Negative interest rates have been in the news this year and have been the source of questions from clients. Negative Interest rates are an extraordinarily unusual phenomenon where an investor pays for the “privilege” of loaning a country money.

Investors Should Be Thankful

As we close out another Thanksgiving week, investors have a lot to be thankful for this year. At this time last year, the Fed was still raising interest rates, global economies were slowing and the S&P 500 was on its way to a negative 13.5 percent return for the fourth quarter.

Mickey Mouse

In April, Disney held an investor event outlining the strategy for their direct-to-consumer streaming service, Disney+. The service not only includes classic Disney films, but also the full library of Star Wars, Marvel and National Geographic. Disney indicated that the service would be priced at $6.99 per month, and projected global subscribers in a range of 60-to-90 million by 2024.

Hope is Not Lost, It is Found

While many eyes were on the impeachment proceedings this past week, we saw encouraging retail sales data and the prospect of a completed trade deal with China push equity markets to another all-time high this week. Even as these new highs are met, many investors have a bad feeling about the market.

'Tis the Season for Year-End Financial Planning

Time seems to move faster as we approach the holiday season. Beyond the festivities, there are a number of year-end considerations that could potentially optimize your 2019 tax liability.

Glass Half Full

With some 90 percent of the S&P 500 having now reported third quarter earnings, investors have responded favorably to a plurality of companies delivering better than expected numbers.

Data Deluge

Equities continued to rise steadily for the fourth consecutive week, reaching fresh all-time highs, as market participants digested several meaningful economic and policy data points.

Allowance Can Be the Best Treat for Kids

This is a great time of year to remind children of the long-term benefits of cash over candy. Beyond Halloween, teaching kids sound money-management skills will serve them well throughout their lives. A good place to start is with an allowance.

Show Me the Money

While the U.S. consumer remains resilient, CEO confidence has been deteriorating as economic uncertainty has been increasing.

