by Peter Jones, CFA

Vice President of Research

In recent weeks, investors and economists alike have been questioning the sustainability of the current backdrop of strong global growth and are considering the longevity of this expansion. No doubt, economic data out of Europe has been weak and some U.S. data has moderated from very strong levels.

Two of the loudest and most respected voices in the investment world expressed their confidence in the current economic strength, and more importantly, in the duration of the expansion. Jamie Dimon, CEO of J.P. Morgan, and Warren Buffett aka, “The Oracle,” spoke to CNBC on Thursday morning to share their respective economic outlooks.

Dimon referenced extremely healthy consumer credit levels, business confidence and employment. Further, Dimon argued that current growth levels are not only sustainable, but that he expects growth to strengthen in the coming quarters. When asked about our positioning within the expansion, Buffet drew a comparison to baseball. He said, “If we’re in the sixth inning, we have our sluggers coming up to bat right now: number three, four and five in the lineup.” In other words, we’re past the halfway point but we’re about to enter the strongest period we’ve seen thus far. While both leaders exuded confidence in the U.S. economy, they tempered investor expectations by reiterating that a solid economic outlook does not necessarily translate into a bullish short-term setup for the stock market. As we’ve witnessed twice this year, stocks can fluctuate dramatically without a turn in the business cycle. In the long term, as go earnings so go stocks. Ultimately, the economy drives earnings.

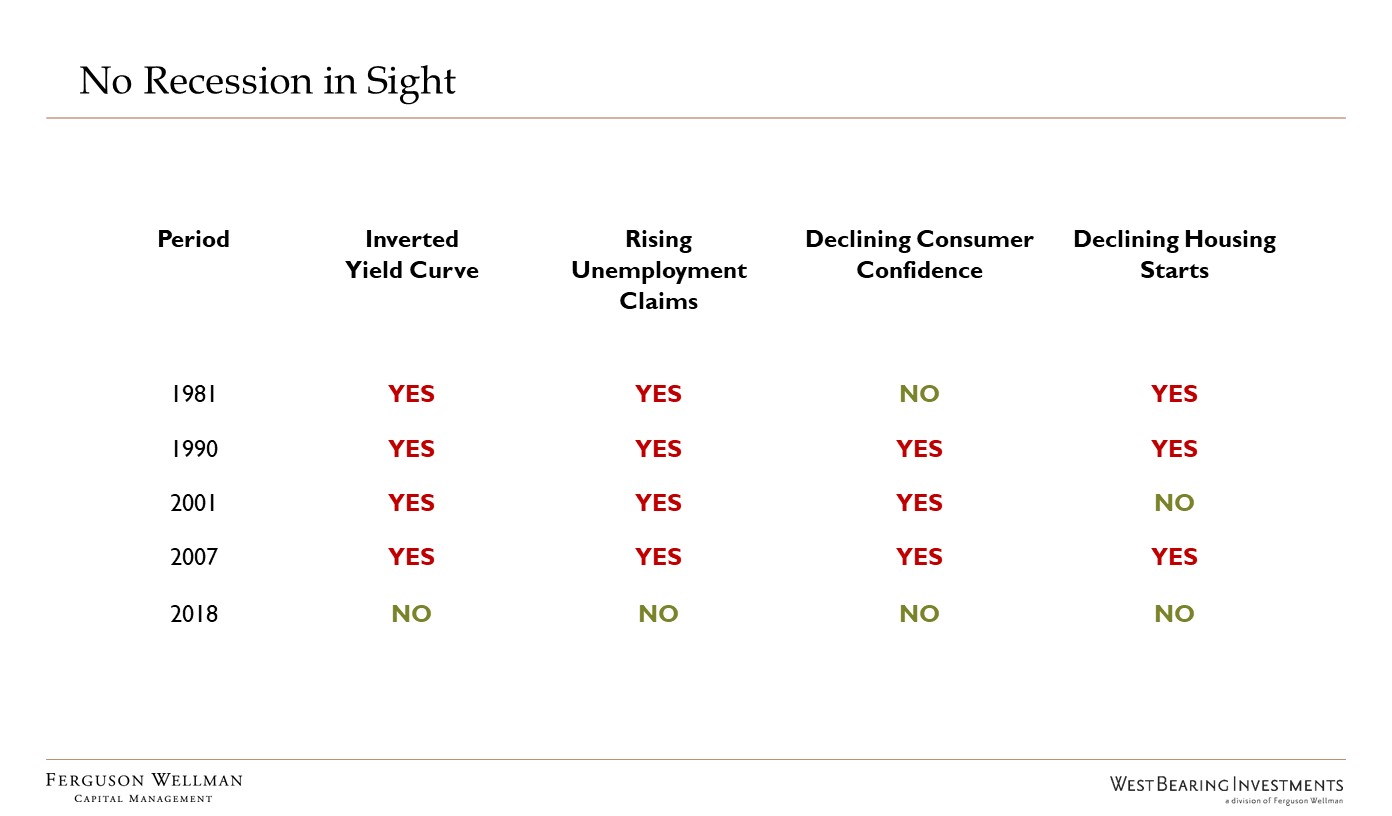

At Ferguson Wellman, we are constantly evaluating economic prospects to decipher between stock market fluctuations and true changes in the business cycle. This is crucial because bull-market corrections are not tradeable events; whereas, a turn in the business cycle has many implications for allocating capital, both within and across asset classes. To that end, we monitor a list of indicators to judge the overall health of the economy. At this point, nothing is flashing red. To provide some perspective, many of these indicators signaled trouble ahead of the last few recessions, as seen in the chart below.

Source: FactSet

At this point, we agree that the expansion has passed the halfway point, but there is certainly room to run. It’s important to note that there has never been a recession while corporate profits are on the rise. This year, S&P 500 earnings are expected to grow more than 20 percent.

Along with their commentary around the business cycle, Mr. Dimon and Mr. Buffett released a joint op-ed in the Wall Street Journal that called for an end to quarterly earnings-per-share guidance from companies. They argue that quarterly guidance prompts investors to focus too much on short-term results. In the op-ed, they said, “Companies frequently hold back on technology spending, hiring and research and development to meet quarterly earnings forecasts that may be affected by factors outside the company’s control. In selecting companies for client portfolios, we focus on reasonably valued companies that are positioned to outgrow the broader economy over the long term, rather than companies that have a good chance of beating near-term earnings expectations.

Week in Review and Takeaways for the Week

- The S&P 500 gained about 1.5 percent this week and is up more than 4 percent on the year

- Interest rates have fallen in the last few weeks but are still 0.5 percent higher than January levels

- No reason to believe a recession is on the horizon

- Quarterly earnings guidance shift investors’ focus away from long-term company prospects