by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Outside of the United States, global growth is challenged. Stagnant economies in Europe, Japan as well as slowing growth in China have led to concerns that the U.S. economy will have a difficult time moving forward on its own. Economic numbers this week were on the slower side here at home.

On the first Friday of each month the jobs report is released and today’s number was quite strong with the economy generating 248,000 new jobs in September. Wages continue to rise slowly and aggregate work hours are expanding to improve as well.

This slow-and-steady growth should enable the stock market to grind higher in the coming months. Worries about slowing global growth and the end of quantitative easing have led investors to take some profit in the past several weeks. These pullbacks were anticipated with the imminent Fed rate hikes in the second quarter of next year.

It’s All About the Money, Money, Money

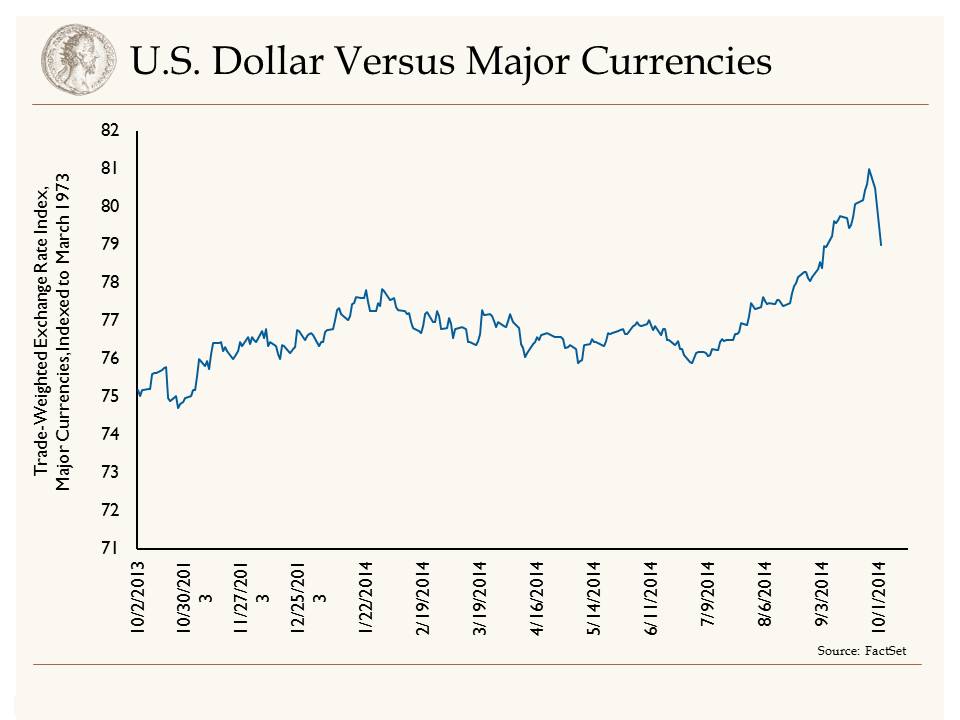

Or should we say it is all about the currency? With U.S. growth outpacing all other developed markets around the world, with the exception of the United Kingdom, it has caused the dollar to rally relative to other currencies. This strength has several ramifications.

First, it makes our assets more appealing to the rest of the world. With rising interest rates and higher government bond yields than other developed economies, capital is starting to flow to the U.S. This has led to a drop in interest rates and further strengthening of the dollar. Think of this as a virtuous cycle.

Second, this could act as a headwind for third-quarter earnings for multinational corporations. U.S.-based companies that sell overseas will take a hit on earnings that occur in other countries, depending on how much the dollar has strengthened relative to the currency of the country where the revenue was generated.

Finally, it is very good on the inflation front because a strong dollar allows U.S. consumers to purchase goods brought in from other countries at a lower price, especially commodities. On the margin, this should help keep a lid on inflation.

Our Takeaways from the Week

- Job growth continues at a steady pace. This a big positive for the economy and will eventually lead to Fed tightening next year

- Growth fears in the U.S. and around the world have led to increased volatility in recent weeks