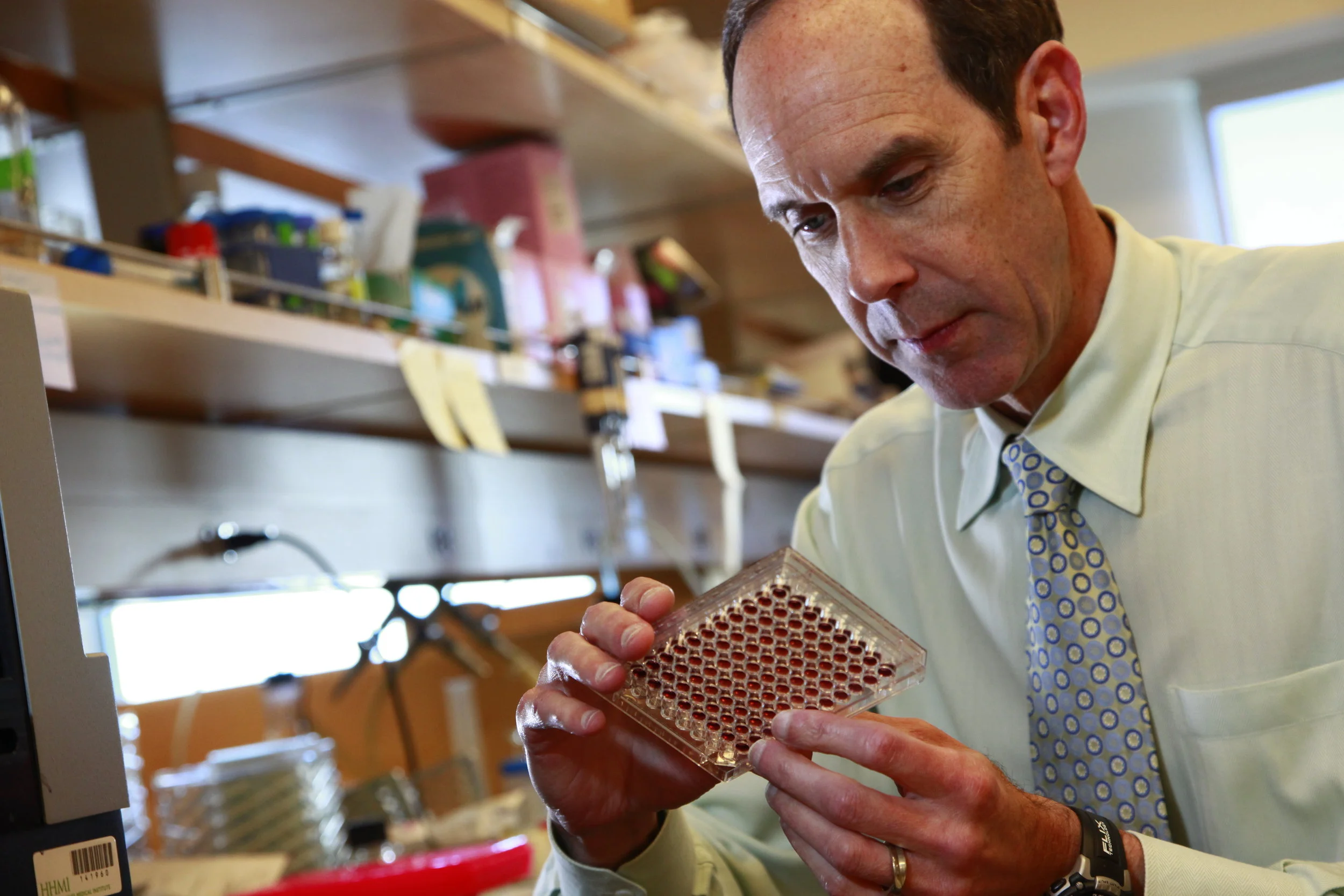

Gratitude for Dr. Brian Druker

The Ivy League … Grades Have Been Posted

The books are now closed on the 2019 fiscal year for the Ivy League endowments and for the fifth time in the last 16 years, the missed the mark.

Making a Change in Medicare

A good practice for anyone covered by Medicare is to assess if your coverage is compatible with your needs. Contrary to conventional wisdom, choosing health insurance may not be a one-time decision for most Medicare enrollees. Plans change … and of course needs may change over time too.

To Q.E. or Not to Q.E.

Federal Reserve Chair Jerome Powell announced this week that the central bank will once again be purchasing U.S. Treasury securities, reversing the recent trend of allowing its balance sheet to shrink. Immediately, many market participants experienced déjà vu, recalling the first time this monetary policy tool was implemented in 2008.

Investment Strategy Video Fourth Quarter 2019: Holding Pattern

Fourth Quarter Market Letter 2019: Holding Pattern

A Cycle Within a Cycle

The U.S. economy has been expanding for over 10 years, the longest economic expansion in U.S. history. When looking back, the bull run in stocks and the economic expansion may seem “easy” but there have been multiple periods of angst as we flirted with slow growth.

Norris Interviewed on Public Radio

Jason Norris, CFA, visits his home state to talk about Idaho’s economy, tariffs and ESG investing with Boise Public Radio.

Whistleblower Markets

With the impeachment inquiry being announced this week, clients have been asking, “What does this mean for my investments?” The short answer: markets trade on economic fundamentals, not political headlines.

Healthy Consumer, Healthy Economy

This week, the Federal Reserve made big news when it reduced the federal funds rate by 0.25 percent, its second cut this year. While any Fed action always dominates the headlines, the interest rate reduction was expected and fully priced into the market. Having raised federal funds a quarter point just last December, it has been a rather dramatic change of monetary policy in which the Fed has now cut rates twice this year.

Does Refinancing Your Mortgage Make Sense?

With interest rates dropping, you may be considering refinancing a mortgage. There are a number of factors to consider and here are some questions we pose to clients to help with the process.