by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Volatility increased this past week in most asset classes with oil being in focus. In the last two weeks, crude oil is up roughly 20 percent, its best two-week move in 17 years. While the demand picture has not changed, we have seen U.S. oil and gas companies announce major employment cuts and capital expenditure reductions for 2015. We believe that there has been some “short covering” in the market which has led to recent strength. Our belief is that by year-end, oil prices will be between to $60-$70/barrel, due to reduced supply in the U.S. In the face of this, we do believe we see some opportunity in energy stocks. While earnings continue to come down, we think we can find value in select names with strong balance sheets.

All Over the Road

As mentioned earlier, the energy complex was not the only asset class exhibiting volatility. In the first five weeks of 2015, the S&P 500 has been either up or down more than 1 percent 11 times, which is 44 percent of the trading days. To put it in perspective, last year the S&P 500 moved this much only 15 percent of the time. The chart below highlights the last five years.

Days the S&P 500 Was Up or Down More Than 1 Percent

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Number of Days | 96 | 50 | 38 | 38 | 11 |

| Percent of total trading days | 38% | 20% | 15% | 15% | 44% |

Source: FactSet

This year is setting up to be similar to 2011, a year that saw a lot of uncertainty due to surprisingly poor U.S. GDP growth, a U.S. debt downgrade and the European crisis coming to the forefront. All this uncertainty resulted in a flat market for 2011, but it was a rollercoaster ride. We believe the fundamentals of the U.S. economy and the recent actions of the European Central Bank leave the foundation of the global economy a little firmer. We don’t think the volatility mitigates itself; however, we do believe that equity returns will be better than 2011.

Working for the Weekend

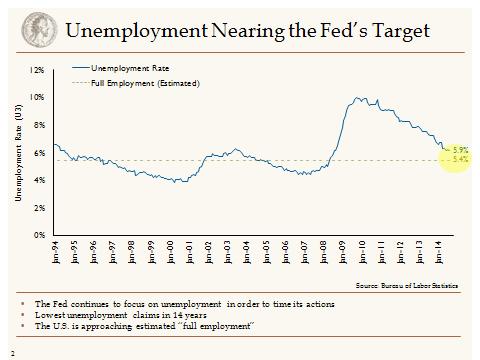

Heading into a wet weekend on the west coast, the monthly jobs report this morning was very strong with the U.S. economy adding 257,000 jobs in January. The unemployment rate ticked up to 5.7 percent due to an increase in people looking for jobs, which is a positive for the economy. This is only a small part of the story. Job gains for December and November were revised higher by 147,000. The third leg of the stool of the January jobs report was an uptick in wages. Wages bounced back after a disappointing December, rising 0.5 percent month-over-month. With a strong labor market and unemployment close to the Fed’s target, we believe this wage growth will persist throughout 2015. This further reinforces our view that 2015 will be a good year for “Main Street.”

Our Takeaways for the Week:

- Main Street will fare better than Wall Street in 2015

- Adding to high quality energy names at this time could pay dividends in 2015