by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

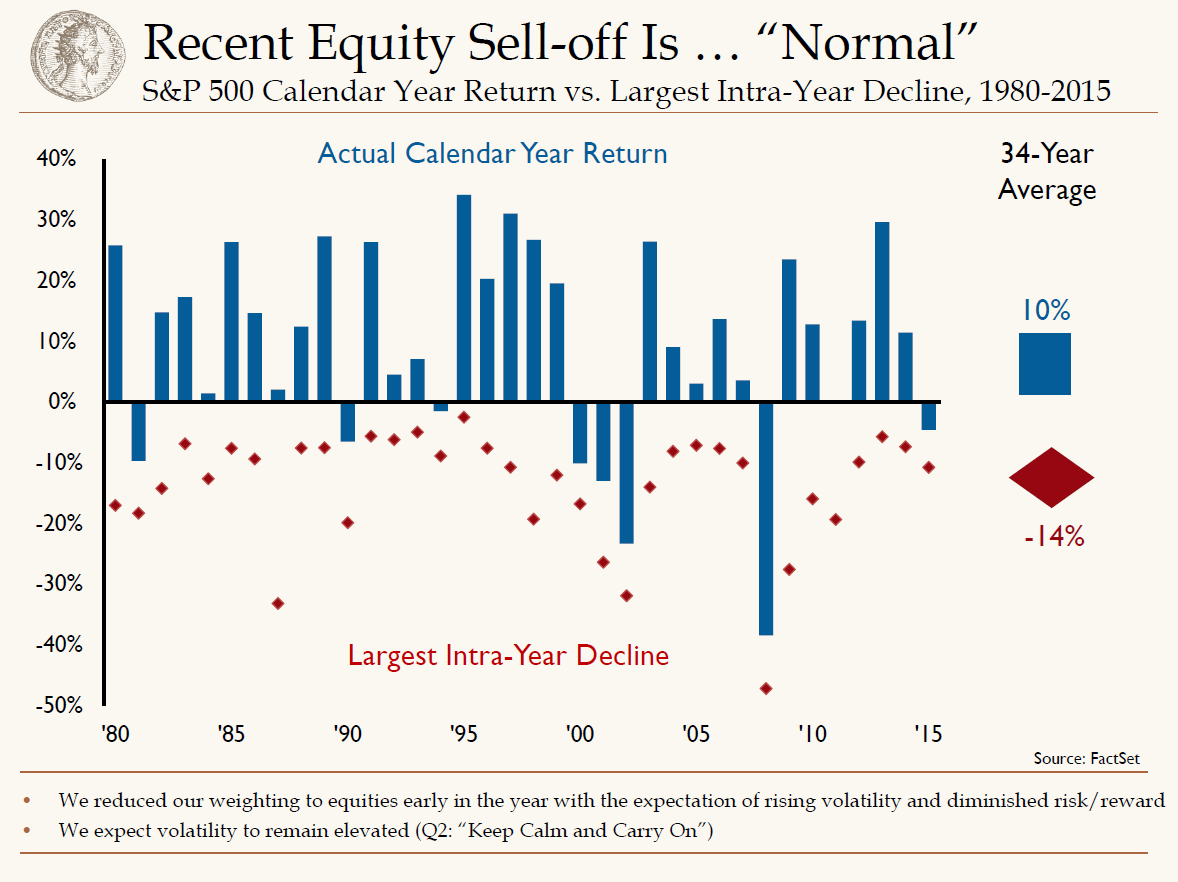

Volatility reigned supreme over the summer. The old Wall Street adage of, “Sell in May and go away,” was prophetic in 2015. Investors had become somewhat complacent the first several months of the year. The market was trading in a relatively tight range and volatility was at a minimum. In mid-May, the S&P 500 closed its all-time high of 2,130.82. As we rolled into June, the media was posing the question, “Should investors sell and move to the sidelines?” June through September is historically the worst period for investing; however, stocks are still positive. Selling in May and going away, in hindsight, would have been the right move. Emerging markets, notably China, Russia and Brazil, began to cause concerns. A major selloff in Chinese equities, lower-than-expected economic growth and a currency devaluation resulted in a major sell off in equities globally. The S&P 500 hit a low of 1,867 for the year at the end August and volatility increased meaningfully. During this period, we had to remind clients that volatility is very common; we have just been in a period of low volatility. In 2013 and 2014, only 15 percent of the time, the S&P 500 was up or down over 1 percent. In 2015, that is closer to 25 percent, which is more in-line with the long-term average. Also, the chart below highlights intra-year volatility; however on average, stocks are still positive.

Over the last 35 years, the average largest intra-year decline has been 14 percent, as shown by the red diamonds. Even in the face of these declines and volatility, the average return for the S&P 500 is 10 percent. This year, we saw a 12 percent drop from peak to trough and we believe that we have already seen the lows of 2015.

As we move into earnings season, the S&P 500 is roughly flat on the year. The volatility experienced in the summer continues as investors sort out exactly how slow global, primarily emerging market, economic growth is? How healthy is the U.S. consumer? And when will the Federal Reserve finally raise interest rates?

Regarding the Fed, the market is discounting a 30 percent chance of a December rate hike. While the employment picture in the U.S. continues to improve, low inflation and global uncertainty has kept the Fed on the sidelines. We believe that the likelihood is closer to 50/50 for a year-end rate. Whenever it occurs, the pace will be a lot slower than previous tightening cycles.

The emerging markets continue to be a headwind to U.S. growth. With recessions in Russia and Brazil, coupled with massive currency devaluations, U.S. exports continue to struggle in those markets. China, while still growing, is slowing. Earlier this month, the Chinese reported GDP growth of 6.9 percent for the third quarter. We believe that the real growth is lower, but positive. The primary slowdown is coming from the industrial areas, while the consumer continues to remain relatively strong. We’ve seen this in the individual companies we follow. For instance, Caterpillar is showing major declines in their business in China, while Apple and Nike are still experiencing growth.

Finally, while exports to emerging markets have been a headwind for the U.S. economy, the key factor is still the consumer. We believe that the state of the U.S. consumer is strong and continues to get better. Consumer confidence is high and wages are slowly moving up. The factor that we are not yet seeing on a meaningful basis is increased spending. The drop in gas prices has resulted in consumers paying down debt, rather than spending more. We believe that eventually this savings will be deployed into the economy as gas prices remain. This will result in an additional tailwind for U.S. economic growth.

With this backdrop, we believe that with interest rates rising and U.S. economy delivering healthy growth, investors should not shy away from equities. If they got out of the market earlier this year due to the volatility, we would be putting those funds back to work.

Our Takeaways for the Week

- Volatility is more common than investors perceive

- We continue to be positive on the U.S. economy and consumer