George Hosfield, CFA, shares our fourth quarter 2022 Investment Strategy video, in which he discusses the Fed raising interest rates in an effort to combat inflation and what that means for investors.

Fourth Quarter 2022 Market Letter: Bad News Is Good News

Read our Market Letter publication for the fourth quarter 2022 titled, Bad News Is Good News, in which George Hosfield, CFA, Peter Jones, CFA, and Joe Herrle, CFA, share our thoughts on inflation, interest rates, the energy sector and housing supply in the United States.

Profits Over Politics

As investors, the best thing about earnings season is it filters a lot of the other noise out of the market. A month ago, a tweet, tariff headlines or even a longshot tax proposal would have moved the equity markets. But now that we are in the throes of earnings season, equity investors are focused on the most important factor in investing: earnings.

A Light in the Black

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

A Light in the Black

What a week! With concerns about growth in China, continued deterioration of the Chinese equity market and U.S. investors rushed to the sidelines by redeeming over $17 billion in equity mutual funds and ETFs. This, coupled with concern over when the Fed will raise rates, led U.S. equities to experience a 12 percent correction from recent highs on Tuesday (see last week’s blog for more detail). This was long overdue as it had been almost four years since the S&P 500 had corrected by at least 10 percent, which was the third longest period in history. However, after six consecutive days of selling, on Wednesday the near-term bottom was reached on the S&P at 1867, down from its all-time high of 2130 which was reached on May 21, 2015.

Understandably, rapid downward moves in equities can be disconcerting. We don’t know if we’ve seen the bottom; however, we believe there is a light at the end of this tunnel in the form of domestic market fundamentals. For example, U.S. GDP was revised higher on Thursday from 2.3 percent q/q annualized to 3.7 percent. This was driven by several factors - primarily capital spending and consumer spending. Earlier this month we also saw retail sales numbers revised higher. When this data was originally reported, we did view it with some skepticism since our bottoms-up analysis did show better strength than the broad government reports.

After analysis of the earnings reports for the companies we own, it revealed annual growth in earnings of 2 percent; however, excluding Energy, growth was close to 13 percent. Even when looking at the broad market, earnings growth (excluding Energy) was around 5 percent. This growth was driven by the U.S. consumer and healthcare. These fundamentals signal to us that the U.S. economy is healthy and improving.

Earnings Growth for the 10 Economic Sectors of the S&P 500

| Q2 y-o-y growth | 2015e | |

| Consumer Discretionary | 9.2% | 11.3% |

| Consumer Staples | 2.5% | 1.7% |

| Financials | 6.8% | 15.9% |

| Healthcare | 14.4% | 12.7% |

| Industrials | -4.5% | -1.0% |

| Info Tech | 4.5% | 4.9% |

| Basic Materials | 6.0% | -1.0% |

| Telecom | 8.5% | 8.3% |

| Utilities | 6.5% | 1.6% |

| Total (ex. Energy) | 5.3% | 7.0% |

| Energy | -55.7% | -56.3% |

| Total | -0.7% | 1.0% |

Source: FactSet

The table above highlights the underlying sectors of the U.S. market, showing both the actual growth rate for the second quarter and an estimate for 2015. The key to focus on is that commodity prices are bringing down Energy and Basic Materials, and the strong U.S. dollar and China is hurting Industrials. However, when you lift up the hood of the market, corporate America is still exhibiting solid growth.

Our Takeaways for the Week

- Corporate earnings remain healthy

- While volatility may remain until the Fed tightens, we still like equities long-term

Slowdown?

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The first couple weeks of trading in October have been volatile, primarily on the downside. While the U.S. economy continues to print positive data points, most other regions around the globe seem to be experiencing some headwinds. We continue to see deteriorating economic data coming out of the Eurozone. Germany had been stronger; however, recent data is pointing to the country possibly entering into recession. Industrial production and manufacturing orders came in weak, and this concern has pushed the yield on the 10-year German Bund to 0.84 percent.

