by Blaine Dickason

Senior Vice President

Portfolio Management and Trading

Jobs on Hold

It is a common refrain that markets hate uncertainty, and this week has delivered plenty. On both the labor front and in technology, the movers in the capital markets were driven by a combination of delayed data, softening employment signals and a sharp repricing in the stock prices of software and services companies.

The first surprise was procedural, rather than economic, with the delayed release of the January nonfarm payrolls report. The short, four-day partial government shutdown was to blame here, and this economic release has been delayed from its original release of today, February 6, until next Wednesday, February 11. Current expectations are for a gain of 70,000 new jobs and an unemployment rate of 4.4% (flat when compared to December). At a moment when investors are trying to fine tune expectations for Federal Reserve policy, the absence of the single most influential labor market datapoint left markets leaning more heavily on secondary indicators. Some of those indicators reported this week continued to suggest a slowdown in the labor market and a continuation of the ‘low hiring – low firing’ environment we’ve reported on since last year.

Yesterday’s monthly JOLTS report (Job Openings and Labor Turnover Survey) for December showed a continued cooling in labor demand as job openings declined for the third consecutive month; down nearly 13% from the year prior. The “quits” rate remains subdued, suggesting workers feel less confident about switching jobs. Meanwhile, weekly initial jobless claims ticked higher, although remain in the same remarkably stable range we’ve seen for the last several years. Both these reports are consistent with a lack of dynamism in the labor market, despite being at full employment as suggested by December’s mere 4.4% unemployment rate. Since one of the Federal Reserve’s two mandates is to maximize employment, these trends in the labor market will remain front of mind for Fed Chair designate Kevin Warsh as he enters the confirmation process to be seated as new Fed Chair in June.

Software Sold

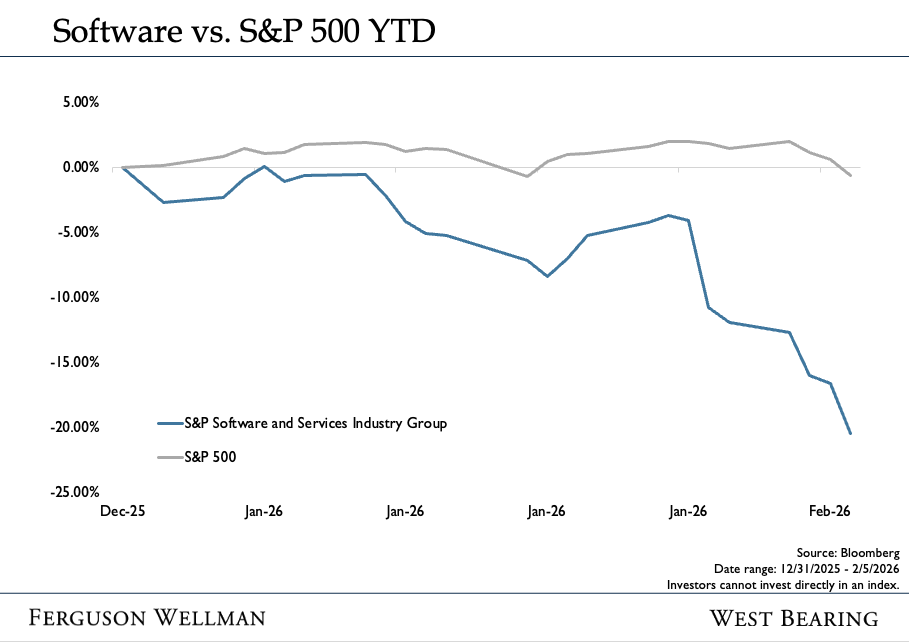

Over the past week, software stocks have sold off sharply. The move has been swift and broad, hitting many of the same companies that had previously been rewarded for their exposure to artificial intelligence. The catalyst has not been a collapse in earnings, but rather a reassessment of business models. Investors are beginning to ask whether AI is purely a revenue opportunity, or also a potential margin threat.

As AI tools become more powerful and more accessible, the risk is that certain software functions become commoditized faster than previously assumed. Customers may require fewer licenses, renegotiate pricing or substitute in-house AI solutions for third-party software. For companies that trade on high growth expectations and premium multiples, even a modest change in long-term assumptions can produce an outsized valuation response.

The juxtaposition is instructive. On one hand, labor market data is softening just enough to keep hopes of rate cuts alive, even as the headline payrolls report sits temporarily on hold. On the other hand, one of the market’s most celebrated growth themes is being forced through a more sober analytical lens. That combination left investors rotating away from narrative-driven winners and back toward balance sheets, cash flows and a more defensive posture.

For now, the message from markets is not one of panic, but of recalibration. Jobs may be on hold, but expectations are not. And software may be sold, but the broader lesson is about discipline: even in an AI-driven world, fundamentals still matter.

Takeaways for the Week:

Through yesterday, nearly 60% of S&P 500 companies (70% by market capitalization) have reported Q4 earnings. Reported annual revenue (+9.2%) and earnings growth (+13.9%) to date have both exceeded estimates.

According to relevant earnings calls, Cap-Ex by the large hyper-scaler companies on artificial intelligence buildout is expected to exceed $700 billion in 2026. This would represent growth of 63% versus 2025 and on its own would contribute nearly 1% to U.S. GDP growth for the year.