This week, investors and capital markets received a dose of holiday cheer as major U.S. stock indices recorded back-to-back highs in the two days before Christmas market closures. Stronger-than-expected economic growth during the summer helped drive the momentum, offsetting fresh evidence that consumers are growing more uncertain about their economic futures.

The most significant economic news this week was the initial estimate of U.S. third-quarter gross domestic product (GDP), which measures the change in value of all economic production, including goods and services, across the country. Tuesday’s reading showed the U.S. economy grew at an annualized 4.3% rate from July through September, well above economists’ expectations and the previous quarter’s 3.8% growth rate. The cause, according to the Bureau of Economic Analysis (BEA), was an increase in consumer spending versus previous quarters. Spending on both goods and services increased: personal computers and information processing equipment saw the largest gains within the goods, while healthcare spending grew most substantially on the services side. While the BEA data collected was from July through September and did not overlap with the government shutdown, delays in data collection since that period mean that the next estimate and any revisions to it will be closely watched.

This growth data continues to offset the downward slide of consumer sentiment regarding the current attitude towards the economy. This week’s consumer confidence index (CCI) update showed another decline, a continuing trend that has persisted for much of the year. The index, which fell by nearly 4% in December, surveys households on their perceptions and expectations regarding current job availability, household income and nationwide business conditions. While consumers’ confidence levels should, in theory, influence their spending behavior, the two measures don’t always track one another closely. As our colleague Jade Thomason, MBA, highlighted earlier this month, variations of these statistics are currently showing meaningful disconnects as consumers continue to spend.

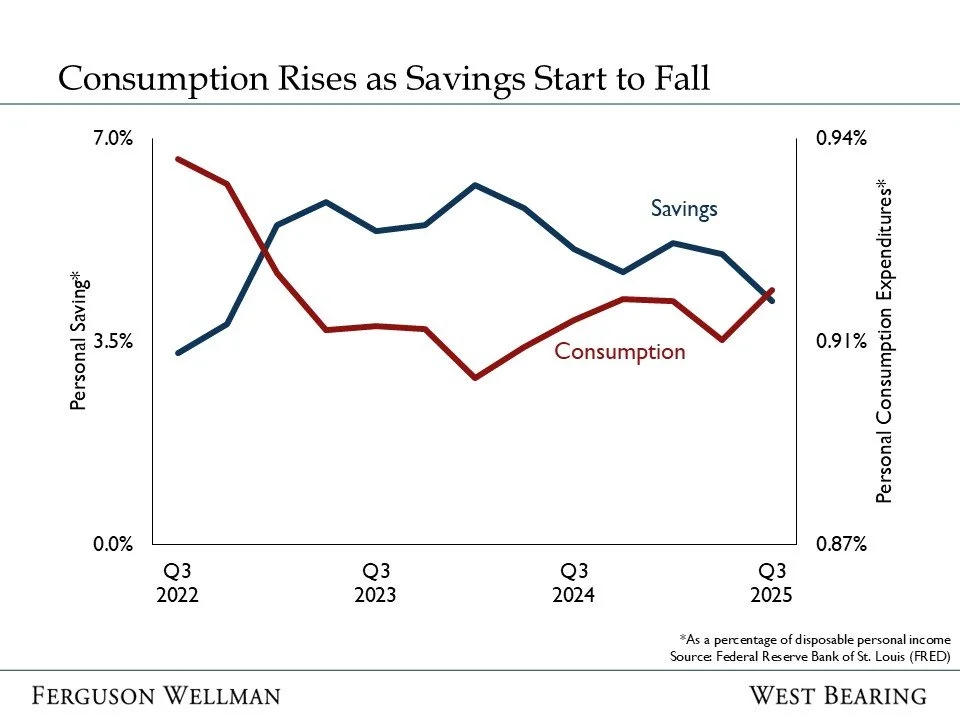

The consumer savings portion of the most recent GDP report offers a somewhat clearer example of why confidence may be continuing to decline. The data showed that the average consumer’s savings rate, measured as a percentage of disposable income, dropped to levels not seen since the third quarter of 2022.

When viewed concurrently with continued increases in consumer spending and stagnating inflation-adjusted growth in disposable income, this decline is more notable. While this single personal savings datapoint does not, in itself, represent a new trend, when coupled with sentiment data, it requires watching and stands as a reminder that consumers are feeling pressure to spend. Unfortunately, a decrease in savings rates will add to the pressure of an unsustainable pattern.

Strong economic growth and signs of consumer uncertainty highlight the push-and-pull influencing capital market behavior. All this data will only grow more important in the months ahead, both in isolation and alongside labor and inflation data. At present, investors and capital markets appear content to focus on what the data is showing: namely, economic growth, driven by sustained corporate and consumer spending, has so far been sufficient to offset declining consumer confidence and questions about the health of the job market.

Takeaways for the Week

The S&P 500 closed at record highs on Tuesday and Wednesday after 4.3% annualized U.S. GDP growth was reported for the third quarter of 2025

The December consumer confidence index (CCI) fell again by nearly 4%

New unemployment claims filed this week dropped slightly, while the number of people still out of work after filing for unemployment modestly increased