by Reilly Blood, CFP®

Associate Wealth Planner

As the pace of life can slow down in the fall and winter seasons, so can we find ourselves noticing the finer details that surround us. These seasons invite reflection and intentionality, making them an ideal time to turn our attention to year-end financial planning. Nestled within cash flow and tax planning is a hidden consideration called the Medicare Income-Related Monthly Adjustment Amount (IRMAA), which affects not only those age 65 and older who are Medicare-eligible, but also individuals as young as 63 due to the two-year income lookback period. With thoughtful attention now, you can position yourself to manage surcharges more effectively and preserve more of your retirement income in the years ahead.

The IRMAA is an income-based surcharge that can apply to Medicare Part B and D premiums. It was initially introduced by the Medicare Modernization Act of 2003 to serve as an additional funding source for the nationwide insurance program. In most cases, the amount of additional cost depends on modified adjusted gross income (MAGI) – adjusted gross income plus certain tax-exempt interest – from two years prior. For example, Medicare enrollees in 2026 can expect their 2024 MAGI to inform their Medicare Part B and D monthly premiums.

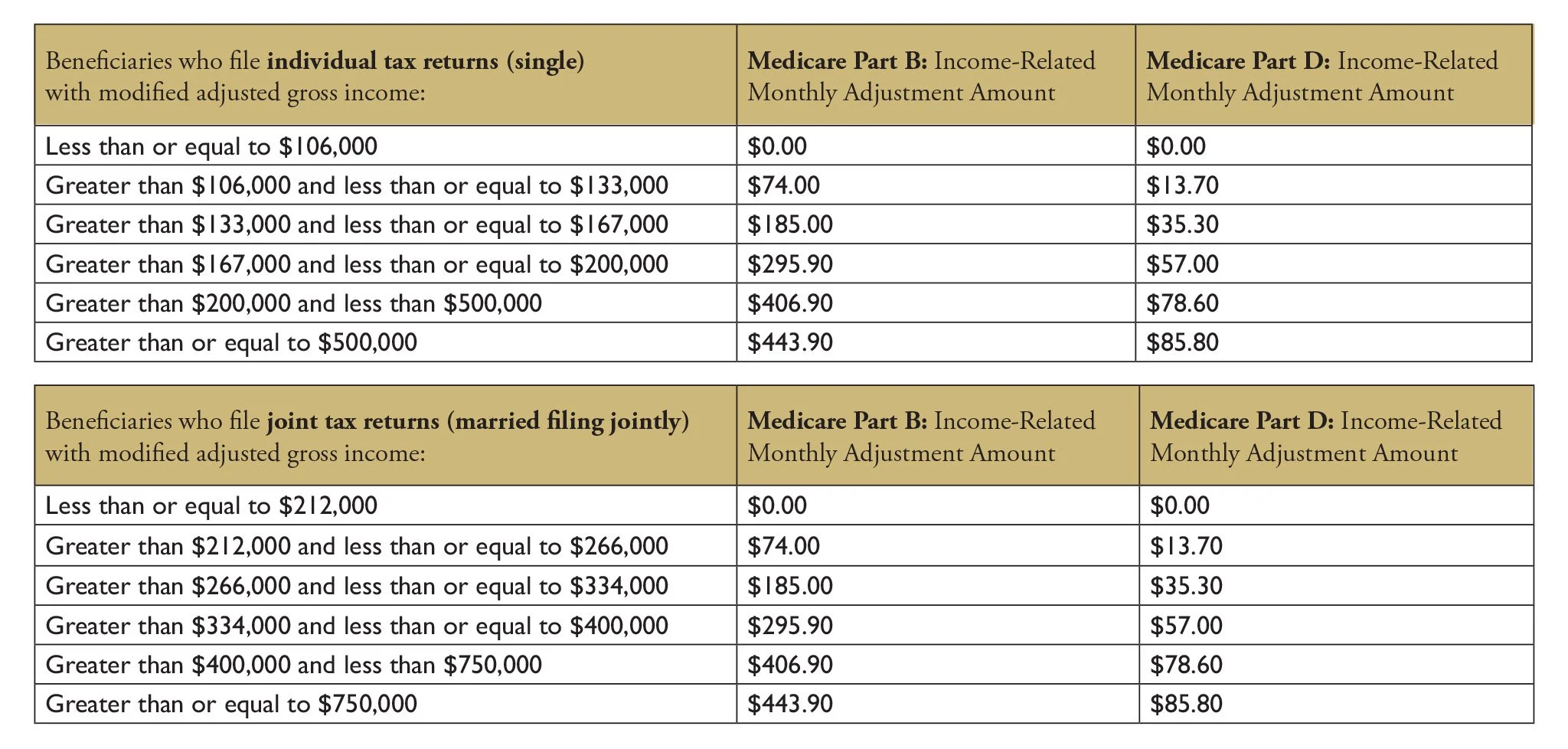

Like a marginal tax rate, IRMAA surcharges are determined when Medicare participants’ MAGI exceed certain thresholds. Enrollees who file individual (single) or joint (married filing jointly) returns could have referred to the following tables to determine their Medicare Part B and D income-related adjustment amounts in 2025:

