by Blaine Dickason

Senior Vice President

Portfolio Management and Trading

After serving two full terms as chairman of the Federal Reserve, Jerome Powell enters 2026 with just three Fed meetings remaining under his leadership. Beginning in June, a new Fed Chair will preside over setting monetary policy for our country. While the list of potential nominees has been fluid, a critical step in this process is that the nominee, and likely new chair, gains the confidence of a wide variety of stakeholders. These include, but are not limited to, members of Congress the nominee will need for confirmation, participants in the global financial system that enable our country to run persistent deficits and the almighty United States consumer who counts on having a job and seeing stable prices. Another important dynamic regarding the selection of Chair Powell’s successor surrounds the independence of the Fed to set interest rate policy. As investor Ken Griffin of Citadel recently shared in a December Bloomberg interview, “The most important move the president and the incoming Fed chairman can make ... is to create distance between the White House and the Fed.” Financial markets are keenly attuned to any development here and how it may affect long-term interest rates and the value of the dollar. Here are three of the Fed transitions we are focused on as we turn the calendar into 2026.

Transition #1: How many more rate cuts? Are we close to the end of the cutting cycle?

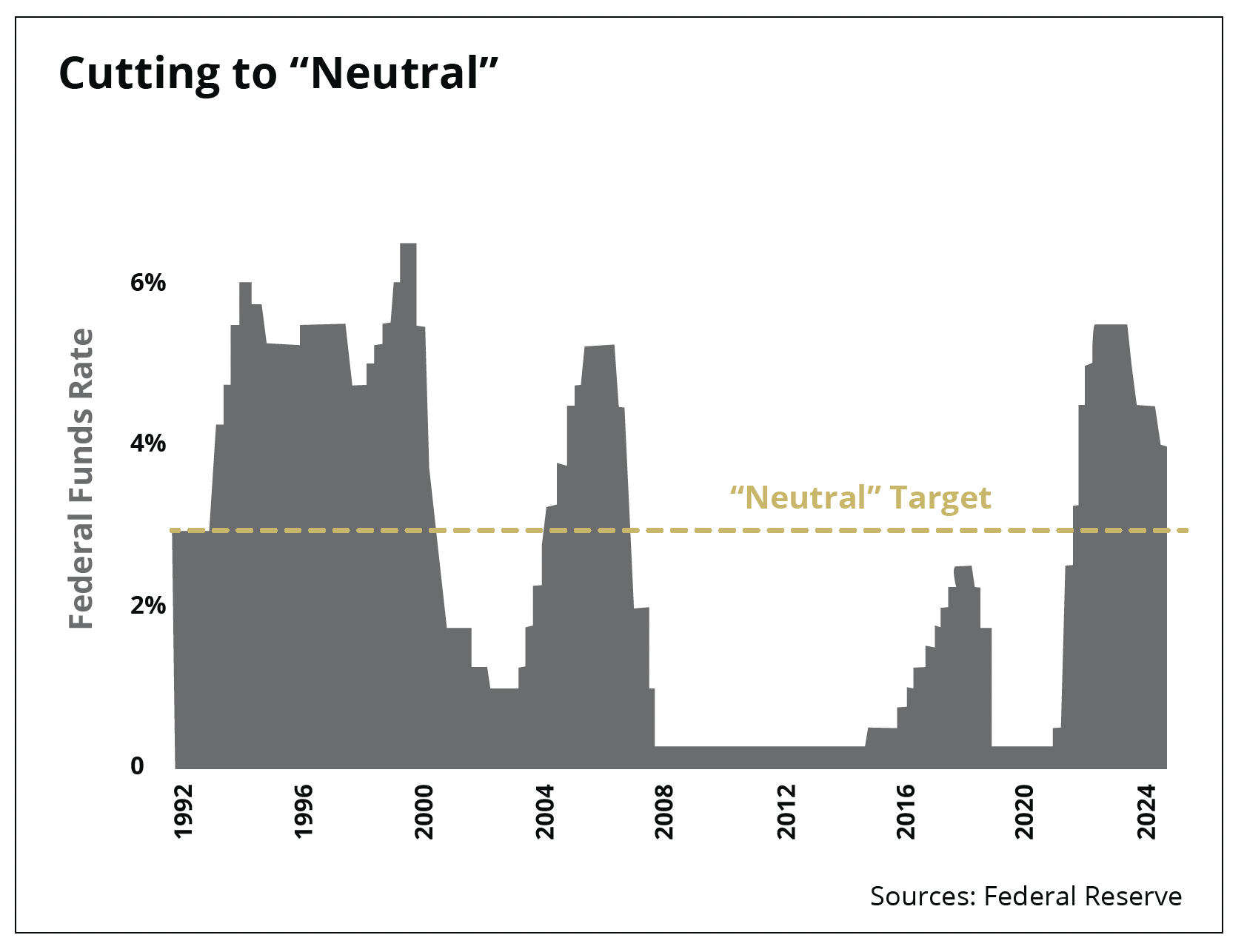

The Federal Reserve cut interest rates in December, its third rate cut of 2025. This was its sixth cut in the current cycle, which began in September 2024. For the last several years, the Fed’s policy rate has been set in restrictive territory, to combat legacy inflation from the pandemic and, more recently, to offset potential inflationary impulses from increased tariffs. Given strong corporate earnings and continued momentum in the U.S. economy, the Federal Reserve is likely targeting a return to a neutral interest rate, which, in their view, neither stimulates nor restricts our economy. Most estimates equate neutral with a roughly 3% federal funds rate. Given that framework, and as you can see from the chart below, this implies the Federal Reserve may have only a couple more rate cuts left in 2026.

Transition #2: A new chair for the Federal Reserve

