by Timothy D. Carkin, CAIA, CMT

Senior Vice President

Last week, the unblemished veneer of the year-to-date equity market showed a crack. After a 24 percent rally, the S&P 500 set a new high and then sold off 5 percent shaking some investors’ confidence.

At a basic level, markets selloff because investors want out of the market, partially or entirely. In some cases, it is profit taking, other times, investors are looking to reduce risk. Both are quite plausible reasons for the recent selloff. The market has rallied all year without taking a breather compounded with the timing of new tariffs. The natural reaction would be to ask yourself, “Should you be selling too?” In short, this is not the time to ask that question.

Humans are hard-wired to react more negatively to loss than react positively to gains. This kind of behavior is called loss aversion, a keystone tenant of behavioral finance. It’s natural to see a selloff and worry you are losing money. But, as we’ve seen this week, the market rebounded and, in a few days, erased half of the selloff. Rash action based on one’s aversion to loss could have resulted in missing the rally. This is a recent example of a story that has been told many times over the last 25 years. It took years for some investors to get over their fear of continued losses and get back in the market following the dot-com crash and the financial crisis, missing out on considerable gains.

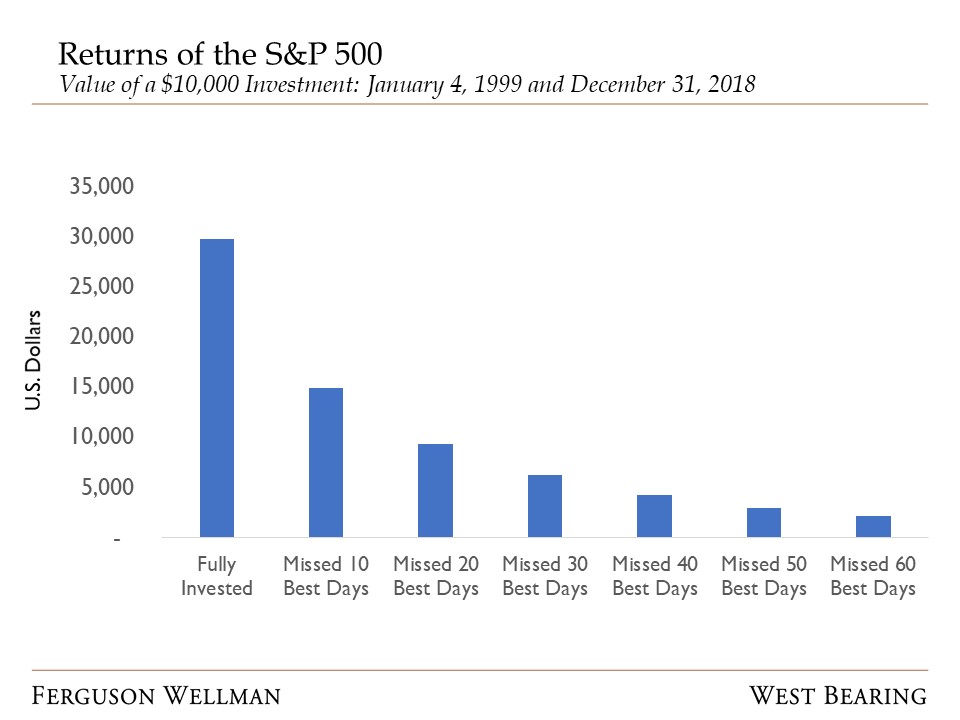

Along those same lines, much of a rally can come in a matter of days. Being absent the market on key days can significantly affect portfolio returns. The chart below shows the return of the S&P 500 for 20 years first, then removes the best trading days. As you can see, removing just the 10 best days in the market halves investors’ returns. Removing the 20 best creates negative returns. Six of the best 10 days in the S&P 500 occurred within two weeks of the 10 worst days.

Source: J.P. Morgan Asset Management

Staying invested is certainly challenging considering anyone’s tendency toward loss aversion. That is why asset allocation is so important. Properly executed, it is a strategy to keep investors engaged in the market through ups and downs. Tumultuous times are not when investors should reflect and re-evaluate their risk tolerance. This year’s rally and abrupt selloff gives investors a chance to reflect on their own loss aversion and make changes, if necessary, to ensure peace of mind.

Week in Review and Our Takeaways

Trade news has investors on edge but earnings reports from blue chips like Walmart and Cisco drove the markets higher