by Jade Thomason

Equity and Fixed Income Trader

We recently published our Market Letter for the second quarter. In it we address many topics that are likely top of mind for our clients such as market performance and the actions of the Federal Reserve. The latest Consumer Price Index release pushed inflation back into the spotlight, causing a stir and resulting in an equity market slump and a spike in Treasury yields.

March Consumer Price Index Release

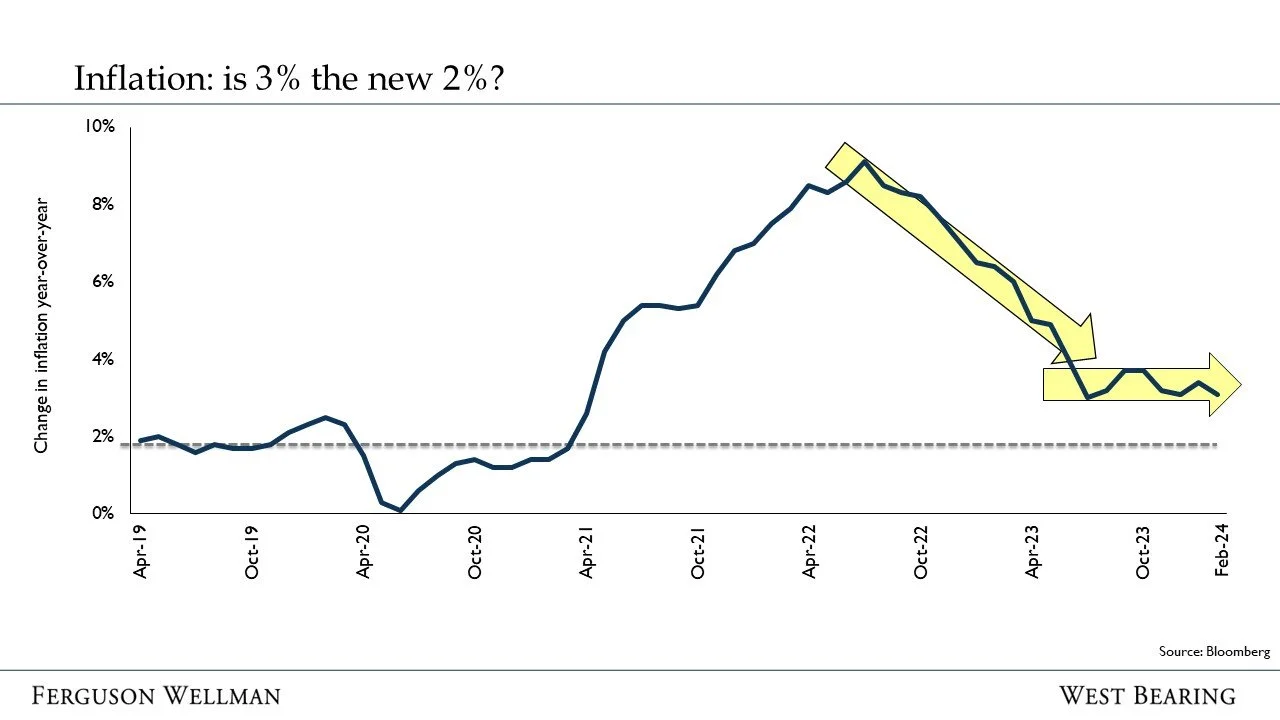

The Consumer Price Index (CPI) is a measure of goods and services prices across the economy, and a popular gauge of inflation. The headline CPI rose 3.5% in March from a year earlier, which was higher than economists had forecast and an increase from February’s 3.2% reading. The Core CPI, which excludes the volatile food and energy components, also rose more than expected, with medical care and auto insurance boosting the non-housing service prices. This report was highly anticipated after two previous months of higher-than-expected prices and begs the question of whether higher prices are here to stay. Historically, the Federal Open Market Committee (FOMC) aims for inflation readings of ~2% because it is consistent with the Federal Reserve’s mandate of maximum employment and price stability. When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing and investment, which contributes to a well-functioning economy. This also leaves room for interest rates to be lowered if the economy needs stimulation. We have stated the last mile of inflation will be the most difficult, and that seems to be what we are currently experiencing. The sticky components of the economy decline very slowly, leading to the trend we see on the graph below.

Federal Reserve Predicament

The Federal Reserve uses CPI releases, in conjunction with other gauges of inflation and economic data, to craft their strategy regarding how much and when to cut interest rates. The hotter-than-expected inflation reports are bringing about the question of “if” rate cuts will occur, and not just “when”. Based on the strong economic data, our view is that the Fed will keep cuts to a minimum in order to close in on their 2% target. The economy needs to show signs of more notable slowing to motivate the Fed to start cutting, and this has yet to occur. Fed officials have been optimistic about achieving a “soft landing” in which inflation slows without a sharp downturn in economic activity. To accomplish that, officials want to cut rates preemptively before the economy weakens. The latest report sets back that effort by depriving them of a credible justification for cutting rates, and it could prompt them to hold rates at their current level, the highest in 23 years, until they see notable slowing.

Takeaways for the Week

We are getting close. April 15 is Tax Day, and an estimated 146 million taxpayers are expected to breathe a sigh of relief once this “to do” is checked off their list. Of those taxpayers, 19.4 million are expected to request an extension to buy six months of time for submission

The yield on the benchmark 10-year U.S. Treasury note marked its highest close since November on Wednesday and its largest single-day increase since September 2022