by Blaine Dickason

Senior VIce President

Trading and Fixed Income Portfolio Management

June Jobs Report

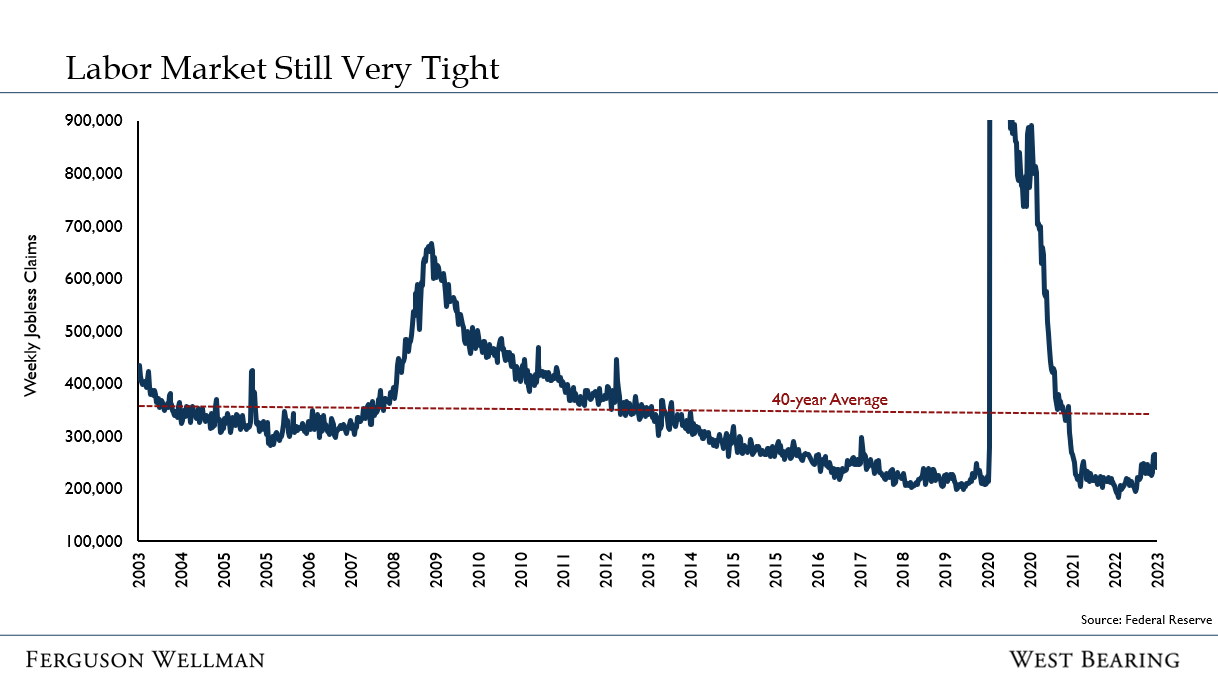

The lead story from the stock market this year may well be the outperformance of a narrow and select group of technology companies, however the leading economic story this year may be the surprising resilience of the U.S. economy in the face of the Federal Reserve’s concerted effort to rein in growth via higher interest rates. Today’s report of 209,000 jobs added in June was slightly below forecast yet still represents a healthy clip historically. Today’s report represents some moderation of activity relative to earlier monthly jobs reports that averaged over 300,000 new jobs through the first five months of this year. Despite this downshift to the pace of net job additions, the unemployment rate dropped to 3.6% from 3.7% in May and average hourly earnings growth in June remained over 4 percent versus last year. Coupled with the still low readings of weekly initial jobless claims as shown in the chart below, today’s jobs report confirms that significant tightness still exists in the labor market and likely remains an important contributor to ‘sticky’ readings of core inflation.

Next Week’s CPI Report:

On Tuesday July 11, the Bureau of Labor Statistics will release the June Consumer Price Index (CPI) report. Current estimates are calling for a +3.1% increase versus last year. If this estimate proves accurate, it would be the lowest reading since March 2021, as well as the 12th consecutive month of year-over-year declines since peaking at +9.1% in June 2022. On the surface, this clearly demonstrates continued progress towards the Fed’s ultimate 2% inflation target, however markets will be watching for specific readings from the services and housing components for any new evidence that the stubborn inflationary pressures in those two sectors have begun to subside.

What does This Mean for Markets and Fed Policy?

The Federal Reserve’s next meeting will conclude on July 26 and will likely include an additional quarter-point hike to their policy rate. In one of his last public comments before Congress, Fed Chair Jay Powell indicated he felt the Federal Reserve had ‘overachieved’ on their full employment mandate while still committing there was additional work to be done to achieve their 2% inflation and price stability mandate. This is the tension that will be driving near-term monetary policy as the Fed judges when it is finally appropriate to stop raising rates. This also indicated he would view the tradeoff of job losses versus a lowering of inflation as acceptable, potentially putting the economy on track for higher rates for longer.

Economic data reports over the last quarter have largely been better than expected, dramatically lowering the risk of recession this year. The start of second quarter earnings season in the coming weeks will provide more information on how the corporate sector has responded to current financial conditions. At present, the Federal Reserve remains on track for their hoped-for soft landing.

Takeaways for the Week:

Apple Inc.’s market capitalization topped $3 trillion last week, exceeding the entire market capitalization of the Russell 2000 Small Cap Index ($2.72 trillion)

Meta Platforms’ (Facebook) new social media app Threads launched as a competitor to Twitter and has garnered 70 million users in just two days according to CEO Mark Zuckerberg