by Ralph Cole, CFA

Executive Vice President of Research

Week in Review

Stock markets were essentially flat for the week, but individual stocks gyrated with earnings announcements. Economic data continues to be solid, but not spectacular. First quarter U.S. GDP came in at 2.3 percent, marking the fastest first quarter growth since 2015. Interest rates were essentially unchanged for the week as well.

Choose Your Own Adventure

This earnings season has already had big winners and big losers. How you felt about it as an investor really depended on which stocks you owned. One sector that can’t seem to catch a break this quarter is the industrials sector, despite spectacular earnings. As you can see below, the industrials sector has had the biggest earnings surprises for the first quarter.

Source: Factset

However, the sector has been the second worst performing sector quarter-to-date, down 1.6 percent. Why? Caterpillar and 3M are probably the biggest perpetrators. Both companies cited rising costs as an issue going forward, and growing margins from these levels would be a challenge. Both stocks sold off dramatically on this information. These companies are highlighting a concern about raw material costs and possibly wage pressure as we move ahead in this expansion. Stock valuations tend to contract when margins are compressed. We expect to monitor this closely in the coming quarters.

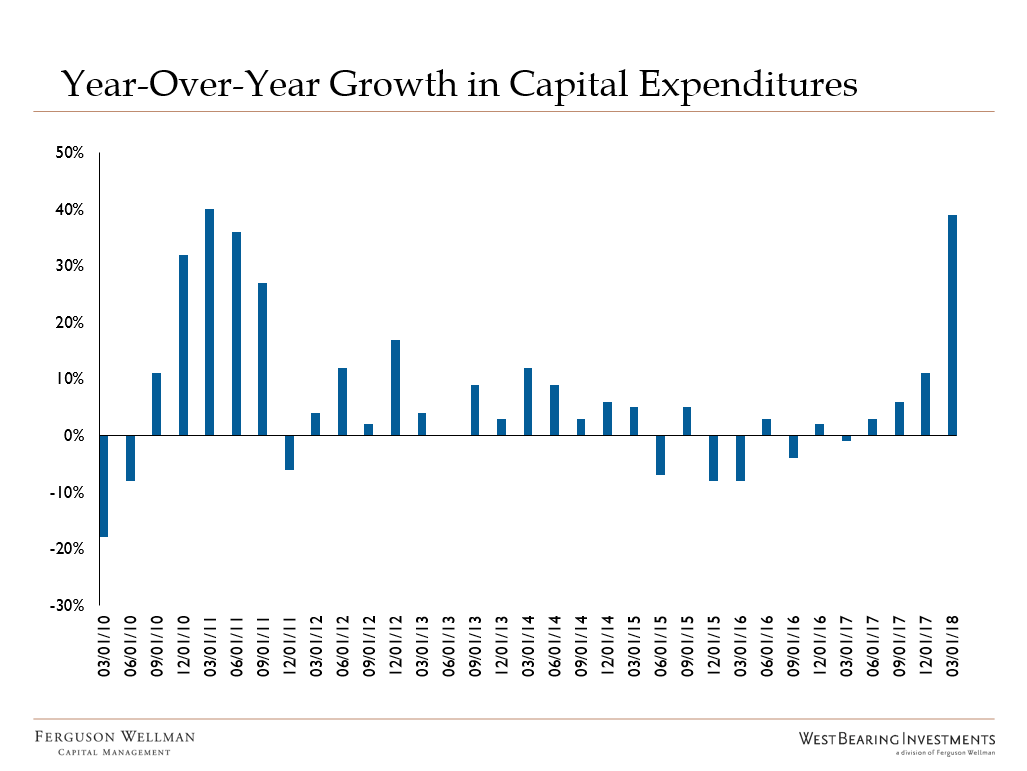

What gives us hope for the industrials sector is the early benefits that we are seeing from the Tax Cuts and Jobs Act. We believe that people are somewhat disappointed in the early benefits of the changes, while we think the economy and companies are just starting to benefit from the new law. See chart below indicating that capital expenditures are indeed accelerating.

Source: Bloomberg

Valuations have come down and analysts are wrestling with how sustainable earnings growth will be in the coming quarters. We are going to remain overweight the industrials sector in the belief that capital expenditures will continue to grow throughout 2018; we foresee that the industrial sector and the technology sector will be the main beneficiaries.

Takeaways for the Week

Earnings season has been volatile on an individual stock level

We still believe that industrials are a good sector in which to be invested in 2018