by Jason Norris, CFA Executive Vice President of Research

When we met with clients in January of this year we highlighted our thesis that while 2015’s equity returns were anemic and there were concerns at the outset of 2016, we maintained that the equity bull market was not over. This assumption was based on the premise of a continued healthy U.S. economy as well as the easing of the strong U.S. dollar and low oil prices.

As we have moved through 2016, these pressures have abated and corporate earnings have come in at … just ok. Now that these fears have been alleviated, the market has continued to appreciate. One could argue that this is a much unloved market, or maybe even the “Rodney Dangerfield” of markets. While there may be skeptics, stocks continue to grind higher. The chart below highlights how we are in the midst of the second longest equity bull market in history.

Source: Bloomberg

Over this seven-plus year period, the S&P 500 is up over 250 percent. Since the bottom, retail investors sold over $670 billion worth of U.S. equity mutual funds. While this may have been offset by ETF flows, investors have not yet been willing to increase allocations to equities. The old adage of return of capital rather return on capital continues to ring true.

With four months in the books and stocks up a few percentage points, we still believe markets will grind higher as corporate profits improve throughout 2016. We reiterate our thesis that the bull market is not over.

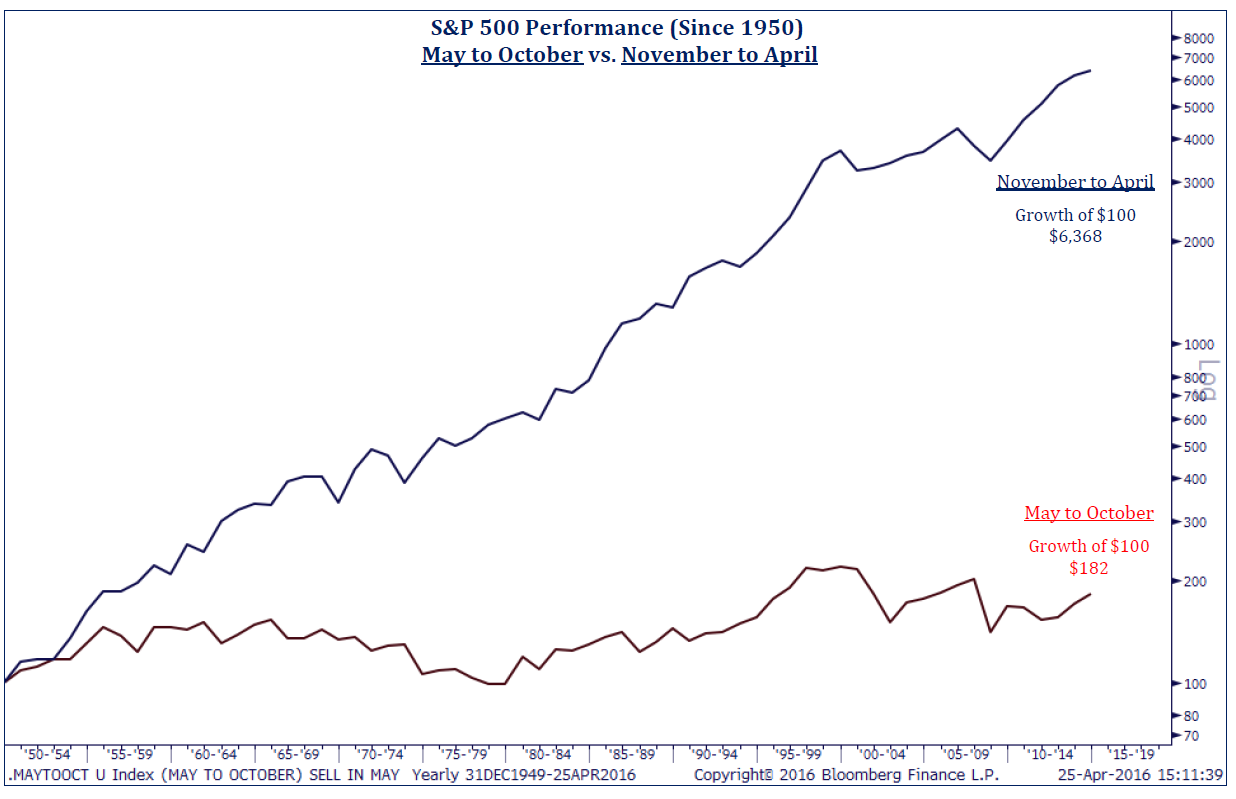

That said, it doesn’t mean that volatility will be reduced this year, or that we will have a smooth ride going higher. The market is actually moving into the “bad” part of the calendar, according to superstition. The chart below highlights this occurrence. The “sell in May and go away” Wall Street adage has some meaning to it. While historically the winter months return more than in the summer, returns are still positive. We do not advocate selling now, or investing based on the calendar, although there may be something to the summer doldrums.

Source: Strategas

Our Takeaways for the Week

- While this bull market is long in the tooth, we do not think it will die of old age

- Corporate earnings should continue to improve throughout 2016, supporting equities