George Hosfield, CFA

Chief Investment Officer

Director

Investors had to contend with plenty of noise in 2025. Tariff uncertainty disrupted markets, the longest government shutdown in U.S. history delayed economic data and the Fed resumed its easing cycle. Nevertheless, economic growth held up and solid earnings growth propelled equity markets to post a double-digit gain for the third consecutive year. Three years ago, stocks (S&P 500) were trading at a price-to-earnings (P/E) multiple of 17x earnings. Today, the S&P 500 is trading at more than 22x earnings, which is at the high end of its historical range. Furthermore, this high-expectation market is being driven by a narrow list of increasingly expensive technology/AI-related titans. Against this backdrop, investors are asking if a fourth consecutive year of positive returns is attainable or simply a “Mission: Impossible.”

The skeptics have a script ready, filled with obstacles that supposedly make a continued rally unsustainable. However, upon closer inspection, we believe these concerns look less like cycle-killing obstacles and more like hurdles that we will likely be able to clear.

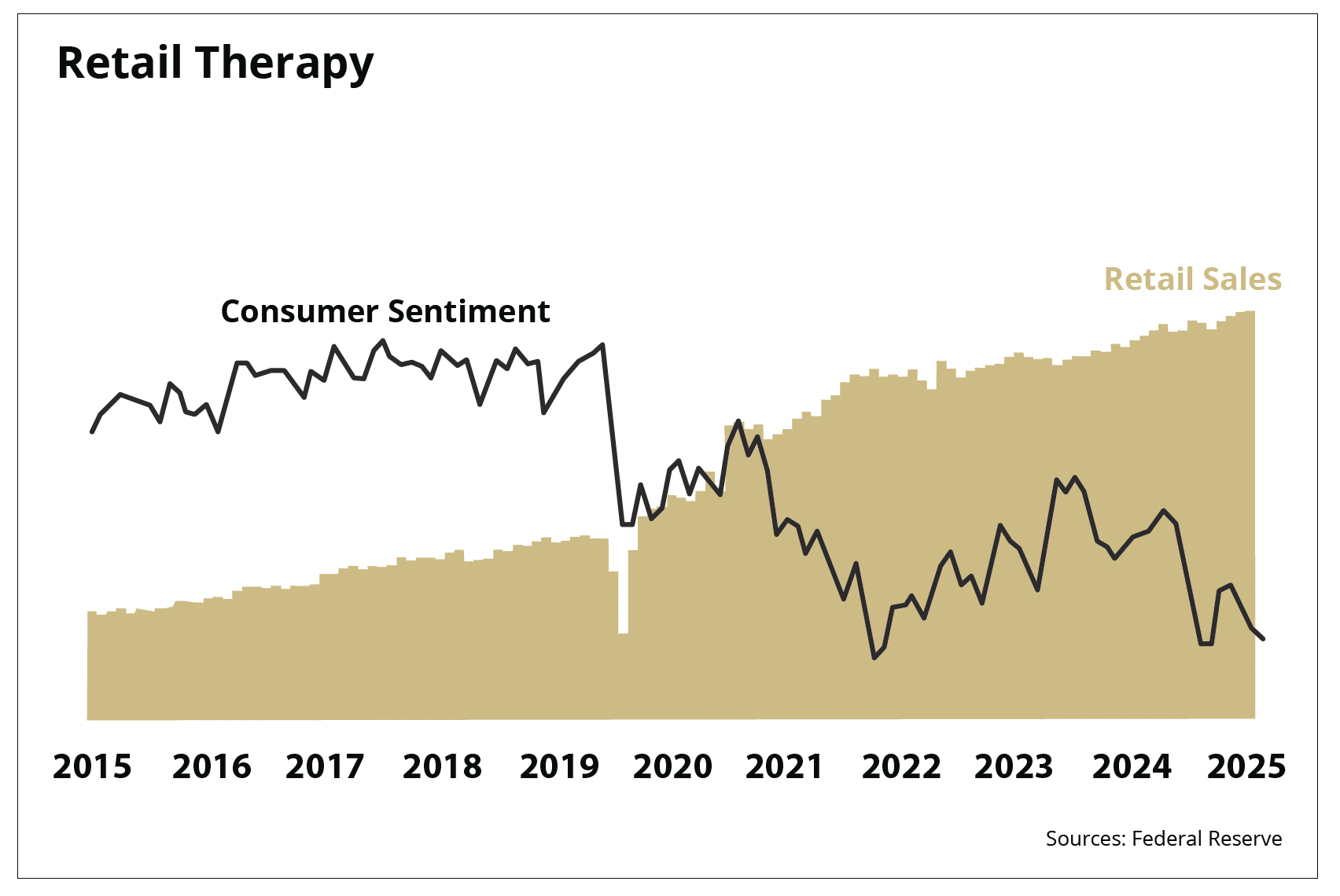

Obstacle #1: Is the Consumer Tapped Out?

We reject the narrative that the U.S. consumer is exhausted. While consumer sentiment surveys remain historically poor, actual behavior tells a very different story. Households continue to display not just a willingness to spend, but also, as measured by debt-service-ratios and total debt load, ample capacity to spend.

Furthermore, looking ahead to 2026, consumers are set to receive a welcome “shot in the arm” in the form of fiscal stimulus, which we believe will provide a tailwind to disposable income and keep consumers ready, willing and able to spend.

Obstacle #2: Is the Fed Behind the Curve?

Critics argue the Federal Reserve has waited too long to cut rates, risking a recession. We disagree. We believe the Fed has acted appropriately to date, successfully balancing its dual mandate of price stability and full employment. Since tariffs were enacted, monetary policy has been on a knife-edge. Tariffs are inherently inflationary, placing the Fed in a difficult position: recognizing that short-term interest rates are higher than necessary while remaining cautious about inflationary pressures creeping back into the economy. In this context, patience was not a policy error; it was a prerequisite for stability.

Obstacle #3: Is AI a Bubble About to Burst?

