by Joe Herrle, CFA

Senior Vice President

Alternative Assets and Portfolio Management

2025 is officially in the books, marking the third consecutive year of double-digit gains for the market. It wasn’t just a good year for returns — it was an eventful one, too. At the start of 2025, our optimism wasn’t based solely on sentiment; the data supported it.

So, what is the data telling us for 2026? As we start the new year, our outlook remains largely unchanged. The U.S. economy continues to show resilient growth, diverse profit drivers and a policy backdrop that supports risk assets. Monetary policy remains accommodative, fiscal stimulus from the new tax bill is still flowing through and the administration remains attentive to financial markets. Meanwhile, inflation continues to ease. We expect CPI to drift lower this year as key inflation components — wages, housing and energy — remain stable.

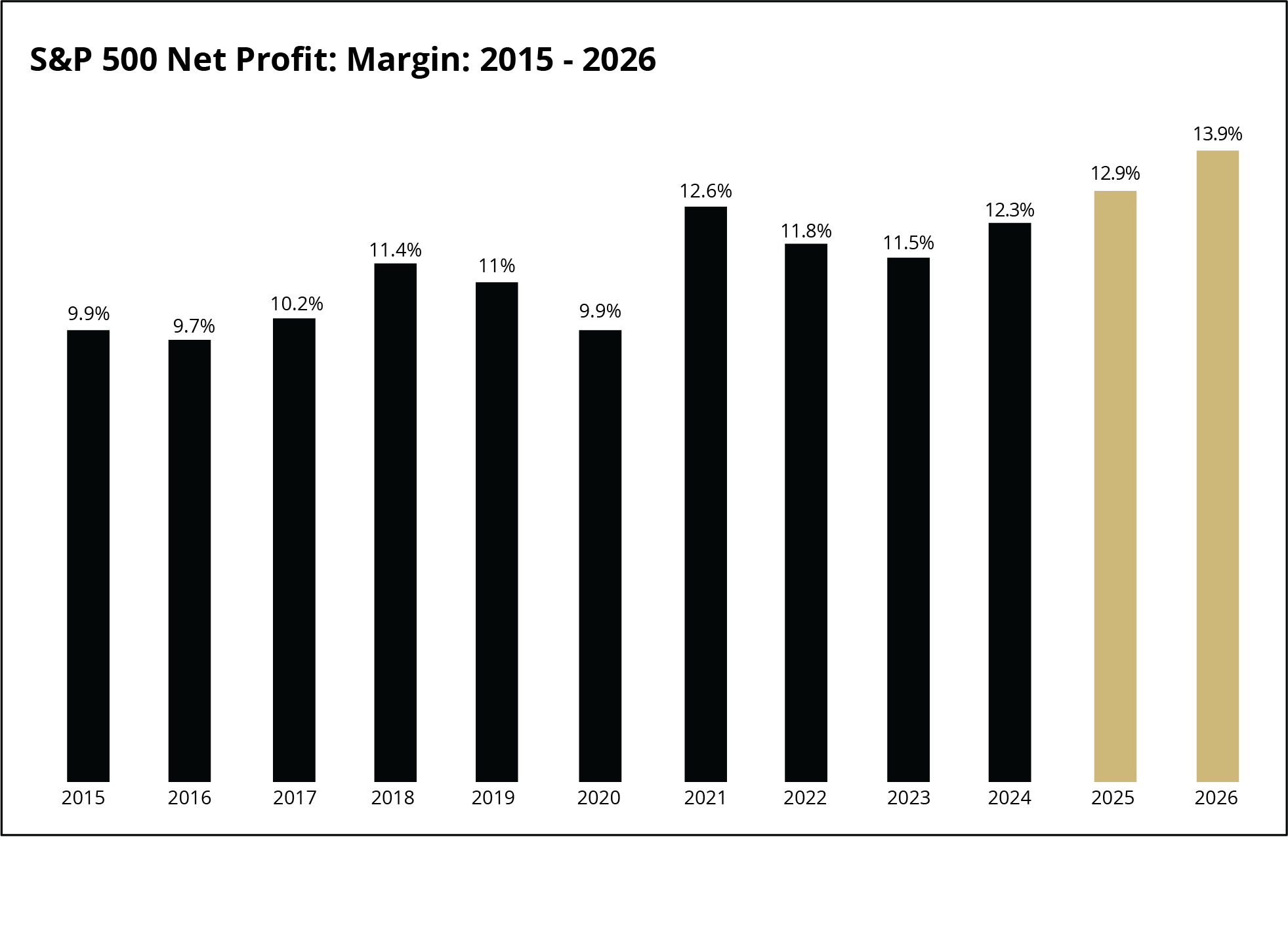

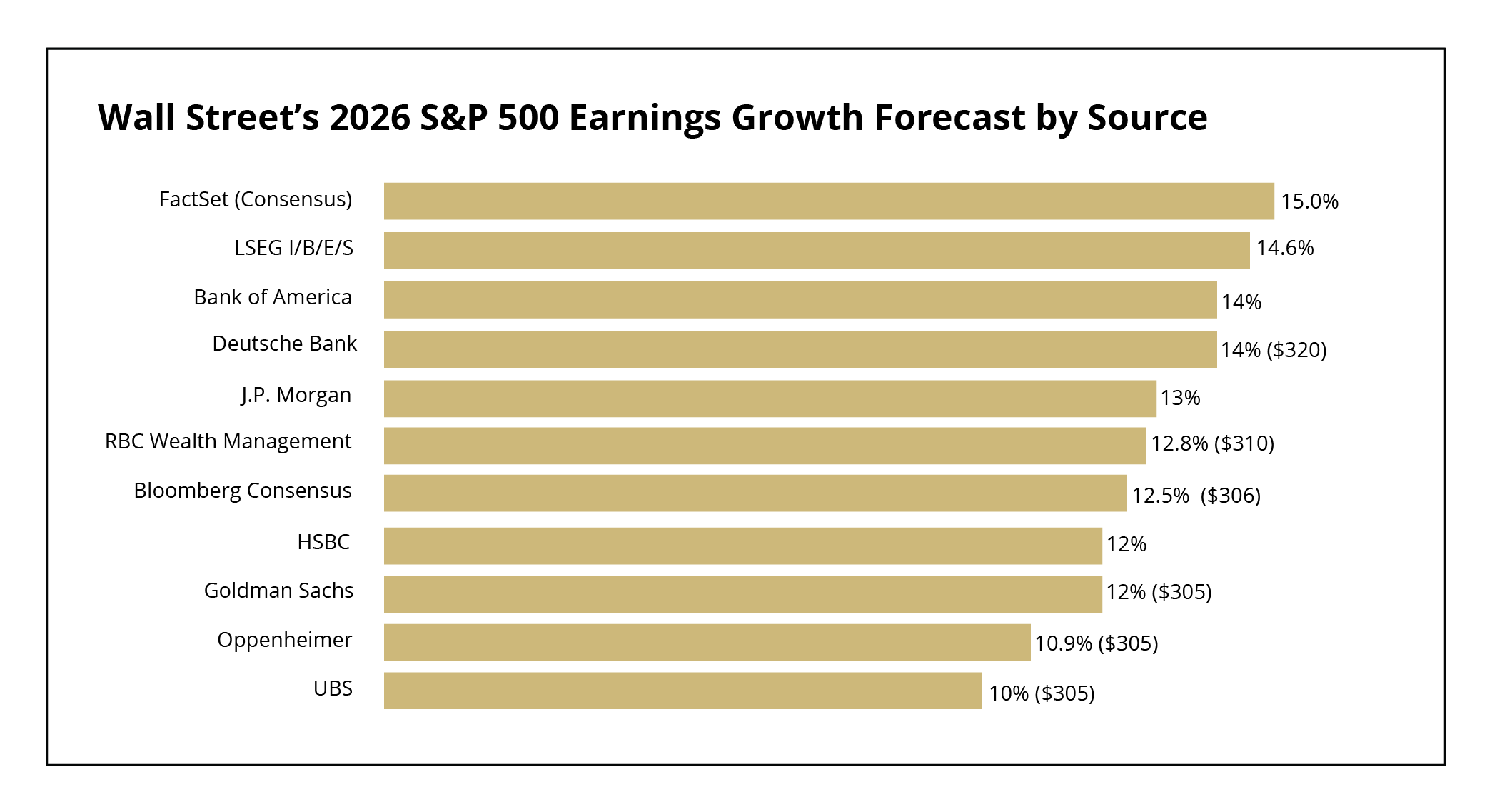

All these positive dynamics support a constructive outlook for equities. Corporate profit margins are expected to hit a record 13.9%, with consensus estimates calling for 15% earnings growth in 2026. And as we often emphasize, earnings ultimately drive market performance.

Source: FactSet

Currently, the average year-end forecast for the S&P 500 calls for a gain of around 10%. That’s near the top of the typical 8–10% range of Wall Street targets — and broadly in line with the index’s long-term average annual return since 1950. But the market rarely lands right on average.

Source: FactSet