China is a wildcard as well. Growth has been slowing moderately; however, Thursday evening technology investors were greeted with bad news from a key component supplier. Microchip Semiconductor, a supplier of chips that go into a broad array of consumer, household and industrial products, issued a warning citing weakness in China. The company believes this is a short-term issue, but demand just three months ago was strong. This resulted in a drubbing of the Philadelphia Semiconductor index and caused the industry to be down over 5 percent on Friday. Even though there may be some general hiccups in demand, we continue to play the semiconductor space through specific technologies and applications, primarily in the wireless space.

We don’t anticipate a slowdown here in the states. The U.S. economy should continue to exhibit solid growth and decouple itself from the rest of the globe. The most recent positive development has been the decline in energy prices over the last couple weeks, which will result in a nice increase of discretionary income for U.S. consumers.

When Doves Cry

The Fed released its meeting minutes earlier this week and the capital markets were pleasantly surprised. There had been some concern that the Fed may become more hawkish and looking to tighten. However, contents of the minutes showed the Fed to be focused on the data. They highlighted benign inflation, a strengthening U.S. dollar (which is positive for low inflation) as well as increased risks of a global slowdown due to Europe’s stalling growth. We still believe that the Fed will be looking to raise the funds rate in the second quarter of 2015. Even though inflation remains low, U.S. economic growth will support the beginning of a rate hike cycle.

European Central Bank President Mario Draghi also signaled his dovish intentions for the ECB earlier this week. At a speaking engagement in Washington D.C., he stated that the bank was willing and able to alter its current bond buying program which may eventually move from just asset-backed securities to actual sovereign debt. We believe the ECB will be active in the market and will attempt to push growth higher to fight any possibility of deflation.

Our Takeaways for the Week:

- While the Eurozone looks to be slowing, U.S. economic growth remains healthy which is positive for both the U.S. dollar and equities

- The Fed will remain data dependent when determining when to increase rates, which probably won’t happen for another 6-9 months

