by Joe Herrle, CFA

Vice President Alternative Asset Research

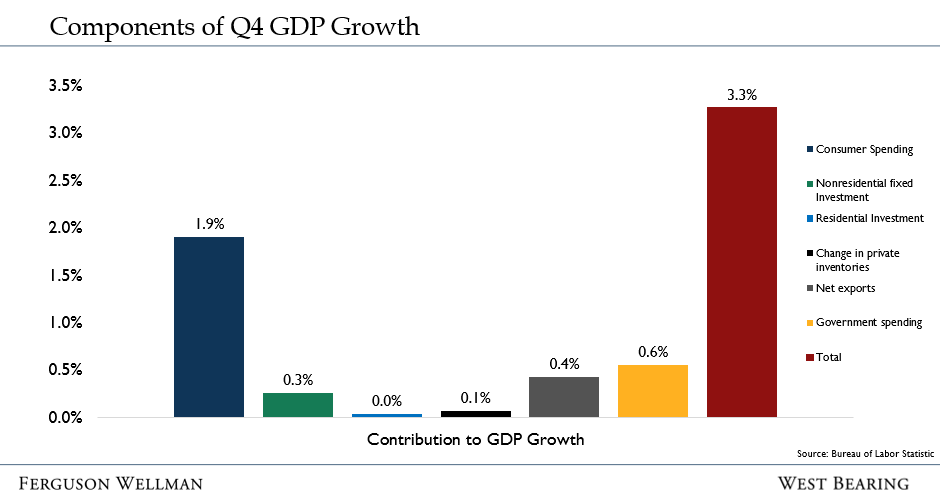

Remember "2023: The Year of the Hard Landing"? That was the dreary refrain echoing through late 2022, with recession fears dominating headlines and investment strategies. Fast forward to today, and the picture couldn't be more different. This week, the U.S. Bureau of Economic Analysis (BEA) dropped a bombshell: a robust 3.3% annualized growth rate for the fourth quarter of 2023, exceeding even the most optimistic forecasts. The once-anticipated hard landing of 2023 turned out to be no landing at all.

This wasn't just a one-quarter wonder. For the entire year, GDP expanded at a healthy 2.5%, far exceeding the initial forecasts of near-stagnation. To understand the bigger picture, it’s important to acknowledge the context. 2023 began with significant headwinds: aggressive Federal Reserve rate hikes, surging inflation and the ongoing war in Ukraine. These factors fueled widespread fears of a material economic downturn. Yet, the U.S. economy has shown impressive adaptability.

What fueled this unexpected buoyancy? A powerful cocktail of factors, including:

Robust consumer spending. Americans kept their wallets open, defying inflation woes and economic anxieties. Consumer confidence, while volatile, held up better than anticipated.

Government spending boost. Fiscal stimulus, particularly infrastructure projects, provided a much-needed shot in the arm for economic activity.

Net exports on the rise. Surging global demand for U.S. goods and services added another layer of growth muscle.

Productivity gains. Despite labor shortages, American ingenuity and technological advancements saw worker output per hour tick upwards.

And it's not just growth that's defying expectations. The long-dreaded inflation monster seems to be tamed. Today's release of the core Personal Consumption Expenditures (PCE) index – the Fed's preferred inflation gauge – came in well below expectation at a tepid 2.9% in December. Annualized core PCE over the last three and six months is now below the Fed's 2% target. This marks a significant decline from the 5.7% peak seen in early 2023, signaling a potential cooling of the price pressures that have haunted us for the past two years.

Deciding which economic feat to marvel at is the real puzzle: surging GDP despite the Fed's most hawkish tightening in decades or core inflation scaling back under 3% by year-end? This combination paints a "Goldilocks" scenario – reasonable growth with tamed inflation. With the inflation dragon seemingly slayed, the Fed looks to be steering the economy toward a soft landing. Chairman Powell and his team might soon usher in an era of lower rates and loosened quantitative tightening, just as markets anticipate five rate cuts priced in for 2024. Upcoming Fed meetings will be must-watch events, where every syllable and policy tweak will carry weight for portfolios.

Remember, as investment professionals, we navigate uncertainty with research, diversification, and a long-term perspective. The unexpected GDP bounce may have reshuffled the deck, but it hasn't changed the fundamental rules of the game. We remain cautiously optimistic about the prospects for 2024, but prepared to adapt to whichever hand the market deals us.

Takeaways for the Week:

U.S. GDP growth in Q4 2023 exceeded expectations of 2.0%, coming in at 3.3%.

Full-year 2023 GDP growth reached 2.5%, defying recession fears.

Core PCE inflation declined to 2.9%, offering hope for further easing from the Fed.