by Blaine Dickason

Vice President, Fixed Income Trading

Federal Reserve Chair Jerome Powell announced this week that the central bank will once again be purchasing U.S. Treasury securities, reversing the recent trend of allowing its balance sheet to shrink. Immediately, many market participants experienced déjà vu, recalling the first time this monetary policy tool was implemented in 2008. Chair Powell, however, was very careful to distinguish this new plan from the large-scale asset purchases and quantitative easing era of the past decade.

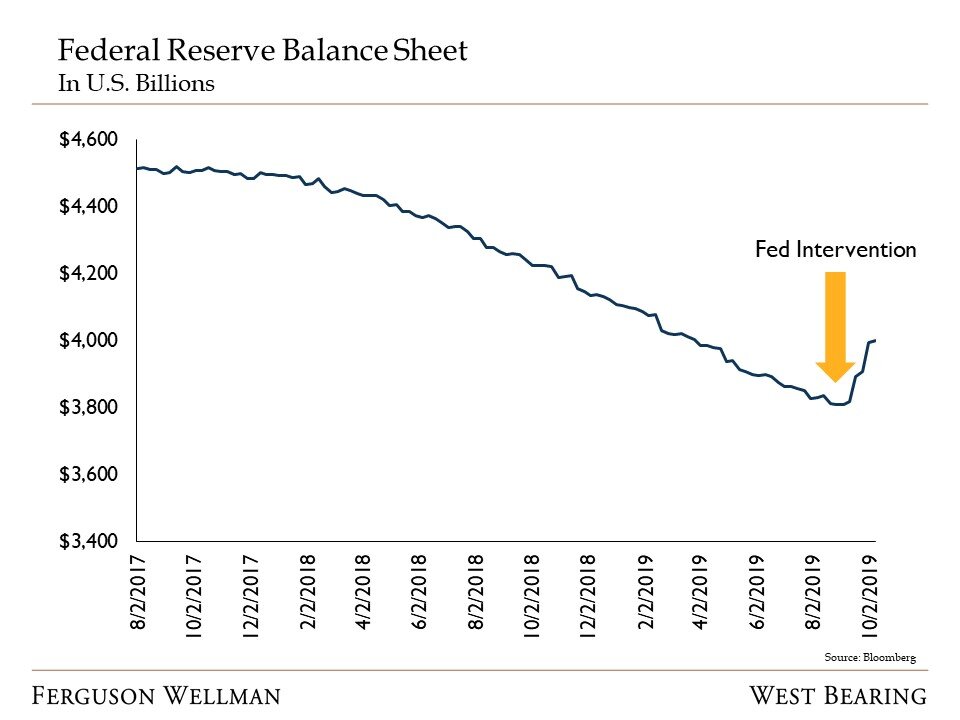

Quantitative easing, or Q.E., was a monetary policy strategy enacted by the Federal Reserve during the 2008 Financial Crisis. This policy entailed the purchase of trillions of dollars of primarily U.S. Treasury and mortgage-backed securities, with the goal of both stabilizing the financial markets and lowering interest rates to stimulate the economy. These purchased securities were then held on the Federal Reserve’s balance sheet, which ultimately grew to over $4.5 trillion from less than $1 trillion in early 2008.

Beginning in late 2017, and consistent with their ongoing interest rate hikes, the Federal Reserve began to reduce the monetary stimulus provided by their balance sheet and allowed some of those fixed income securities to mature without being reinvested. Through August of this year, over $700 billion of securities had matured off the Fed’s balance sheet and some estimates at the beginning of this year were for it to ultimately retrace to half its peak.

Short-term funding pressures experienced by banks and other financial institutions near the end of September were the first warning signs that perhaps the amount of reserves held on the balance sheet had been allowed to shrink too much. Overnight market-based lending rates spiked, and the Fed reacted by stepping in with temporary measures to inject liquidity back into the system.

These new Treasury bill purchases by the Federal Reserve will begin in mid-October at a rate of $60 billion per month and are scheduled to continue at least through mid-2020. Treasury bills are issued with less than one year to maturity and this focus on shorter maturities will aid the Fed’s goal of stabilizing the critical overnight funding rates that govern so much of the financial ‘plumbing’ in our banking system.

While this new plan to expand the Federal Reserve’s balance sheet can be differentiated from prior versions of quantitative easing, it still represents an active approach to monetary policy. Our central bank clearly remains committed to acting appropriately to sustain the current expansion.

Week in Review and Our Takeaways

Lucky 13? Optimism surrounded Round 13 of the U.S.-China trade talks that commenced yesterday

The S&P 500 index finished up +0.91 percent for the week. Third quarter earnings reports will begin next week

Greece sold almost 500 million euros of 13-week Treasury bills at a -0.02 percent yield this week, joining Europe’s negative-yield debt club