by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

In Europe there are now more than $4 trillion in bonds that have a negative yield, a number which is about 15 percent of the global bond market. The countries of Germany, Switzerland, Sweden, Finland and the Netherlands are all unfortunate members of this club for at least part of their respective yield curves. What this means is investors are paying a government such as Germany for the privilege of loaning them money. This is contrary to the concept of compound interest or the time value of money. In the investment profession we do not use the word "guarantee" as it can cause trouble with our chief compliance officer or possibly the SEC. However, with negative yielding bonds you are all but guaranteed to lose money except in the circumstance where the yield on the bond goes more negative. In this instance you can then sell the bond for more than you paid for it earning a small profit. This is a flimsy investment thesis at best.

Bond yields in Europe are negative for fear of falling inflation and the fact that the European Central Bank is purchasing large quantities of sovereign debt in an effort to hopefully stimulate the economy. All of this begs the question: who is buying these bonds with negative interest rates and why? Some bond managers are forced to buy negative yielding bonds due to flows of funds into the mutual funds they manage. For example, if the bond manager is managing an index fund that replicates the debt markets of countries experiencing negative yields and receives cash deposited in the fund, the manager is forced to invest in bonds in markets that are outlined in the prospectus of the fund. In addition, many investors are restricted to investing in very narrow slices of the bond market. Owning sovereign debt is important to banks due to regulatory capital requirements. This means that banks need to own high quality assets as part of their capital in order to makes loans to customers. For instance, it’s likely that a bank in Germany will need to own negative yielding German government bonds as capital.

The long-term implications of negative yields are unknown. This phenomenon has been exceedingly rare in history and has never been this widespread. We have received questions from clients as to the chances of this happening in the United States. Short-term treasury bills did go negative for a time during the financial crisis in 2008; however, we do not believe that we will see negative interest rates in the United States anytime soon. While it is possible, the U.S. has inflation of 1.6 percent, as measured by the Consumer Price Index last month, and the U.S. also has GDP growth of 2.2 percent. These facts would suggest higher interest rates as opposed to negative interest rates.

Our Takeaways for the Week:

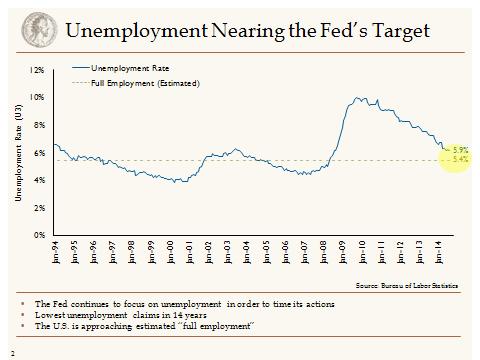

- Risks of negative interest rates in the United States are low. Our economy is growing as evidenced by consumer spending in the United States. Household consumption grew by 4.2 percent year-over-year in the fourth quarter of 2014. Consumer spending, which comprises 70 percent of the economy, has been robust due to a strong labor market and falling gas prices