by Jason Norris, CFA

Principal Equity Research and Portfolio Management

It’s All About Rates

The 10-year U.S. Treasury touched 5% earlier this week, the first time since 2007. By the end of the week, yields had settled at 4.9%, representing a significant increase from the rates of 3.7% on January 1. In the world of “bond math,” bond values fall when rates rise. Therefore, bond returns, as measured by the Bloomberg Aggregate Index, are down over 3% this year. If rates stay stable at current levels for the rest of the year, this will be the first time (data post-1925) that bonds have had three consecutive years of negative returns.

The move in Treasuries has resulted in the 30-year mortgage rate reaching 8%, up from under 3% two years ago. This increase raised consumers’ monthly mortgage payments on the average home from roughly $2,100 to $3,600. This tightening continues to work its way through the economy, and we believe we have yet to see the full impact of higher rates.

One anomaly with mortgage rates is the spread above Treasuries. Historically, 30-year mortgages usually yield 1.5-2.0% above the 10-year Treasury yield, which has only been at these levels after the Financial Crisis. These spreads usually increase when rates and credit conditions are volatile. Therefore, as we get more clarity on the impact higher rates have on the economy, this spread should move lower.

Source: Federal Reserve

“Proceed Carefully”

Fed Chair Jay Powell presented at the Economic Club of New York this week, and we believe his message was that the Fed will continue to be on pause and assess how higher rates will impact the economy as we move into 2024. The Fed Governors continue to stress data dependence. While economic data continues to hold up well, specifically in the jobs market, there have been anecdotes of weakness recently, which will be monitored. While equities didn’t move favorably with Powell’s commentary, the Fed Funds futures market reduced the probability of a hike this year from 40% to 20%.

Long Live the Consumer

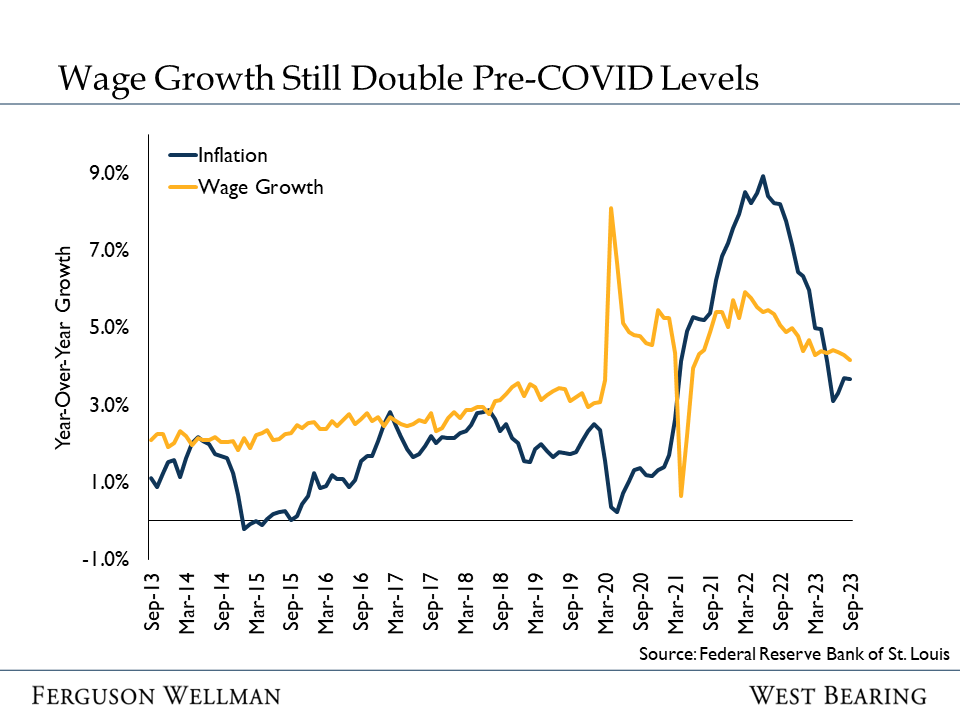

Retail sales data was released earlier this week and increased by 0.7%, above the estimated 0.3%. Even in the face of higher rates, consumers continue to spend. The main driver of the resilience of the U.S. economy, specifically consumption, has been the labor market. The economy remains at full employment, and wages continue to increase. The chart below highlights the increase in average hourly earnings, which is now at the high end of its post-Global Financial Crisis levels and above the inflation rate.

Source: Federal Reserve Bank of St. Louis

Therefore, when the U.S. consumer is employed and making more money, they will spend it.

Takeaways for the Week

Corporations continued to release earnings this week, as we’ve seen close to 20% of the S&P 500 report; so far earnings have come in 7% above estimates and earnings per share (EPS) growth for the third quarter is expected to exceed 9%

Higher interest rates continue to be a headwind for equities, with the S&P 500 falling close to 2% this week, led lower by semiconductor stocks as the U.S. tightened its export controls on chips shipped to China