2025 Medicare Part and D Income-Related Adjustment Amounts

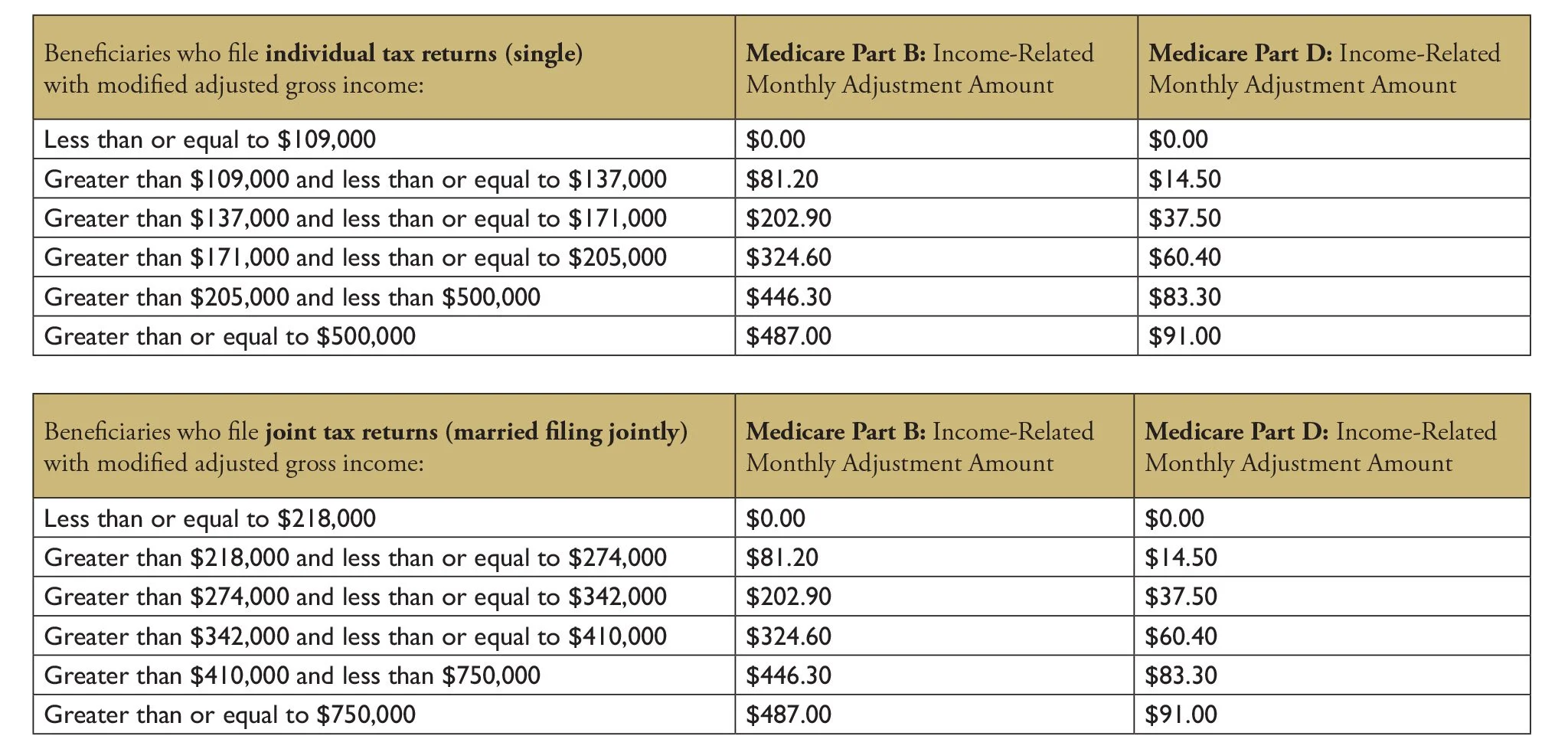

Whereas enrollees who file individual (single) and/or joint (married filing jointly) returns can refer to the following tables to determine their Medicare Part B and D income-related monthly adjustment amounts in 2026:

2026 Medicare Part B and D Income-Related Monthly Adjustment Amounts

The monthly premium and any applicable surcharge are typically deducted automatically from social security benefits for those enrolled, though they can also be paid directly to Medicare.

The Social Security Administration has identified seven official categories that allow for downward IRMAA adjustments when MAGI has decreased due to life events:

Marriage

Divorce or annulment

Death of a spouse

Work stoppage (retirement)

Work reduction (reduced hours or earnings)

Loss of income-producing property (due to an event beyond your control)

Loss or reduction of pension income

Reductions can also be granted due to incorrect or outdated tax data such as an amended return. Less common are reductions due to one-time income events such as sale of property or stock liquidations that are documented and explained as nonrecurring.

To request an IRMAA review, complete Form SSA-44 (Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event) and include documentation that reflects your situation. For instance, if your income drops due to retirement, provide a recent tax return and a letter from your employer confirming retirement. You can submit these by mail, fax, or in person at your local social security office.

Requesting an IRMAA adjustment is often a necessary reactive step when income changes unexpectedly, but proactive planning remains the ideal way to manage future tax exposure and maintain flexibility throughout retirement. Building cash flow and tax planning into a financial strategy creates a strong foundation for reaching your goals. It can help uncover opportunities like qualified charitable distributions (QCDs), social security filing and other ways to accelerate income or deductions to optimize your tax situation and maintain financial flexibility throughout retirement. Ongoing planning is increasingly important as tax laws evolve – the recent One Big Beautiful Bill Act, signed into law on July 4, 2025, is just one example of how quickly things can change.

Contact your portfolio manager to discuss how IRMAA might apply to you, and which strategies should be considered in coordination with your CPA or tax professional.

Ferguson Wellman, Octavia Group and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. We believe the information provided is from reliable sources but should not be assumed accurate or complete. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.