Scott Christianson, CFP®, discusses the SECURE Act and other changes that retirees and those planning for retirement should know.

The Song Remains the Same

Recent uncertainty due to the COVID Delta variant as well as concerns over the Federal Reserve tapering has resulted in a “risk off” market.

Backdoor and Mega Backdoor Roth Strategies

If you are looking for ways to increase your tax-advantaged retirement savings, it may be worth exploring the concepts of the backdoor Roth, and the newly popular mega-backdoor Roth. If the circumstances fit and the rules are followed, both strategies allow individuals to save money for retirement without ever paying income taxes on the funds again. Yes, you read that right.

Synchronicity

With global governments and central banks providing liquidity at an unprecedented pace, you would expect global growth to be growing synchronously. But, as has been the case from the beginning of the pandemic, the virus and the multitude of government responses to combat the virus have varied from country to country.

Housing Bubble 2.0?

The residential housing market can be characterized as frenzied in many parts of the country, which begs the question — is it in a bubble?

Are We There Yet?

“Are we there yet?” is a familiar back seat refrain that often occurs during long, summertime road trips involving bored children and their beleaguered parents. As we transition through our second COVID-affected summer, this frustration is also felt by investors and other market participants who long for some return to “normal.” Surely, we must all be there by now, right?

Tax Strategies to Help Navigate the American Families Plan Proposal

Tax policy is being proposed and revised at a furious pace in Washington. Not knowing if, when and in what form the proposals might turn into law, it may be tempting to ignore the process and wait for the final outcome.

Breakthrough Earnings

A week that began with the sharpest pullback in equities since last fall concluded in remarkable fashion, as investor concerns about the economic repercussions of rising COVID-19 infections gave way to an increasingly constructive second quarter earnings season.

Third Quarter 2021 Investment Strategy Webinar

On July 22, our firm hosted an Investment Strategy Update webinar presented by Charissa Anderson, CFP®, CDFA®, Ralph Cole, CFA, and Jason Norris, CFA.

A recording of the presentation can be viewed below and the slides can be found by clicking the button below.

A Quick Look Under the Hood

The S&P 500 is up over 15% this year and up almost 35% over the last 12 months. This week, the Dow Jones Industrial Average eclipsed 35,000 — another “round number milestone.”

Third Quarter 2021 Wealth Management Insights Video

Josh Frankel, CFP®, discusses five questions to talk to your insurance agent about that will help you protect your assets.

A Reality Check on College Costs

In the past 30 years, the cost of your cup of coffee doubled. Medical care costs rose 435%. And college costs? According to a study by J. P. Morgan Asset Management, tuition increased … 822%.

What’s the Deal with Interest Rates?

As investors, it’s important to have a view of the world and what you think the economy is going to do in the coming months and years. This informs all investment decisions from which stocks to purchase to which asset classes to over-or-underweight.

Third Quarter 2021 Wealth Management Insights Publication

Wealth Management Insights Third Quarter 2021: Protecting Your Assets and the Evolving Retirement Rulebook

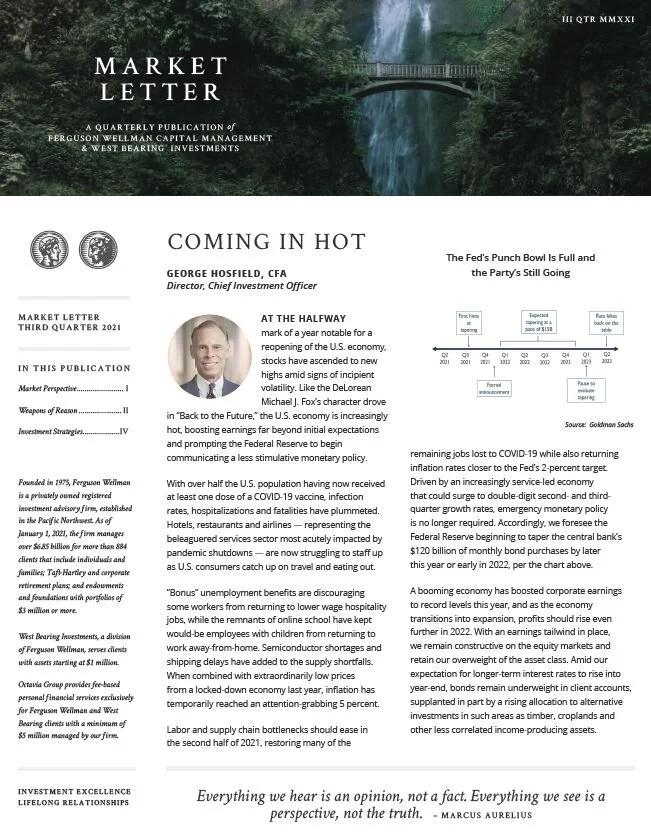

Third Quarter 2021 Market Letter: Coming in Hot

Third Quarter 2021 Investment Strategy Video: Coming in Hot

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Sign of the Times

Earlier this week, my family and I were out to dinner when we saw a sign on the front door of the restaurant that read: “Being short staffed is the new pandemic… Thank you for your patience with us.” While we are familiar with the standard “help wanted” signs, specifically in the service sectors industry, you may have noticed a recent addition to these signs: signing bonuses.

New Payroll Tax for Washington Residents

Washington State has created the nation’s first public state-operated insurance program for long-term care insurance funded by a new payroll tax of 0.58% paid by employees (not employers) starting January 1, 2022.

Summertime Blues

The Dog Days of Summer are here! In addition to the record heat waves expected to bombard the West Coast this weekend, we also await what typically occurs around this same time: equity market volatility and below average returns.

Exit Strategy

A year ago, Federal Reserve Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” At this week’s Federal Open Market Committee (FOMC) meeting the Fed took its first tangible steps to lay the groundwork for a gradual removal of the stimulus measures enacted last year.