Since 1950, the S&P 500 has finished between 8–10% only four times. Most years, it moves much more dramatically. In positive years, the average gain is about 17%, similar to last year's return. In down years, the average loss is around 13%. Over that same 76-year period, the index has posted gains in 57 of those years — a 75% success rate.

While the current backdrop looks favorable, complacency would be ill-advised. The labor market has softened modestly, and equity valuations remain above historical norms. Neither suggests an imminent downturn, but both warrant attention. Additionally, geopolitical events, policy shifts, or unexpected moves from the Federal Reserve could easily test investor confidence.

Even so, a recession doesn’t appear likely in 2026. With policy tailwinds, steady earnings growth and stable inflation, another year of positive market performance — potentially the fourth in a row — is not impossible: in fact, in our opinion, it is probable.

Takeaways for the Week

U.S. stocks started 2026 on a positive note, with the S&P 500, Nasdaq, and Dow all on track to finish the first full trading week of the year with gains of at least 1%, as investors responded favorably to the latest jobs data and monitored a pending Supreme Court ruling on tariffs.

The December jobs report showed a still‑soft labor market, with nonfarm payrolls rising by about 50,000 but unemployment edging down to 4.4%, reinforcing expectations that the Federal Reserve will move cautiously and keep additional rate cuts on hold for now.

Economic data continued to signal solid underlying momentum: the Atlanta Fed estimated fourth‑quarter GDP growth at roughly 5.4%, while separate reports pointed to robust third‑quarter productivity gains and easing labor costs, helping support the constructive macro backdrop.