by Peter Jones, CFA

Executive Vice President

Research and Portfolio Management

Over the course of the third quarter, the focus among investors, economists and the Fed itself shifted from tariff policy to jobs. We’ve arrived at a dynamic in the labor market that can best be described as a “stalemate.” Both hiring and firing rates sit at low levels. Businesses, uncertain about the future, are holding onto the employees they have, while simultaneously hesitating to bring on new staff. Top of mind is whether the frozen labor market will thaw through a resumption of hiring or whether we are in the early stages of an eventual rise in the rate

of unemployment.

The Federal Reserve has a dual mandate: price stability and full employment. Beginning in 2022, with the onset of surging prices, the Fed has been laser-focused on the inflation side of the mandate, raising interest rates by a cumulative 5.5% in just 16 months. While the Fed cut a percentage point in 2024, they have remained wary of a second wave of inflation, especially with the initiation of tariffs this spring. Although monthly tariff revenues have climbed from $5 billion in January to $30 billion in August, inflation has remained in a 2.5% - 3.0% range. At the same time, job growth has collapsed from 200,000 per month in January to 30,000 in August.

As a result, the Fed has pivoted to the other side of the mandate—full employment. While inflation remains a consideration (the ultimate impact from tariffs remains unknown), the Fed’s primary focus has clearly shifted toward the labor market. This shift was underscored by the Fed’s decision to cut interest rates by 0.25% in September. This initial move signals the resuming of the easing cycle that has been on hold since December 2024, with further rate cuts likely over the next year as the central bank prioritizes sustaining the labor market. The Fed is signaling it would rather risk a minor rebound in inflation than a major downturn in jobs. Historically, easing Fed policy, in the absence of recession, provides a supportive backdrop for financial assets.

At first glance, the stock market’s roaring performance seems disconnected from what the job market headlines suggest. While recent monthly payroll reports have stalled, it is crucial to recognize that this is a lagging economic indicator, telling market participants what has happened, as opposed to what will happen. We prefer to focus on more timely, forward-looking data. For this, we watch weekly unemployment claims, which are not subject to surveys or revisions and have consistently remained

at levels that suggest a healthy labor market. The market, in our view, is looking past the old payroll

data and focusing on leading indicators and the potential for a stronger economy in 2026.

