Amid growing investor pessimism, for the first time in more than two decades, the Dow Jones Industrial Average has now declined for seven consecutive weeks. Similarly, the S&P 500 and the NASDAQ have dropped for six straight weeks … the first time since 2011 and 2012, respectively. Given the material correction we have witnessed across most asset classes, we think it timely to share our current market outlook.

1. Equities and bonds have largely priced in the Fed tightening cycle.

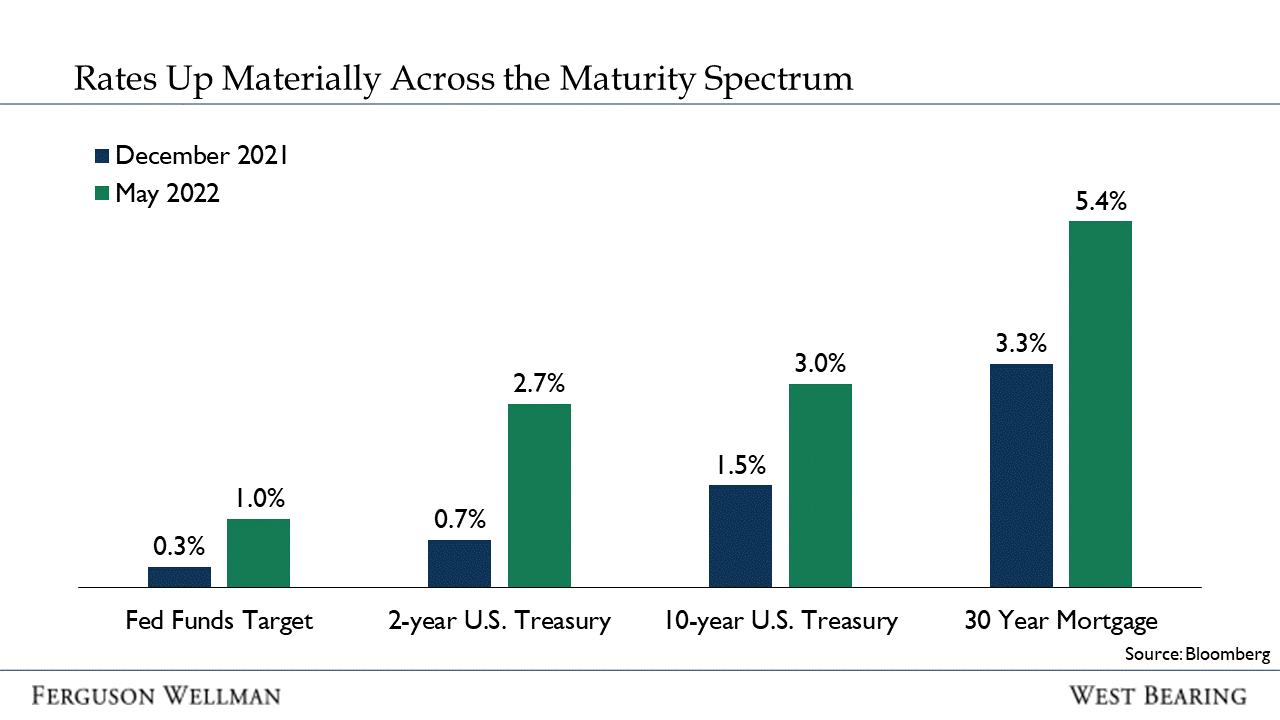

While the Federal Reserve has only just begun to raise rates, the “bond market vigilantes” have already discounted virtually the entire tightening cycle. To that end, while the Fed has only raised Fed Funds 0.75% year-to-date, interest rates are up much more than that across the maturity spectrum. For example, we have seen the 10-year U.S. Treasury yield increase from 1.5% year-end in 2021 to approximately 3.0% today. This move resulted in a meaningful increase in mortgage rates as well. For instance, the increase in mortgage rates will increase new mortgage payments from 19% of household income to 31% ... the highest level since 2008.

Source: Bloomberg

These higher interest rates have also adversely impacted equity markets and have led to a reduction in the current price/earnings multiple of the S&P 500 from 21x to 17x. While it is impossible to predict the exact market bottom, given the current macroeconomic environment, we believe that worst of the selloff related to anticipated Fed tightening is behind us.

2. Inflation has peaked … but is persistently sticky.

We believe the +8.5% annual change to the headline consumer price index (CPI) for the month of March will be the high-water mark for this inflation measure in the current post-COVID economic cycle. The volatile energy sector propelled this measure of headline inflation to 40-year highs in March as energy markets priced in heightened geopolitical risk and supply constraints associated with Russia’s invasion of Ukraine. The April CPI reading contained a sequential and welcome moderation in energy prices; however, the ‘stickier’ services sector that includes rent and shelter costs continued to trend higher. The structural undersupply of housing in the U.S. is contributing to the momentum driving housing costs, which were reported at +5.1% annual rate in April. At nearly one-third of the headline CPI weighting, rent and shelter costs will have significant influence on overall measured inflation. While we believe inflation has peaked, it is likely to remain elevated until the forecasted interest rate hikes by the Federal Reserve can induce their intended slowdown in economic activity and aggregate demand. Though we are highly confident that directionally inflation will be trending down from its March peak, it remains to be seen whether the pace will be sufficient to approach our current estimate of CPI falling towards 3% by year-end 2023.