We shouldn’t mistake strong performance for a bubble. Comparisons to the year 2000 are frequent but flawed. Unlike the speculative mania of the dotcom era, today’s leaders are cash-generating behemoths. Current capital expenditures as a percentage of gross domestic product (GDP) are lower than during past infrastructure booms, and crucially, their spending is primarily funded by massive internal cash flows rather than debt issuance. In short, this AI spending cycle continues to be driven by profit growth and not empty hype.

Obstacle #4: “Is the Stock Market Overvalued?”

With the S&P 500 trading at a P/E over 22x forward earnings, sticker shock is understandable. Yet, we believe these levels are justified. The bulk of the market’s gains have come from earnings growth rather than multiple expansion.

For 2026, consensus expectations are for S&P 500 earnings to grow by 14%. Importantly, the drivers of this growth are broadening; we expect accelerating contributions from the “other 492” companies outside the Magnificent Eight. Finally, a premium multiple is warranted given that 30% of the index’s profits are derived from eight companies delivering explosive, secular growth.

Our View

While we are not anticipating a recession in the coming year, in recent months, we found it prudent to modestly realize some profits and reduce exposure to a possible market correction in client portfolios. Though we do not believe we are in a “technology bubble” nor that the AI theme has run its course, we have nonetheless been mindful that many AI-leveraged technology stocks have exhibited very strong returns, and we therefore modestly reduced our target weight in this sector. Finding current yields attractive and believing that bonds will provide a meaningful degree of insurance to portfolios if

equity markets suffer a correction, we increased

client exposure to that asset class with the recent equity sale proceeds.

Though we still recommend a slight overweight to large-cap equities, we enter 2026 with the most conservative recommended asset allocation in over a decade, with balanced accounts having a slight overweight to bonds and underweights to small-cap equities, international equities and alternative assets. The mission to secure a fourth year of gains is not impossible; it is probable. While the market is vulnerable to a correction, both fiscal and monetary policy alongside broadening earnings contribution, lead us to expect the market to once again deliver a positive return in 2026 … albeit at a more moderate level than we’ve enjoyed over the last three years.