by Peter Jones, CFA

Executive Vice President

Research and Portfolio Management

On Wednesday, Congress failed to reach an agreement to fund the government, resulting in the first shutdown since 2018. While news headlines are filled with political drama, the financial markets have told a different story. This past week, even as government services paused, the S&P 500 shrugged off the news and marched to new all-time highs. For investors, this non-reaction can be confusing. Shouldn't a government shutdown be bad for the market?

History provides a clear and reassuring answer: not really.

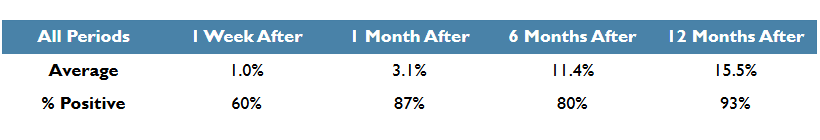

There have been 15 government shutdowns since 1981. The table below shows the average S&P 500 returns and frequency of positive returns in the week, month, half-year and year following a shutdown. Average returns are positive following shutdown for all periods and returns are positive 87% of the time in the first month following a shutdown.

Source: Bank of America

Investors cannot invest directly in a index.

Looking back at previous government shutdowns, a clear pattern emerges. These events, while disruptive for government workers and certain services, have historically been non-events for the broader economy and the stock market. Investors understand that shutdowns are temporary, that essential services continue and that the economic impact is typically minimal and quickly reversed once a funding deal is reached. Markets are forward-looking, and they have consistently priced in the high probability that political gridlock will eventually be resolved. Investors have rightly concluded that these episodes are more about political theater than a fundamental threat to corporate earnings or economic growth.

The Real Concern: Flying Blind

While the shutdown itself isn't likely to be a direct threat to the market, its timing creates a subtle problem in the form of an economic data blackout.

Just as we were seeing signs of potential cooling in the U.S. labor market, the agency that reports on it, the Bureau of Labor Statistics (BLS), has closed their doors. This means the crucial monthly jobs report, which includes data on payrolls, the unemployment rate and wage growth, will be delayed. This is highly unfortunate timing as the Federal Reserve hopes to monitor labor market data with a laser focus to determine when to cut interest rates.

As such, the state of the labor market has suddenly become opaque. Is the recent slippage in hiring a blip or the start of a trend? Without reliable and timely data, it is difficult to know. This makes the Fed's already challenging job even more so. Just as the Fed has begun to ease monetary policy by lowering rates, one of its most important gauges has gone offline.

For now, investors should remain focused on long-term fundamentals. The market is correct not to panic over the shutdown itself. However, we must watch closely how this data blackout affects the Federal Reserve's confidence and communication in the weeks ahead. The real story isn't the shutdown, but the smokescreen it has created.

Takeaways for the Week:

The government shut down and the market shrugged it off, ascending to new all-time highs

Historically, government shutdowns have not been market or economic events, with returns overwhelmingly positive in the periods during and following shutdowns

The timing of the current shutdown is unfortunate for the Fed given their hope of being data dependent when it comes to further interest rate cuts