by Jason Norris, CFA

Principal, Equity Research and Portfolio Management

As we wrap up 2023, we always like to look back on the year in the markets and put the last 12 months in perspective. In December 2022, the S&P 500 had just finished an 8% rally from the October lows. With stocks still down close to 20% for the year, the outlook for 2023 looked bleak as forecasts by economists were overwhelmingly skewed toward recession.

At Ferguson Wellman, we were in the minority with the belief that the U.S. consumer was much more resilient than feared, primarily because they were employed and making more money than they ever had. That said, we weren’t blind to the potential for higher interest rates and its impact on spending. Therefore, while we remained overweight equities, we were positioned defensively, i.e., overweight Healthcare and Consumer Staples stocks. While this allocation, in hindsight, was too conservative, the important factor was that we stayed invested.

Source: Bloomberg

Time

A few weeks ago, a client sent me an article entitled “Why Market Timing Doesn’t Work...” The article emphasizes the point that attempting to “time” the stock market usually doesn’t work. Investors get caught up in emotion and can often sell at the wrong time. The last two years have reiterated that point. The chart below highlights the returns of three large-cap equity asset classes: the S&P 500, large-cap growth stocks (primarily Technology-focused), and dividend-paying stocks*. In 2023, large-cap growth, driven by the Magnificent Seven, led the markets higher, rallying over 40%, resulting in pulling the S&P 500 up over 25%, leaving dividend-paying stocks* at the bottom, up just over 3%.

Source: Morningstar

When taking 2022 into account, all three equity classes ended the two years up low single digits. This year’s strong returns in Technology stocks were just enough to dig out of the hole of 2022. While dividend-paying stocks were lackluster this year, their performance in 2022 kept a lot of investors’ minds (and investing accounts) level.

When investing in equities, time horizon and risk tolerance are key to an appropriate asset allocation and the types of equities. We have many clients whose time horizon may be long but who don’t have the “stomach” for the volatility of parts of the equity market. Therefore, allocation to dividend-paying stocks may be warranted to “smooth” the ride. What’s important to remember is trying to time “buys and sales” is generally a fool’s game when market volatility increases. Your equity allocation should be appropriate for your time horizon and risk tolerance; thus, remaining invested is optimal.

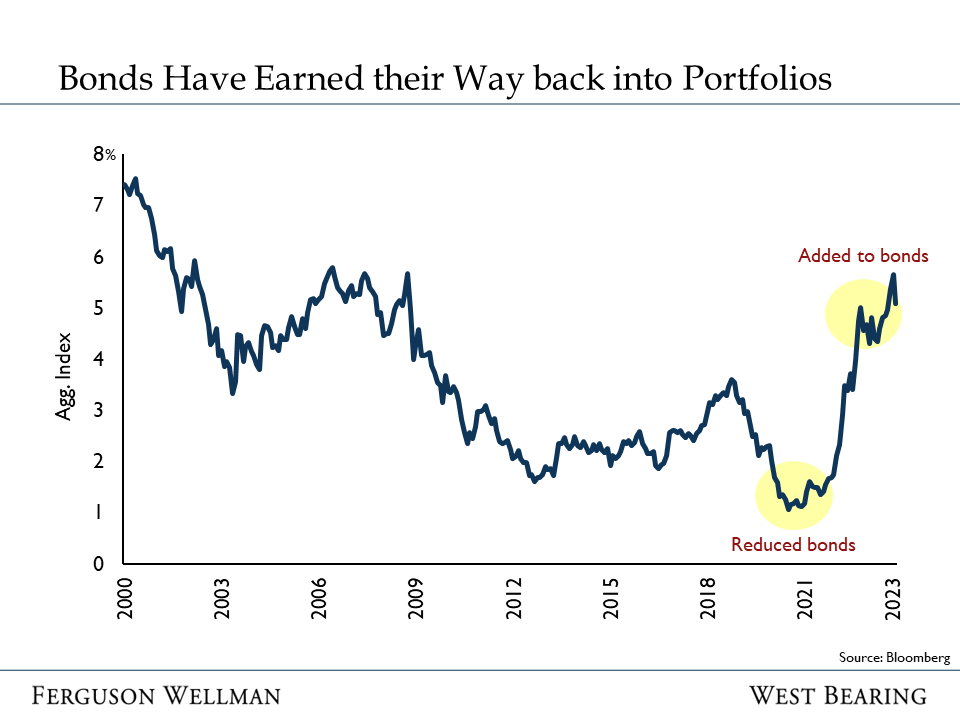

Turn The Page

The consistent attribute of the equity market is the “batting average.” Since 1926, the S&P 500 has been positive in any given year 75% of the time. Thus, staying in the market is key if your time horizon is long. A common question we’ve received the last couple of weeks is, after such a strong market in 2023, should we expect some weakness in 2024? Since 1926, the S&P 500 has delivered annual returns of 25% 19 times; the following year, 73% of the time, stocks are up with an average return of 10%. Taking advantage of opportunities with tactical shifts in asset allocation can add value, as shown by our reduction in bonds in 2020 and then increasing our allocation to bonds in late 2022 and 2023. However, maintaining a core allocation to equities has historically been the most important factor in wealth creation.

Source: Bloomberg

*iShares Select Dividend ETF (DVY), SPDR S&P Dividend ETF (SDY) and Schwab US Dividend Equity ETF (SCHD)

Takeaways for the Week

Stocks continued their Santa Claus rally finishing the week slightly positive and resulting in a 25% plus gain for the S&P 500 for 2023

After a volatile year for interest rates, the 10-Year Treasury finished 2023 where it started: around 3.9%