by Krystal Daibes Higgins, CFA

Vice President

Equity Research and Portfolio Management

The idea of an AI bubble has been the topic du jour among mainstream investment news channel commentators. It’s no surprise: AI has been the primary driver of the stock market’s rise for the third consecutive year. Watching AI-related stock prices surge, some with eye-popping daily moves, can make it hard to avoid comparisons to past manias, particularly the dot-com era. But as our colleague Joe Herrle, CFA, CAIA, noted in a recent blog post, the fundamental differences between today’s AI-driven returns and past bubbles suggest we are unlikely to see a systemic crisis. While a slowdown in capital spending could cause significant volatility in stock prices, there is still ample free cash flow to support continued multi-year investments and sustained growth.

While we view the risk of an AI bubble as low, we believe the risk lies elsewhere in the longer-term disruptions AI will bring to traditional technology businesses. Mid-sized software firms, in particular, face the greatest risk of seeing their services commoditized or replaced entirely. Generative AI systems like OpenAI’s are becoming more capable and deeply integrated into enterprise workflows at a fraction of the cost. On the other side, tech behemoths such as Microsoft are pouring massive amounts of capital into embedding these capabilities directly into their software, allowing companies to simplify and reduce their technology stacks. In short, the once-resilient high-growth “disruptors” are now on the brink of being disrupted themselves.

These established technology firms, which have long thrived on stable, recurring revenue models such as subscription licenses, are being forced to rethink their long-term strategies. The rise of overlapping services between AI-native companies and software businesses’ core services such as data analytics, summarization, transcription, etc. could lead to a market share shift that results in slower revenue growth, pressured gross margins and ultimately lower valuations and stock prices for the latter group. According to a study by AlixPartners, the percentage of high-growth companies has declined from 59% to 27% in recent years. Over the same period, more companies are switching software providers than ever before.

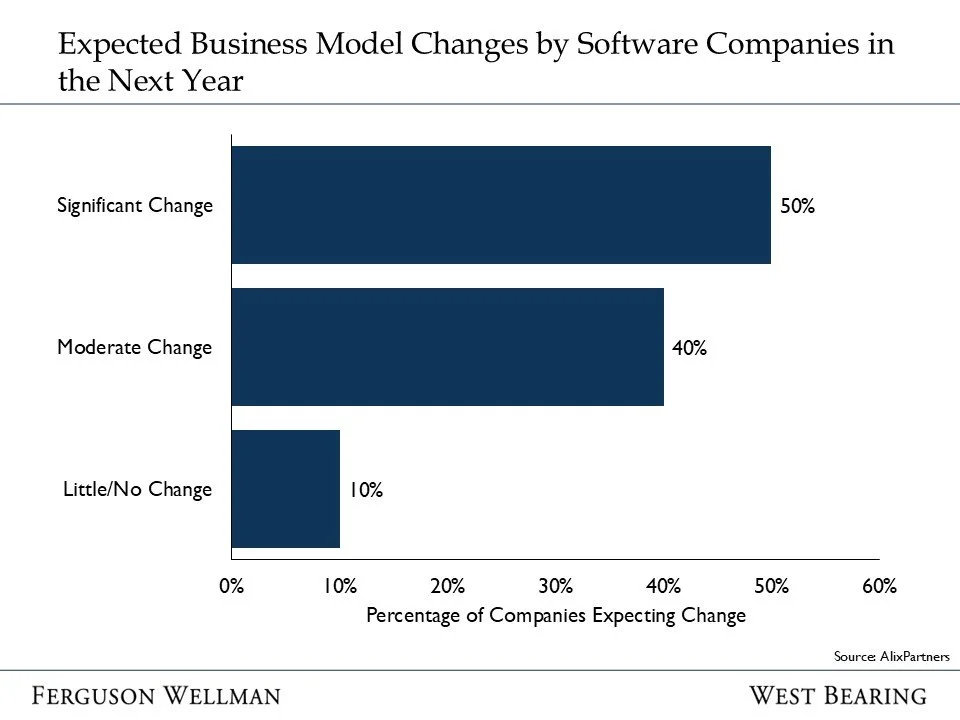

Some companies are moving quickly to adapt. For instance, Salesforce and ServiceNow are already adjusting their pricing structures by linking fees to outcomes rather than user counts, according to the same AlixPartners study. Meanwhile, half of mid-sized software- as-a-Service (SaaS) firms surveyed indicated they plan to make “significant changes” to their business models within the next year.

Source: AlixPartners

Earnings Strength Kicks Off

While we are still early in earnings season, with only about 150 companies reporting so far, results are much stronger than expected. The earnings-per-share (EPS) beat rate — or the percentage of companies that exceed their EPS forecasts — is the third highest at this point in the season since 2001. Even more impressive, the magnitude of revenue beating estimates has been even stronger—an encouraging sign given that revenues are typically harder to manage than costs. At the same time, management teams are boosting forward-looking guidance, and the magnitude of these increases are trending above average.

As markets continue to move higher and valuations remain near the upper end of historical ranges, strong earnings and revenue fundamentals are providing meaningful support. If this momentum carries through the remainder of the reporting season, it could further bolster investor confidence and help sustain the rally in the months ahead.

Takeaways for the Week

While an AI bubble appears unlikely, mid-sized software firms face major risks as AI capabilities from companies like OpenAI and Microsoft threaten to commoditize traditional services and force rapid business model changes

Early earnings results show robust revenue and profit growth, helping sustain high market valuations and investor optimism