by Blaine Dickason

Vice President, Fixed Income Trading and Analysis

“An ounce of prevention is worth a pound of cure.” – Federal Reserve Chair Jerome Powell, June 19, 2019

Federal Reserve Chair Jerome Powell and other members of the rate-setting Federal Open Market Committee (FOMC) have signaled they will be cutting the benchmark federal funds rate at the end of this month. This will be their first interest rate cut since December 2008. Under the Fed’s newly explicit refrain to “sustain the expansion,” we should expect a more accommodative monetary policy response going forward as they combat the heightened uncertainties stemming from increased trade tensions and slowing global growth.

Source: Strategas

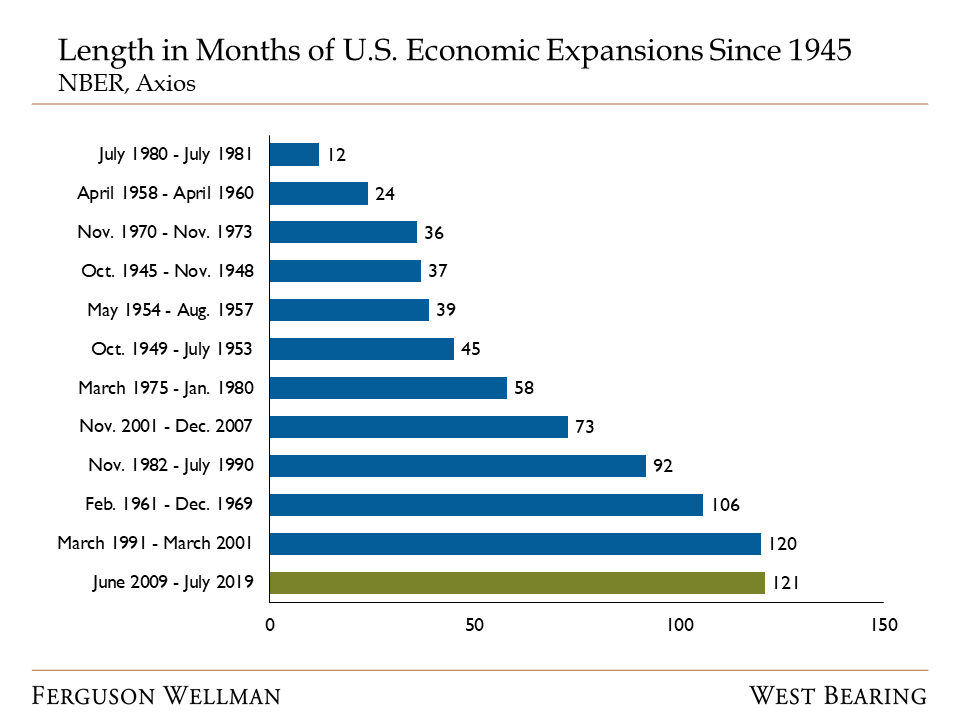

July 2019 marks the 121st consecutive month since the end of the last recession and we are now officially in the longest economic expansion since World War II. What we’ve felt in longevity has been muted in magnitude, as the current expansion has also been the slowest on record as measured by growth of real GDP. Along with slowing global growth, concerns surrounding trade relations, and another upcoming U.S. debt ceiling debate, the Federal Reserve has identified sufficient uncertainties to suggest they will deliver a 0.25 point cut to the federal funds rate on July 31.

Source: Strategas

Credit conditions remain favorable in part because of the recent ‘dovish’ tilt by the Federal Reserve. Lower policy rates suggesting borrowing costs will decline and continued access to capital are both important, contributing factors in sustaining the expansion. In this context, the Fed is viewing their projected rate move as an ‘insurance’ cut that will continue to support this business cycle.

With an unemployment rate near a 50-year low, average hourly earnings over 3 percent annualized, and a June nonfarm payroll employment report of over 200,000 jobs added, it could be easy to question why the FOMC would consider lowering rates. It is important to note these three data points all tend to be coincident indicators of economic activity. Of more predictive value are leading indicators, such as manufacturing surveys and a recently inverted yield curve, both of which are clearly signaling slowing growth ahead. By acknowledging an “ounce of prevention,” Chair Powell has expressed that an early, preemptive policy shift may be the best path to sustain our record run.

Week in Review and Takeaways for the Week

The S&P 500 closed above 3,000 points for the first time this week

The last time the S&P 500 traded below 2,000 was June 27, 2016 during a period of stock market weakness associated the initial concluded Brexit vote