by Krystal Daibes Higgins, CFA

Vice President Equity Research

This week investors shrugged off hotter-than-expected inflation data, one of the most important data inputs for the Fed in deciding its next policy moves. The impact of the Fed aggressively raising rates over the past year has brought inflation down from a whopping 9% in June 2022 to 3% by the end of 2023. The Fed’s ultimate target is 2%. Much like updating a computer, the last bit sometimes takes the longest. The latest reading of the consumer price index (CPI), a metric closely monitored to gauge changes in the cost of living, came in higher than estimates. The change wasn’t a dramatic increase, but most of the increase over the prior month was driven by energy and shelter. Combined, these two categories contributed over 60% of the monthly increase. The energy category is relatively benign because these prices tend to fluctuate over time. The shelter, or housing, component is considered “sticky” as it can perpetuate inflation or move it higher. While housing costs increased, the good news is that it is subsiding and heading in the right direction. Additionally, egg and milk prices stayed the same.

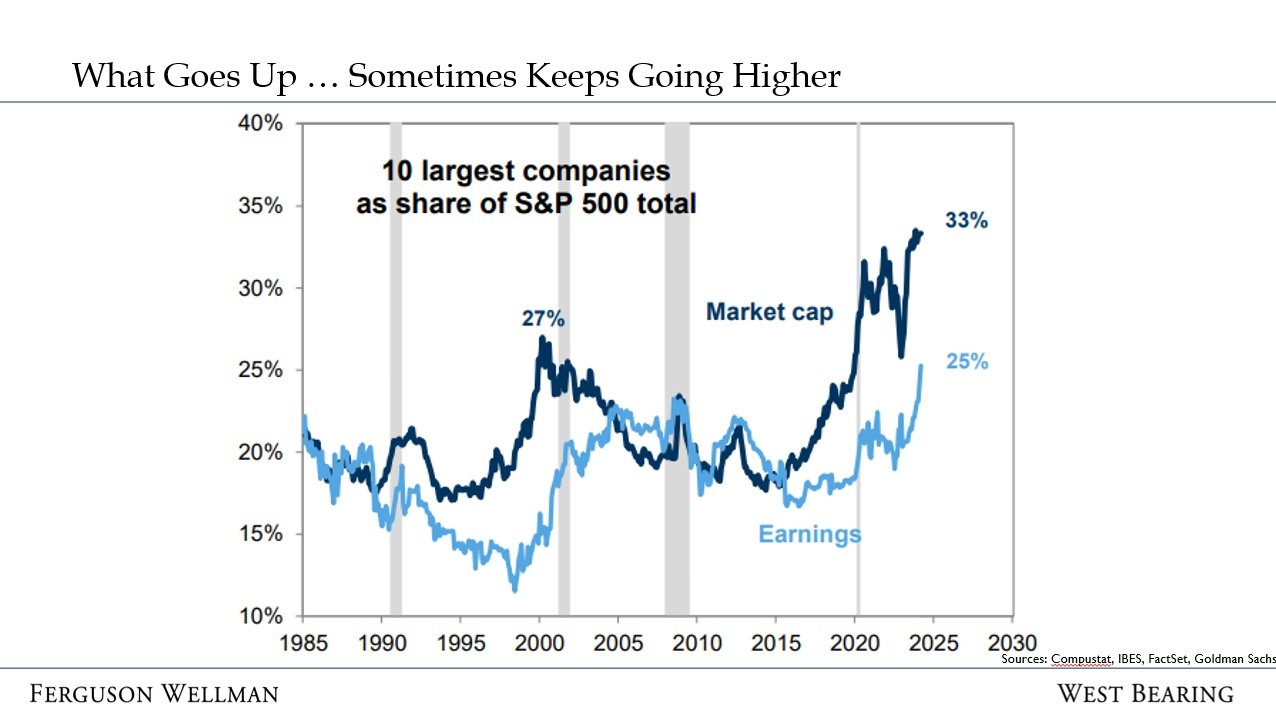

What Goes Up … Sometimes Keeps Going Higher

The stock market as measured by the S&P 500 ground higher, led once again by the relatively newer tech titan Nvidia. The rise in the company’s share price recovered from last week’s decline, after another semiconductor company reported weaker results, bringing the entire semiconductor sector down. Nvidia, as well as some of the largest companies in the S&P 500 stocks, have been significant contributors to the stock market’s returns so far this year. The rise in their share prices has increased their weight in the index to 33%, the highest it has been in over 100 years by some measures (according to Reuters). This has been causing some apprehension about a potential bubble.

However, we believe that these 10 companies generally have good fundamentals, especially when examined individually, and do not appear to be in proximate danger of being a ‘bubble.’ For example, the net profit margin (profit percentage after all expenses) of the 10 largest companies in 2023 is 28%, compared to 11% in 2000 during the dot-com bubble. At the same time, these companies are trading almost 40% cheaper than their 2000 counterparts based on the price relative to next year’s earnings. Further, while certain companies at the vanguard of artificial intelligence, like Nvidia, have seen their earnings grow much faster than the increase in their stock prices. That dynamic makes their valuation look more attractive, even though its stock price has gone up significantly over the past year. That’s not to say that there aren’t pockets of bubbles, or there won’t be volatility. There are some stock prices going up because they are perceived to benefit from the enormous investment being made in artificial intelligence. As investors, it is important to cut through some of the noise and hype to find the companies that are actually well-positioned to win market share and grow earnings over the long term.

Takeaways for the Week

Inflation continues to abate, but energy and shelter costs remain higher-than-desired by the Fed

Stocks finished slightly lower on the week as interest rates moved higher as investors continue to believe that the Federal Reserve is going to keep rates higher, longer