by Shawn Narancich, CFA

Executive Vice President

Equity Research and Portfolio Management

August Headwinds

Having already digested 90% of the S&P 500’s second quarter results, investors this week parsed earnings for the major retailers still left to report. Despite the likes of Home Depot and Wal-Mart continuing the recent trend of companies delivering better-than-expected earnings, the recent rise in longer-term bond yields is dampening investors’ enthusiasm for stocks. As our Chief Investment Officer George Hosfield is prone to observe, what matters for stock prices is earnings and what investors are willing to pay for those earnings. As we have highlighted, earnings overall have exceeded investor expectations so far this year amid a stronger than expected economy and effective cost control by corporate America. But as the chart below demonstrates, stocks are also inversely correlated with long-term interest rates set by the bond market, specifically corporate bonds, thus impacting the valuation investors place upon earnings. Higher fixed income rates make less volatile bonds a more competitive alternative to stocks and weigh on corporate earnings burdened by additional interest expense. Amid the benchmark 10-year U.S. Treasury yield reaching a 15-year high of 4.25% this week, the S&P 500 notched its third consecutive week of declines.

Bookending Earnings Season

Gainfully employed U.S. consumers with a penchant for spending create fertile ground for American retailing, and this week’s earnings did not disappoint. Perhaps most illuminating are the market share shifts and mix of sales reported. General merchandisers Target and Wal-Mart have both had to adjust to consumers’ slowing pace of retail spending amid their renewed focus on experiences such as eating out and travel. While both retailers posted better than expected earnings, Wal-Mart’s sales notably outperformed Target’s, as the nation’s largest retailer enjoyed a 6.4% same-store sales gain that sharply outperformed Target’s 4.3% decline. Despite Target lowering its full-year sales and earnings guidance, the stock rose on the day as investors inured to its recent merchandising woes were braced for even worse.

Tales of the Tape

In addition to Wal-Mart’s market share gains, investors also noted retailers’ commentary about their sales mix, which in the most recent quarter demonstrated consumers emphasizing groceries and consumer healthcare at the expense of more discretionary categories like electronics and furniture. For the economy overall, consumers’ emphasis on spending for “needs versus wants” was evident in this week’s U.S. retail sales report for the month of July. With U.S. credit card debt eclipsing $1 trillion for the first time ever and interest rates on that credit card debt now north of 20%, these anecdotes point to the potential for consumers to reign in spending, despite newfound higher wages and increased savings.

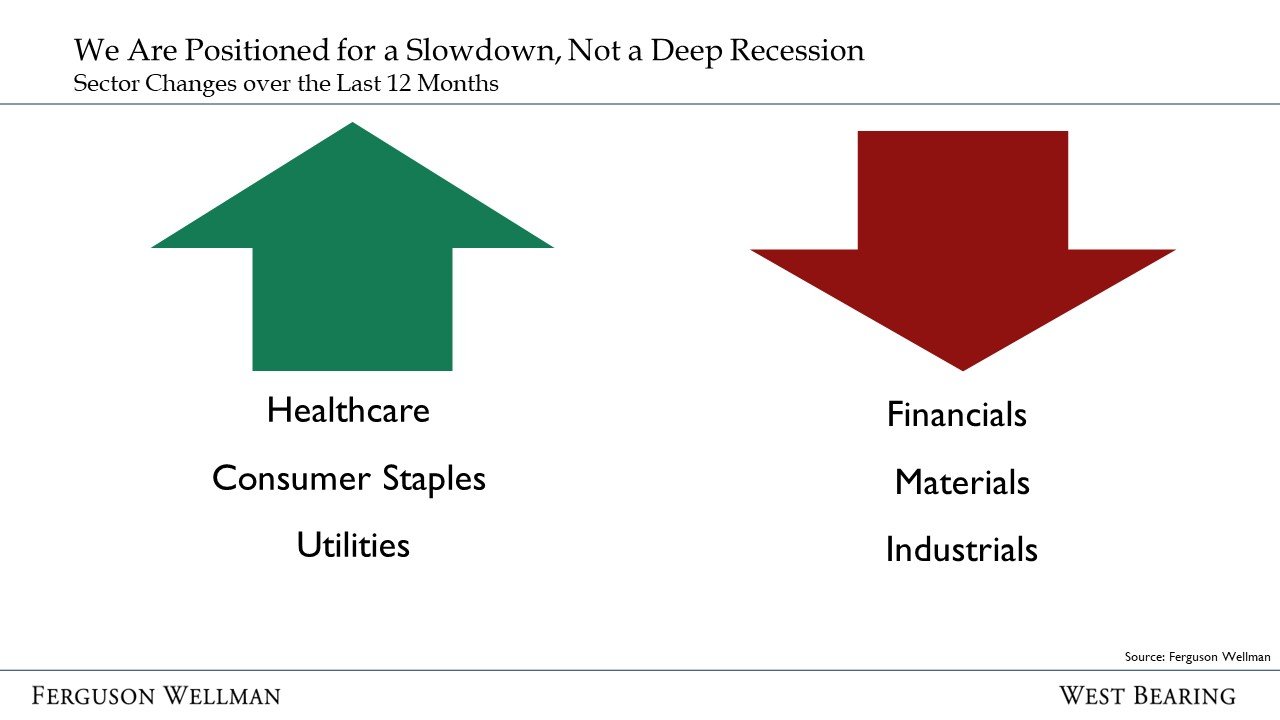

Amid higher interest rates, our stock and sector selection has become more defensive. Per the chart below, we have added healthcare and consumer staples companies to client portfolios so far this year, as earnings from these blue-chip companies stand to be more stable across the economic cycle.

Takeaways for the Week

Stocks extended August declines, falling by over 2% on the S&P 500 as benchmark U.S. Treasury yields hit a 15-year high

Major retailers reported better-than-expected second quarter earnings, concluding a successful second quarter earnings season