3. No recession in 2022.

We believe the economy will bend, but not break, amid stubbornly persistent inflation and a Fed interest rate hiking cycle. As expected, GDP growth is now slowing following the sharp move higher from the 2020 recession whose recovery was fueled by easy money and fiscal stimulus. Our expectation is the GDP growth will be 2%+ in both 2022 and 2023. Correspondingly, corporate earnings growth is expected to be a robust 10%+ for calendar 2022. In addition, the U.S. consumer which makes up 70% of the economy is employed and has been utilizing excess savings to vigorously spend on goods and increasingly, on services. In short, coupled with the index of Leading Economic Indicators still at a lofty level, this is not the backdrop that suggests that a recession is imminent. In our view, it would take an unforeseen external shock to the system or a policy mistake by the Fed to tip the economy into a recession this year. Given that the Federal Reserve under Chairman Powell’s leadership has been deft at altering course when economic circumstances have changed, we remain constructive on their ability to extend this cycle.

4. Remain overweight inflation compatible assets.

As we indicated in our 2022 Outlook, we have positioned client portfolios for an environment of both rising rates and elevated inflation. Specifically, we are overweight stocks and alternatives, and underweight bonds.

Stocks are fractional claims on corporate cash flows. Because corporations generate profits based on prevailing consumer prices, their revenues and earnings are positively correlated with inflation. As such, equities participate with inflation.

Similarly, alternative assets such as Real Assets (timberland, agriculture and infrastructure) and Private Real Estate, represent ownership of finite, income-producing property and land. These attributes tend to index with inflation and protect portfolios against rising consumer prices. To that end, alternative assets have been the only asset class this year that has provided a positive return.

On the other end, bonds are not a good way to protect portfolios from inflation as the value of a fixed interest payment erodes as inflation increases.

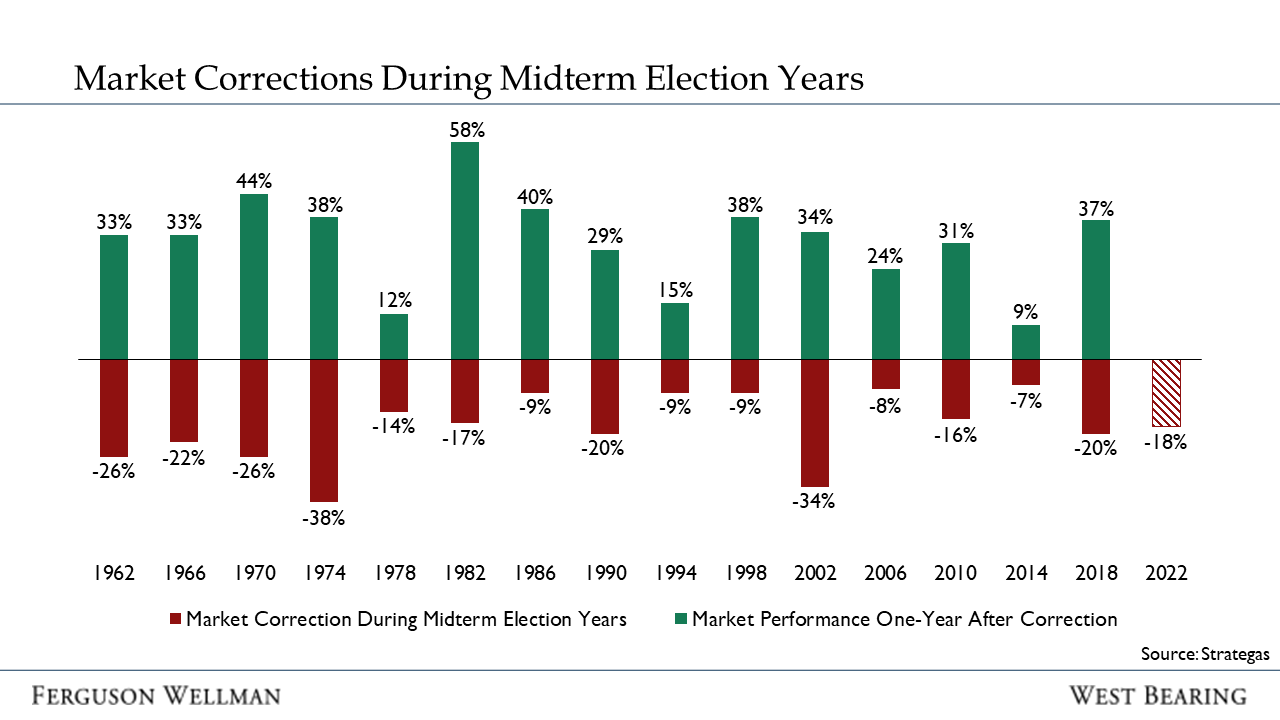

Given our belief there will be no recession in 2022, it therefore remains prudent to overweight equities. As can be seen in the graph below, historically, mid-term election years coincided with market corrections in the first half of the year and were then followed by substantive market rebounds. As such, we have positioned portfolios to capitalize on a continuation of this pattern.

Source: Strategas

As always, if you have any questions we encourage you to reach out to your portfolio manager.