by Shawn Narancich, CFA

Executive Vice President

Seasons of Change

For a holiday-shortened week, this one is experiencing more than its fair share of action. Blue chip stocks fell a combined 3.4 percent on Monday and Tuesday before giving way to a more constructive tape mid-week, but the narrative concerning investors remains in place – slowing growth against a backdrop of a Fed continuing to raise interest rates. For our part, we continue to observe a U.S. economy growing at a rate faster than in recent years, and one globally that should continue to gain ground at a productive pace in 2019. Domestic tax cut tailwinds will fade next year, but additional GDP growth paves the way for higher earnings. What investors are grappling with is how much they should pay for these earnings in a slower growth environment.

De-FAANG’d

When growth at the margin slows and stock valuations are rich, the resulting pullback in equities can be dramatic. As the chart below illustrates, stocks of the now famous FAANG trade – Facebook, Apple, Amazon, Netflix and Google – have led the market lower in recent weeks.

Source: FactSet

It isn’t that Amazon’s e-commerce or cloud computing businesses have faltered, or for that matter that people have suddenly stopped using Facebook’s social network. These businesses are still growing, but the expectation is that this rate of growth will begin to slow. In Amazon’s case, revenue growth in its cloud computing business slipped from 49 percent to 46 percent in the third quarter. While the growth rate is still high, investors become less willing to pay over 100x earnings for it when the rate of growth begins to slow. We remain overweight the technology sector but are beginning to reduce the magnitude of that overweight.

Change at the Margin

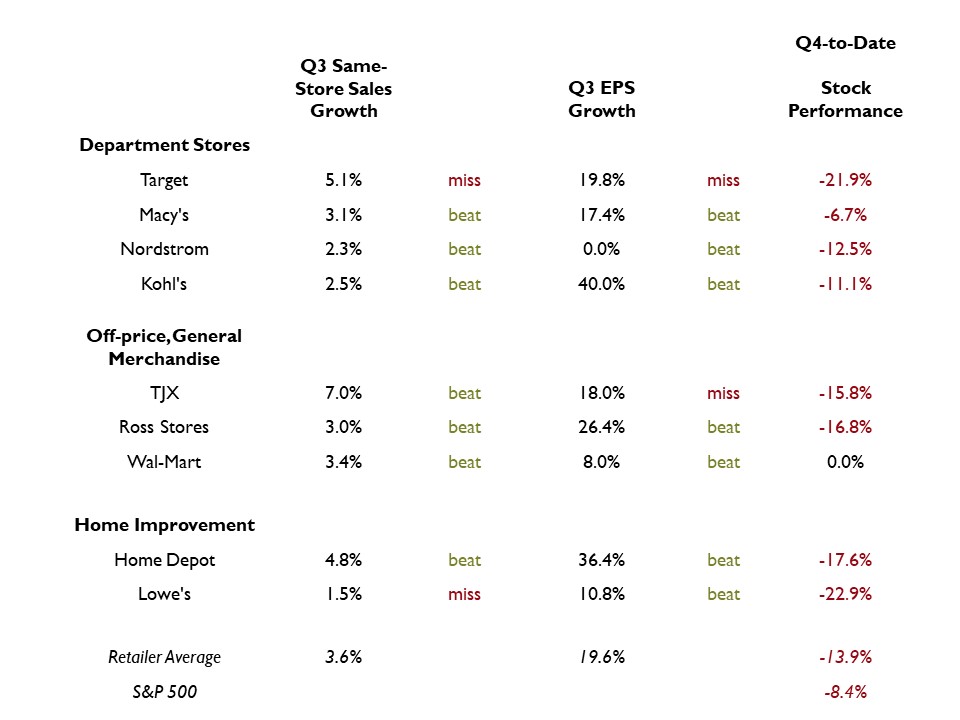

With Black Friday sales beckoning, what better time to delve into some detail on the retailers that have just reported their fiscal third quarter earnings? Shown in the table below are some key indicators for nine of the largest U.S. retailers.

Source: Company data, FactSet

While these retailers reported healthy levels of growth — same-store sales averaging 3.6 percent and earnings per share of nearly 20 percent — that in most cases beat third quarter expectations, the stocks have faltered. For department stores in particular, the stocks had already risen handsomely ahead of third quarter earnings, thus creating a higher bar of expectations to clear. Seven of the nine retailers proceeded to report gross margins as a percent of sales that fell from year-ago levels, citing higher freight expenses, rising fulfillment costs associated with beefing up e-commerce capabilities and, increasingly, tariffs. And while retailers have been big beneficiaries of the U.S. tax cuts that have put more disposable cash in consumers’ pockets, same-store sales comparisons will become more difficult upon the anniversary of last year’s. The net of these factors has led investors to discount slower growth in retail profits next year, causing the stocks to underperform the broader market so far this fourth quarter. Historically, retailing stocks have outperformed earlier in an economic cycle. With profit growth here set to slow substantially, we are underweight the consumer discretionary sector primarily populated with these stocks.

Week in Review and Our Takeaways

Stocks remain volatile as investors grapple with the proper multiple to place on earnings ahead of slower profit growth next year

From all of us at Ferguson Wellman and West Bearing, happy holidays!