Slow Ride

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Slow Ride

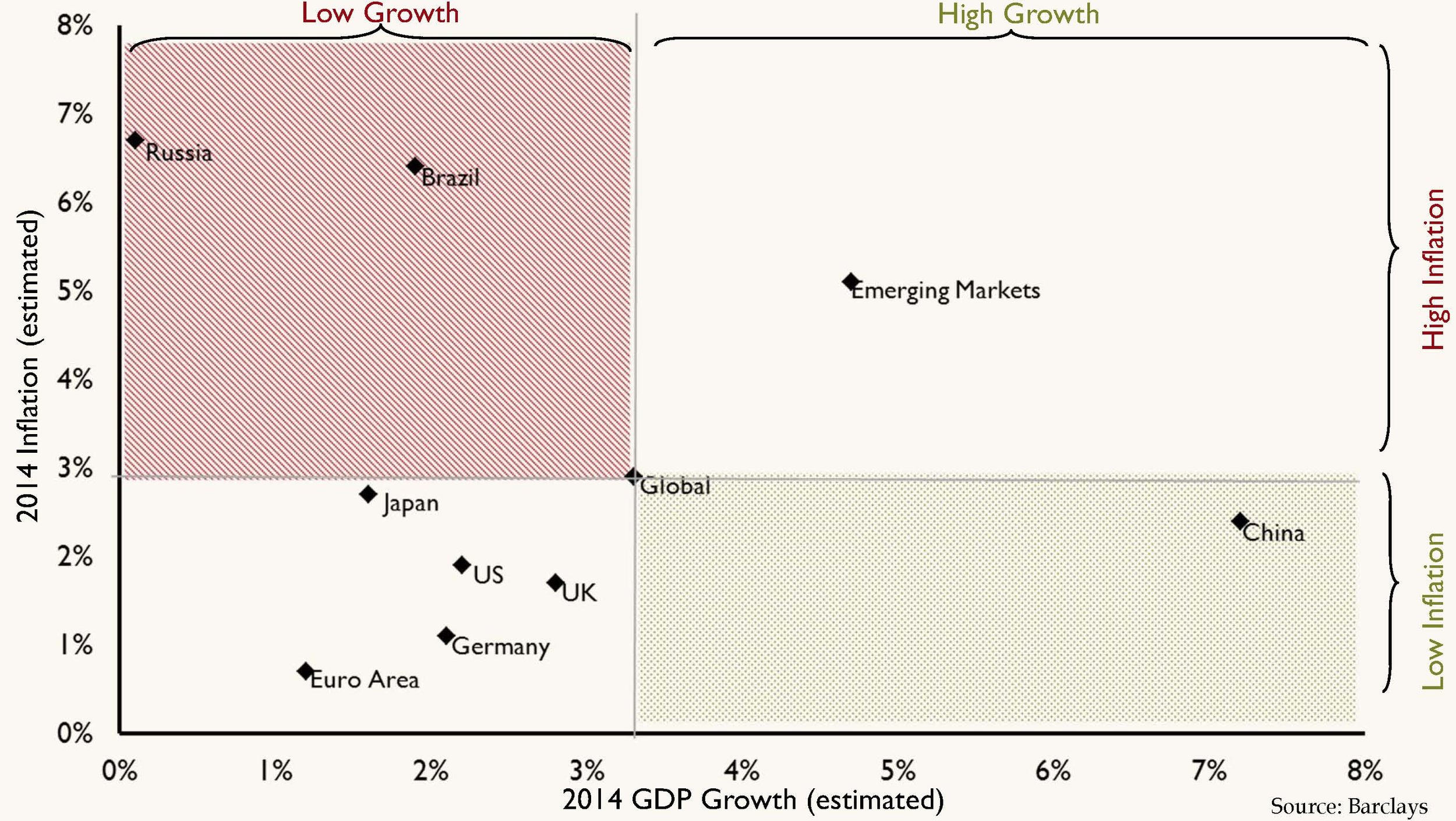

This week, the World Bank lowered their global GDP assumptions for 2014 to 2.8 percent from 3.2 percent. The bank cited the BRICs (Brazil, Russia, India and China) as well as the U.S. as culprits for the lowered estimates. We believe the slowdown in the U.S. is solely a first quarter event due to weather, and we expect to see acceleration throughout the year. China’s growth, though slowing, is still relatively robust and inflation remains under control. Regrettably, Brazil and Russia have not fared as well. As the chart below highlights, Brazil and Russia are stuck in a slowing growth, high inflation environment that is difficult to overcome. With high inflation, there is pressure to raise interest rates, but that leads to increased headwind for growth.

Unfortunately for Brazil, the build up for the World Cup has not provided the added stimulus that was hoped for. Corruption and cronyism have proved to be rampant and the economy has not seen the desired lift. There was the expectation that the employment opportunities would bring about an economic boost for their citizens. However, this hasn’t happened and there remains strong sense of frustration among the public.

London Calling

Earlier this week, there were protests centered in London (with minor demonstrations in Paris and other European cities) due to the growth of the online transportation company, Uber. This company is disrupting the “old” taxi cab model by allowing customers to access drivers of vehicles for hire through a mobile app. This disruption allows consumers to by-pass the classic taxi for a private hire, which in many instances, may be cheaper and more convenient. The company started in San Francisco and is expanding globally.

The protests may have had an unintended counter effect. A lot of the general public, especially in Europe, have not heard of Uber, thus these actions just put the start-up on the front pages. Competition for the general public is usually a good thing in pushing prices down and improving service. However, as a CNBC reporter stated, the French public are in favor of the protests, but that doesn’t come as a surprise “in a country where competition is not really a key word and where a strike is probably some sort of national sport.” On a final note, Uber recently completed a round of financing which valued the company at close to $18 billion.

The Mob Rules

While stocks hit new highs at the beginning of the week, geopolitical issues in the Middle East have tempered those gains. With militants gaining control of key cities in Iraq, the supply of oil has now come into question. This has resulted in a run up in the price of crude. We are of the belief that the price of oil will remain stable as the U.S. continues to increase its supply over the long term. However, we will continue to experience short term volatility due to global tensions and we remain overweight the energy sector based on our thesis that the global economy remains in expansion mode. This recent spike has resulted in the sector being the best performer this last week.

Takeaways for the Week

- Key emerging markets are struggling with flagging growth and high inflation and investors have to be selective

- In aggregate, global growth is still healthy and the U.S. should lead the developed world

- The U.S. will make it out of the first round of the World Cup and Germany will win it all