one cycle to the next. From 2000 through 2006, home prices doubled at an unsustainable pace and we all paid the price. The current cycle is much more measured and thus, much more durable in our mind.

Home Is What You Make It

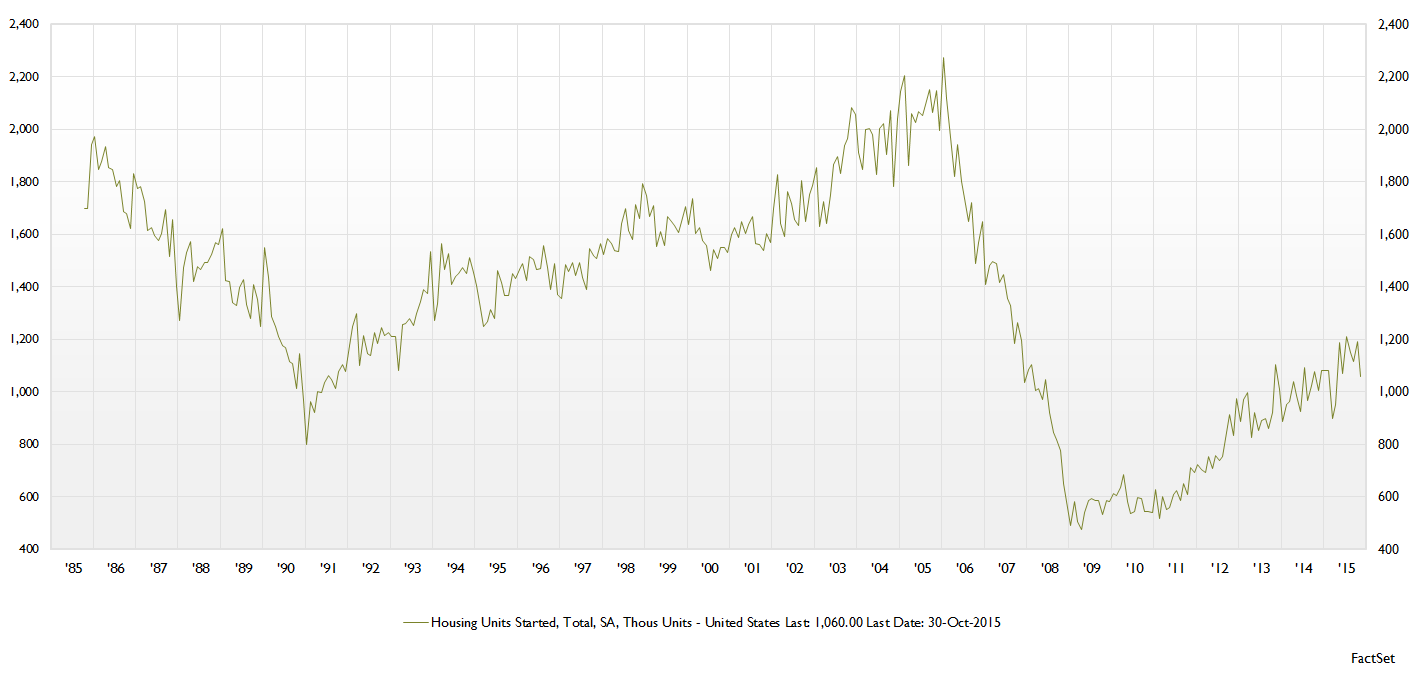

Prices are just one part of the overall housing equation. Below you can see housing starts for the past 30 years. Housing starts in the U.S. are just now barely above levels reached at the bottom of the last housing cycle in 1990. The first few years after the housing crash we experienced low rates of construction before it finally started to accelerate in late 2011.

The Incredible Journey

A continued rise in housing starts is needed to offset continued strong demand for new homes. If supply were too low, we would expect home prices to accelerate at a faster pace, making them less affordable. To this point, the market seems to be in balance.

Takeaways for the week

- The housing market is on much sounder footing this time around

- Have a safe and healthy Thanksgiving Holiday