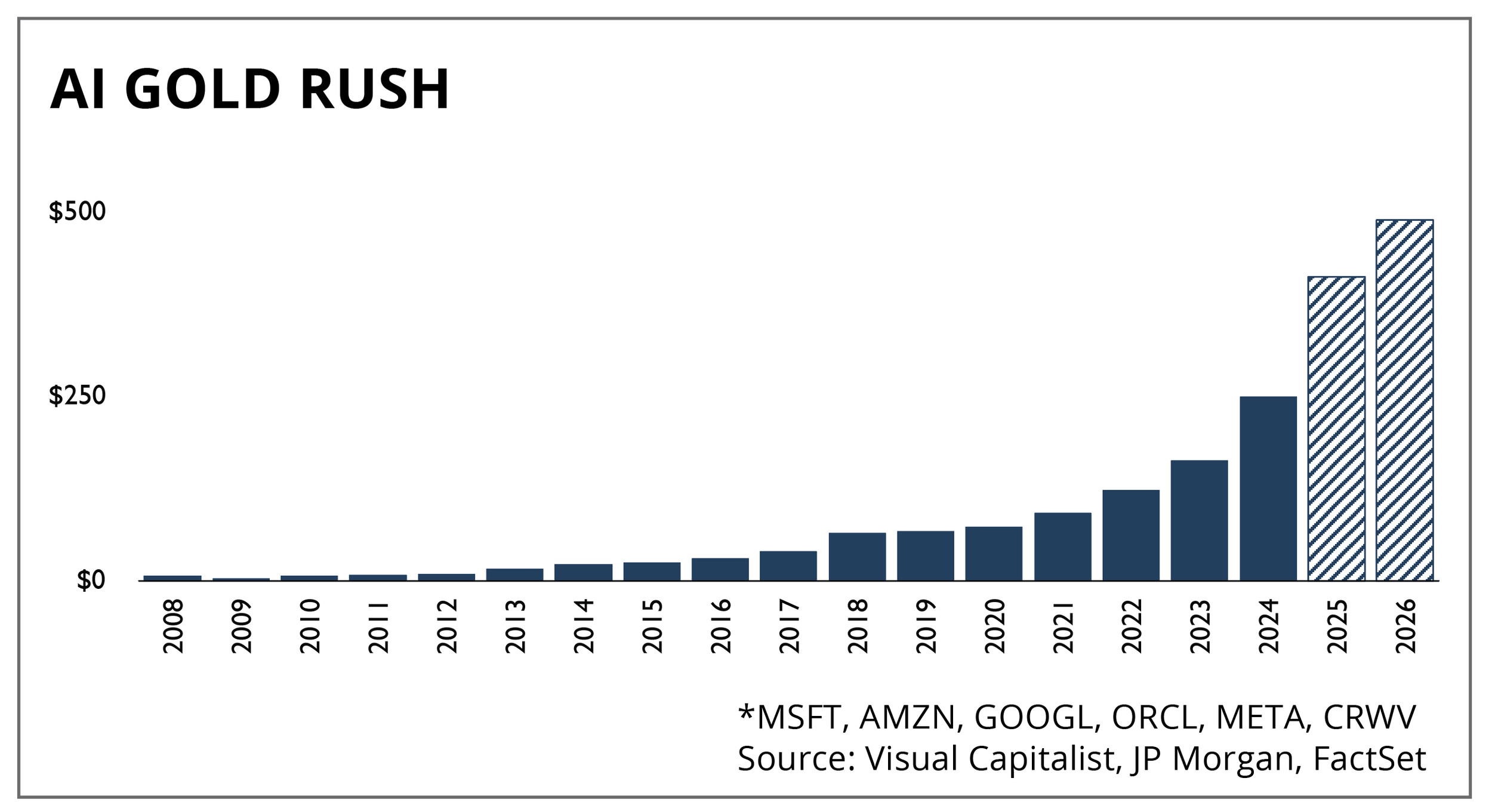

Powering much of the optimism embedded in stock market prices is the sheer magnitude of investment flowing into artificial intelligence (AI). We are witnessing a capital expenditure cycle of historic proportions.

The billions of dollars being poured into AI are not confined to the technology sector: this wave of investment is fundamentally reshaping industries across the board. The demand for AI is driving massive buildouts in power infrastructure to fuel data centers, revitalizing domestic manufacturing for semiconductor production and creating ripple effects through countless other sectors. This investment is far from a plateau and will continue to be a powerful, durable engine of economic growth, providing a crucial buffer against potential slowdowns elsewhere.

Looking further ahead, the economic landscape is set to receive another boost from fiscal policy. Beyond direct government spending on infrastructure and domestic manufacturing, a supportive tax environment is also taking shape. The reload of bonus depreciation expensing for businesses and lifting the cap on the state and local tax (SALT) deduction for individuals is poised to put more money into the hands of corporations and consumers alike. This combination of direct spending and tax relief will act as a layer of support, emboldening corporate investment.

This confluence of positive factors—a supportive Fed, a resilient stock market, an AI-driven-investment boom, and forthcoming fiscal stimulus—has led to a market that is priced for perfection. Current valuations reflect a strong and stable economic outcome, leaving little room for error. The primary risk for investors today is not a deep recession, but rather a scenario where growth simply muddles through or inflation proves stickier than anticipated. In such an environment, the high expectations embedded in stock prices could be difficult to meet. After all, the S&P 500 has returned 80% since the beginning of 2023, a pace that will be difficult to sustain as we move toward 2026.

On one end, the labor market has clearly weakened—and the stock market is expensive. On the other hand, the Fed is lowering interest rates, we are amid a historic investment cycle for the buildout of AI infrastructure—and fiscal support is coming in 2026. Putting it all together, we maintain a balanced approach to asset allocation in client portfolios. Specifically, we hold a neutral allocation to both bonds and stocks. Within equity asset classes, we prefer U.S. large-cap stocks. This position allows us to maintain exposure to the most innovative and fastest-growing companies in the world while navigating the current environment with a disciplined, balanced approach.