by Peter Jones, CFA

Executive Vice President

Equity Research and Portfolio Management

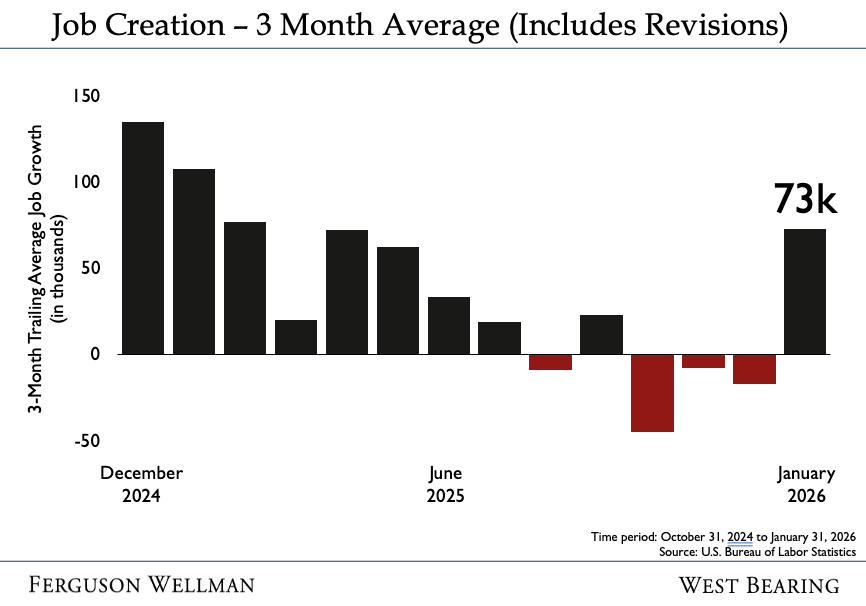

It was an exceptionally busy week for economic data, and by and large, the news this week was very favorable. After a period of weakness in the second half of 2025, the labor market appears to be finding its footing.

As you can see in the chart below, job creation stalled significantly late last year. However, the latest numbers show a significant turnaround. Job additions accelerated from around zero to 130,000 in the month of January, which is the best single print we have seen in over a year. Consequently, the unemployment rate ticked down to 4.3%, likely signaling renewed health in the labor market.

For those who might be skeptical of these sudden improvements, it is worth noting that third-party sources and initial jobless claims (aggregated using state level data) corroborate this strength.

Moreover, inflation data came in at 2.4% year-over-year, which was cooler than expected. We are now within a rounding error of the Federal Reserve’s 2% target. This "Goldilocks" scenario of stronger growth with cooling inflation was cheered by the bond market. The 10-year Treasury yield, which influences mortgage rates and borrowing costs, fell to 4.05%, its lowest level since the beginning of December.

The Market: Calm Surface, Turbulent Depths

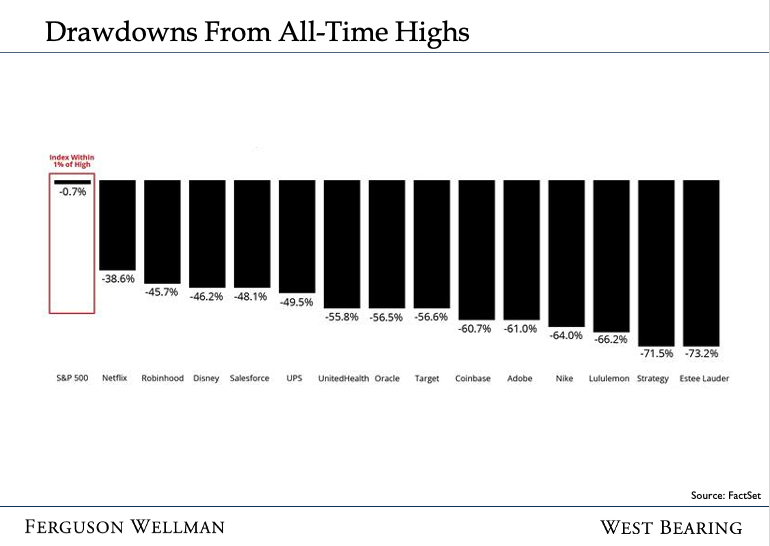

Judging only by the S&P 500 index level, which has oscillated between +1% / -1% all year, one might conclude that it has been a calm year. However, under the surface, there has been significant volatility. While the broad index is steady, individual sectors and "blue-chip" companies are experiencing significant selloffs. As the chart below illustrates, while the S&P 500 is within 1% of its high, major household names—from entertainment giants to software leaders—are seeing drawdowns ranging from 38% to over 70% from their all-time highs.

The selling has been most intense in the software sector, with the software ETF currently down 24% year-to-date. Investors have adopted a "shoot first, ask questions later" mentality, punishing any company in this space that shows even the slightest sign of being in the crosshairs of AI disruption.

The Case for Diversification

This divergence where the broad market holds up while popular sectors decline reinforces a lesson that has been easy to forget since the AI boom began in November 2022: DIVERSIFY!

From 2023 through 2025, it was incredibly tempting to own nothing but artificial intelligence and tech stocks - they were the only game in town, and owning a diversified portfolio often felt like a drag on performance. But 2026 has been a jolting reminder that market leadership changes.

Takeaways for the Week:

Both employment and inflation data surprised positively this week

While the S&P 500 index level suggests calm, there has been immense volatility under the surface