Jerome Powell’s term as chair concludes in May. It is up to President Trump to nominate a successor, who then must be confirmed by Congress. While a short list of likely candidates has already emerged, so have questions about maintaining the Fed’s independence. An ideal candidate will leave financial markets confident that they will act to protect the long-term interests of the U.S. economy, which may lead to difficult decisions in the short term. Additionally, there has typically been a learning curve for both financial markets and a newly appointed Fed chair as they get used to one another. Each new Fed Chair has their own communication and leadership style that will need to be accounted for. In the past, this has meant additional market volatility early in their term as they steer monetary policy to achieve their dual mandate of maximum employment and price stability.

Transition #3: More polarization and therefore more competing mandates

This past year has brought increased tension to the Fed’s targeting of its dual mandates for maximum employment and price stability (i.e., inflation). Inflation that continues to run above the Fed’s 2% target has emboldened certain members of the Fed’s board to become vocal “hawks,” advocating for rates to remain in restrictive territory until inflation recedes further. Several of these hawks who were vocal opponents to additional rate cuts will not be voting members in 2026, which on its own suggests the committee will tilt more “dovish.” Other members of the Fed board, including newly appointed Governor Stephen Miran, have strongly advocated for continued cuts to support full employment as the labor market has shown slowing momentum this year. The net of this more vocal debate is that there appears to be greater polarization among the members of the Fed board. For an institution that relies on strong communication with financial markets to conduct much of its policy work, a fractious membership is likely to make its job more challenging, which may have implications for heightened market volatility and the likelihood of policy errors.

There are many changes unfolding at the Federal Reserve that are likely to influence how monetary policy is conducted in the near term. Recent economic data suggesting slowing momentum in the labor market, along with moderating inflation pressures, should keep the Fed’s bias towards additional rate cuts in 2026. Fiscal stimulus for both consumers and businesses from the One Big Beautiful Bill Act will likely limit the magnitude of any additional cuts. Regardless of who is the next Fed Chair, a return to a ‘neutral’ interest rate policy will allow other priorities by Congress and the administration to take the lead without either being stimulated or restricted by the Fed.